Solana and the Solana ecosystem are constantly growing and moving forward. To help you not miss any news & movements of the ecosystem in the last 7 days, here is your Solana Weekly Recap.

TL;DR

- Orca introduced the Orca Climate Fund.

- UXD Protocol introduced The Asset Liability Management Module.

- All Ethereum NFTs collections are now available on Magic Eden.

- Monke DAO announced an approved grant from Solana Foundation.

Ecosystem Updates

Despite the recent problems relative to the Solana network, the NFT market has always been the bright spot that makes Solana stand out. Let’s take a look at some critical information from the big projects below:

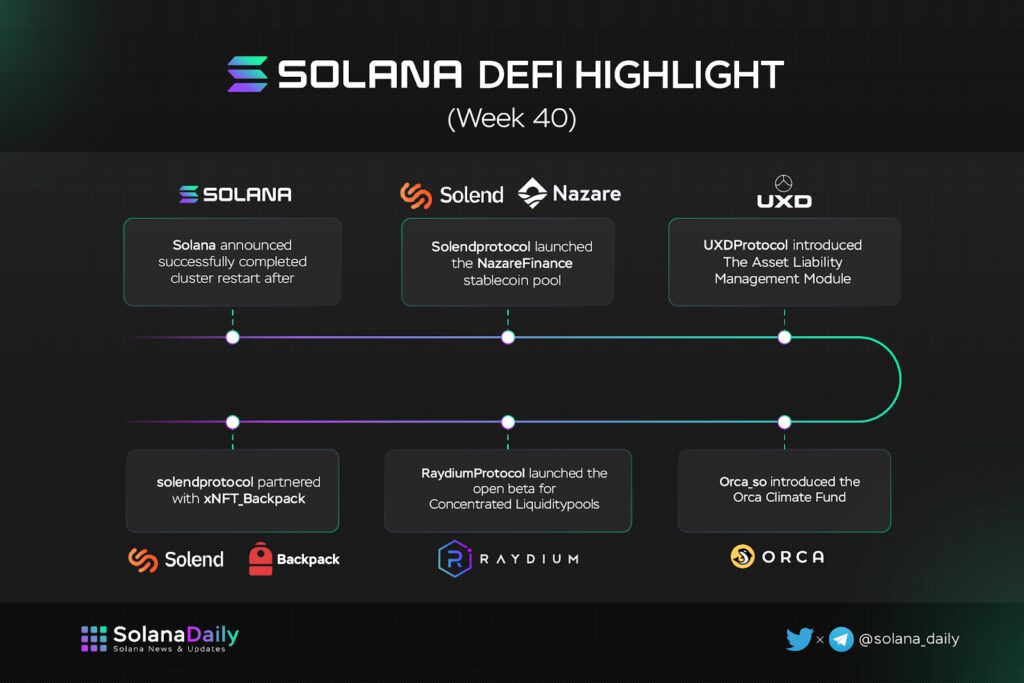

1 – DeFi Highlights on Solana

DeFi Highlights on Solana (Week 39) – Source: Solana Daily

Orca introduced the Orca Climate Fund

In August 2021, the Orca Impact Fund was born. Since that time, a portion of fees on every trade on Orca has been allocated to the Impact Fund, which aims to mitigate the effects of climate change and promote sustainable practices.

Going forward, the Orca Impact Fund will be relaunched as the Orca Climate Fund (OCF). For the fund to retain these core values as Orca continues to move toward full decentralization, it must support Orca’s core business. The name “Climate Fund” is a better reflection of the work that has been completed and the work that lies ahead.

Going forward, the Climate Fund will expand beyond philanthropy and focus also on the intersection between climate change and web3. Instead of solely making charitable contributions, the Climate Fund will also explore ways for DAOs to make an impact on the climate more directly.

UXD Protocol introduced The Asset Liability Management Module

Asset Liability Management Module is a generalized strategy that they believe will be the endgame of stablecoins. This will potentially enable UXD to scale to billions efficiently and at the same time, generate positive cash flow via various sustainable sources of yield on the asset side, which will transform UXP from a pure governance token into a productive asset.

The Asset Liability Management Module can be applied cross-chain, thus making UXD a modular structure that is agnostic between chains and can maintain various asset positions across a variety of chains.

The asset liability management module is a structure that combines various low-risk strategies to back the stablecoin. These strategies generate yield, which will accrue to UXP stakers and the insurance fund.

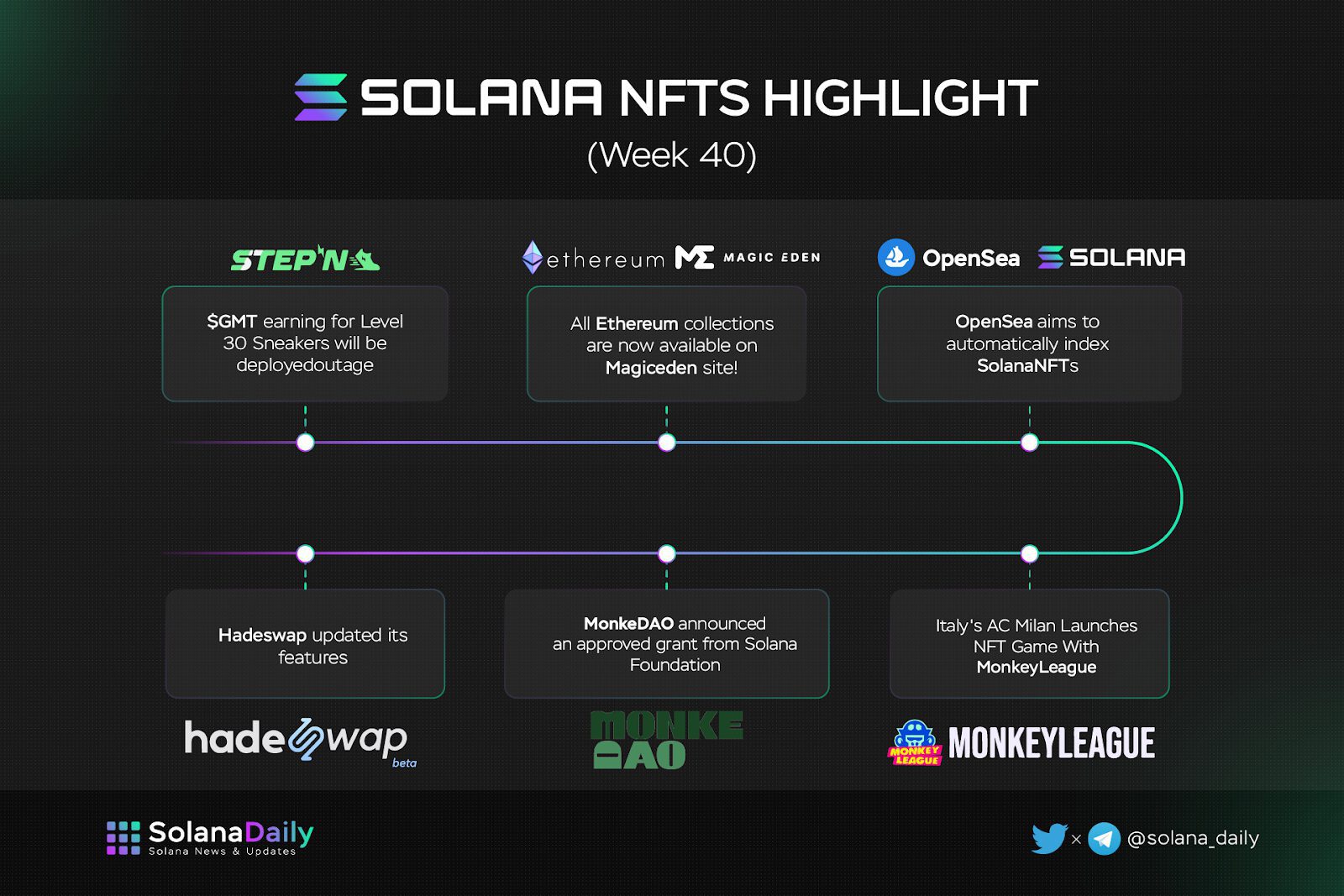

2 – NFTs Highlights on Solana

NFTs Highlights on Solana (Week 39) – Source: Solana Daily

All Ethereum NFTs collections are now available on Magic Eden

So after a month of integrating the Ethereum blockchain, Magic Eden has officially brought the entire NFTs Collection from this largest ecosystem to its platform.

Magic Eden officially becomes a multi-chain NFTs marketplace platform. Direct competition with OpenSea

Monke DAO announced an approved grant from Solana Foundation

The project is developing a module for Solana Validators to automatically purchase Carbon Credits to offset emissions. Beside that, they have also focused on the development of open-source tools designed to improve the DAO and NFT ecosystems on Solana.

Additional Notable Events

DeFi Market

NFTs Market

Fundraising events