BeInCrypto takes a look at on-chain indicators for Bitcoin (BTC), more specifically the Spent Output Profit Ratio (SOPR) in order to isolate patterns relative to prior bullish cycles.

What is SOPR?

SOPR is an on-chain indicator that measures the aggregate state profit or loss in the market. In order to arrive at its values, the buying and selling price of each unspent transaction output (UTXO) are divided with each other.

The adjusted SOPR (aSOPR) is slightly different, since it does not take into account transactions that have a lifespan lower than one hour.

2017 reading

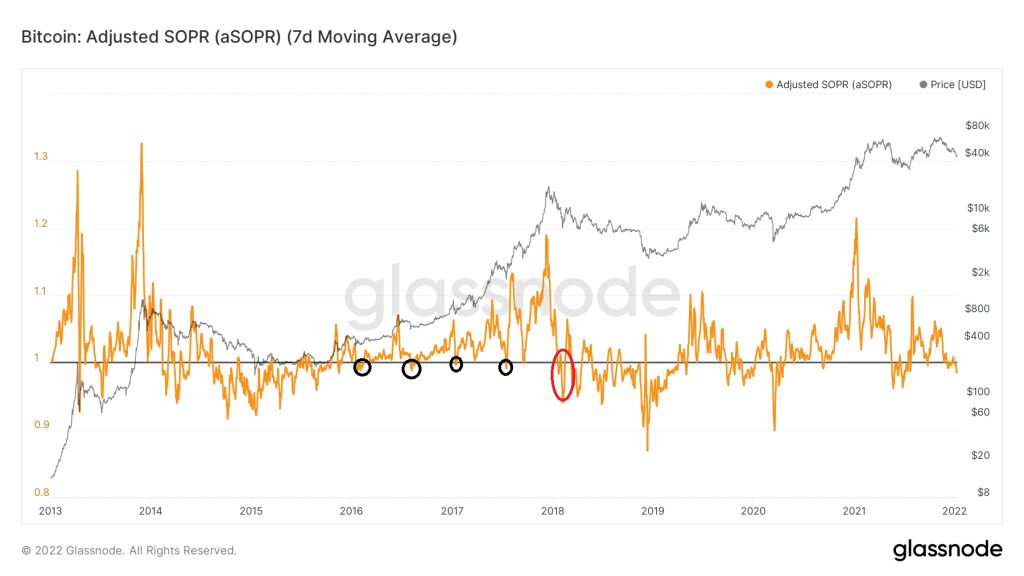

During bull markets, the SOPR consistently stays above one. The reason for this is that the market is in profit as new all-time highs are reached.

In the entire 2016-2018 bull run, the indicator bounced at the one line numerous times (black circle) but did not break down until Jan 2018 (red circle), which was the beginning of the downward movement.

Therefore, the entire bull run was accompanied by readings above one, while the breakdown below the line marked the beginning of the long-term correction.

Current reading

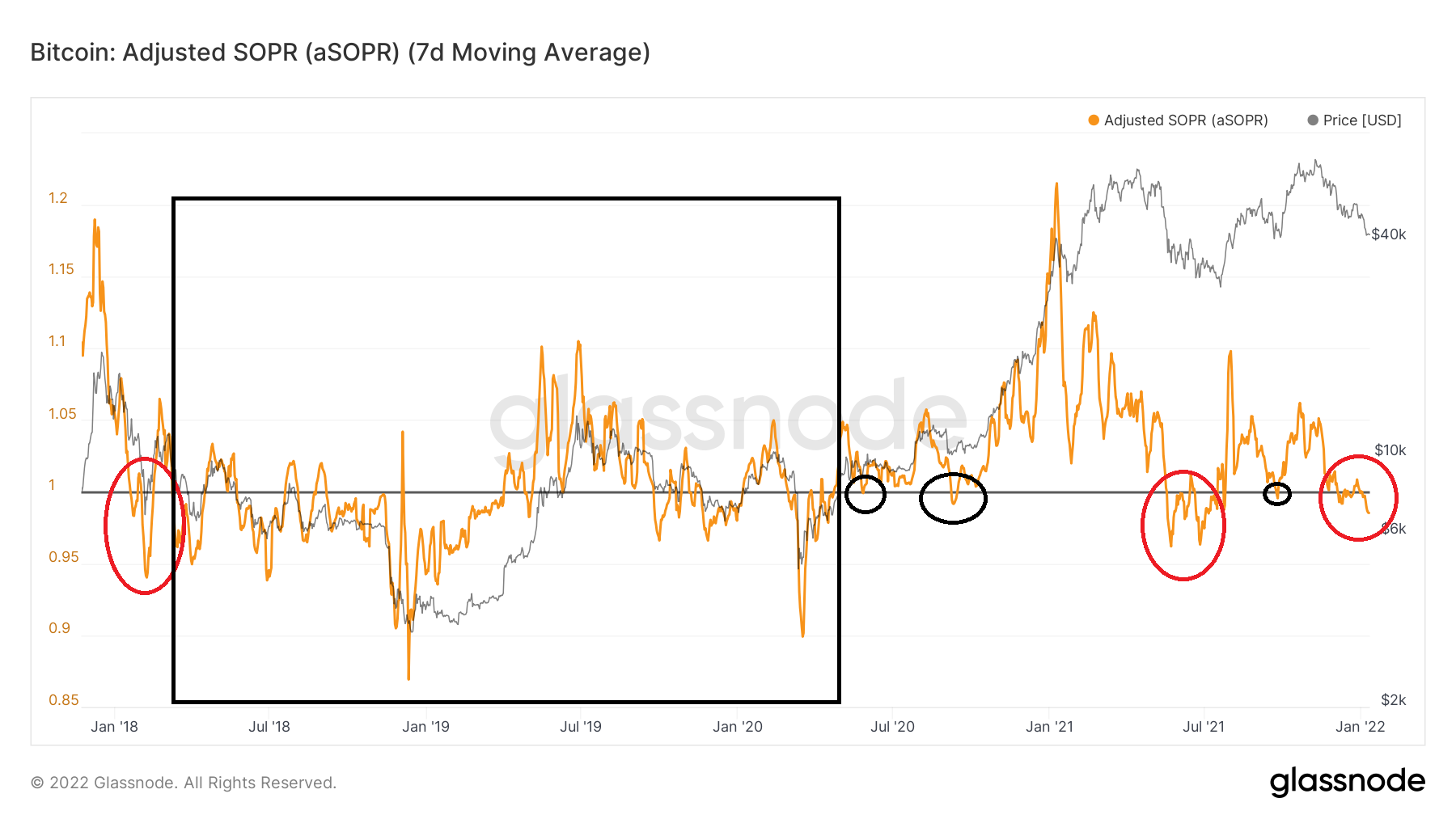

During the ensuing correction, SOPR moved freely above and below 0, a sign of an undetermined trend (black box).

After the bullish trend began again in 2020, the indicator bounced at the 0 line once more (black circle).

On July 2020, SOPR deviated below the 1 line (red circle). This potentially indicated that the bull run was over. However, since it reclaimed the line shortly afterwards, the decrease was only considered a deviation.

However, it has fallen below one (red circle) once more, doing so in the beginning of Jan.

Findings

So far, we have found that SOPR consistently gives readings above 1 during bullish periods. As seen during the 2018-2020 correction, the indicator freely moves above and below 1 during corrective periods.

In the current bull-run, SOPR stayed steadily above one, suggesting that the trend is bullish. The July decrease was also cast aside as a deviation, since the indicator reclaimed the line shortly afterwards.

However, the current decrease below 1 is worrisome, and could signify the start of a long-term correction. The movement during the next few weeks will be crucial, since it could lead to a full on breakdown or another potential reclaim.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.