BeInCrypto takes a look at on-chain indicators for Bitcoin (BTC), more specifically the Stablecoin Supply Ratio (SSR), which has reached a new all-time low.

What is SSR?

SSR is an on-chain indicator that measures the ratio between the supply of BTC and that of stablecoins. Since the supply of BTC is fixed and so is the price of stablecoins, the indicator changes whenever there is a change in the BTC price or in the supply of stablecoins.

A low value suggest that a significant percentage of the supply of BTC can be purchased by stablecoins. For example, an SSR value of 10 suggests that 10% (1/10) of the BTC supply can be bought by stablecoins, while a value of 5 suggests that 20% (1/5) of the supply can be bought by stablecoins.

Buying signal?

An effective buy signal has been given whenever SSR falls below the lower Bollinger band (black circle). This means that it deviated to the downside when comparing it to its normal movement.

So far, it has deviated four times. Each of them have been followed by a very considerable upward movement.

On Jan 19, SSR reached a new all-time low value of 5.26. However, it has yet to fall below the lower bollinger band, even though it is very close to doing so.

Therefore, a buy signal has not yet been given.

USDT Balance

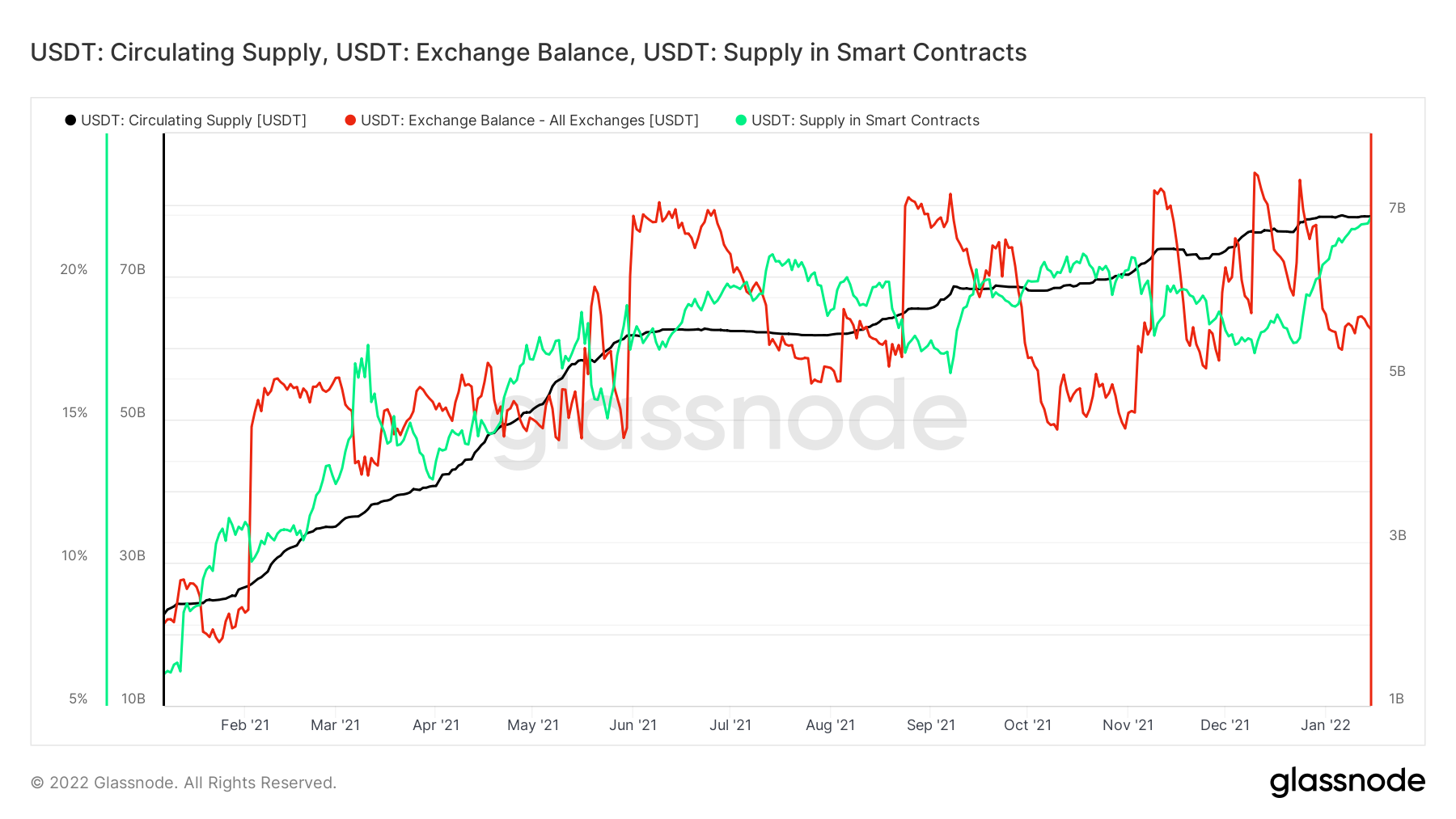

The circulating supply of USDT (black) has been moving upwards since Sept 2020. The increase has been continuing over the past two months, and when combined with the drop in the price of BTC, it has been the catalyst for the SSR drop.

An interesting observation is the fact that the USDT balance on exchanges is decreasing (red). This usually means that investors are bullish for the future outlook of the market, hence are moving their tokens outside of exchange addresses.

Furthermore, the USDT supply that is locked into smart contracts (green) is increasing. This is in stark contrast to December, when the opposite was occurring.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.