As the market has plunged into chaos with the recent crash, stablecoins have once again become the unlikely winners of the day. Cryptocurrencies in the market have all been shedding their values at a rapid pace as investors sell off their holdings. This has to do with the correlation of altcoins with the price of bitcoin. However, these stablecoins have maintained their performance in the market by detaching from the general downtrend.

Stablecoins Take Control Of Top 10

Since the crash, most stablecoins have maintained their 1:1 peg with the dollar. This has made sure that they have retained their market caps where others have seen theirs slashed by large percentages. The result of this has been three stablecoins now being in the top ten cryptocurrencies by market cap.

Related Reading | Altcoin Discount: What Ethereum Whales Are Buying Through The Dip

Now, the bigger digital assets such as Bitcoin, Ethereum, and BNB continue to maintain their position on this list despite the crash. However, they are down by a considerable amount. Recently, BUSD has made its way back into the top 10 after being kicked off by the likes of LUNA and UST. But with the recent scandals rocking both these digital assets, they have lost a significant part of their market caps and as a result, have fallen out of the top 10.

Bears take hold of market | Source: BTCUSD on TradingView.com

Nevertheless, stablecoins such as a USDT, USDC, and BUSD continue to maintain their hold in the market. While other cryptocurrencies drown in a sea of red, they have mostly been the only ones with some semblance of green in their charts.

How The Indexes Are Performing

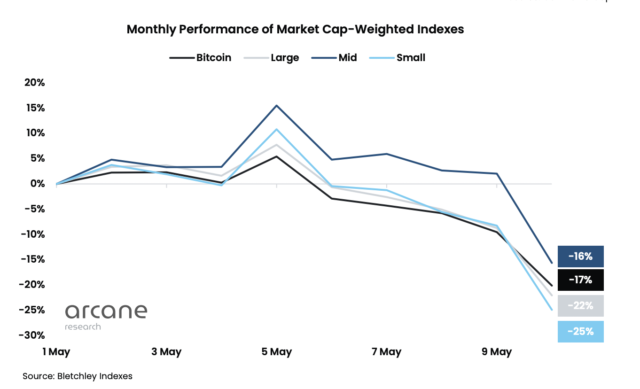

The stablecoins mentioned above have really been the only ones to retain the majority of their market values before the crash. The other indexes have all been rocked by double-digit losses in the space of a single month.

Starting out with the small cap index, they have taken the largest hit. This was the case with the month of April and such continues to be the case in May. This index is usually at the forefront of gains in a bull rally and does the same in a bear. It has recorded -25% losses in less than two weeks into the month of May.

Small cap index take a beating | Source: Arcane Research

The large cap index follows the small cap index to be the only index to record losses above the 20% mark. This index saw -22% losses. Following this is the bitcoin index. This is one that had served as a haven for investors escaping the altcoin bloodbath that started in the month of April but even this proved to not provide enough cover as losses ran as high as -17%.

Related Reading | India To Levy 28% GST On All Crypto Transactions?

The mid cap index is the best performing of all of the indexes. In what has been an incredibly poor start to a historically bullish month of May, the mid cap index saw its losses reach -16%. Although billed as the best performer of these indexes, investors in these mid cap coins still took a hit due to the recent crash.

Featured image from Vulcan Post, charts from Arcane Research and TradingView.com