Avalanche’s price witnessed a pretty decent rally during 2021 with over 3000% price appreciation over the year. In fact, in the first half of November itself, Avalanche witnessed a 130% pump from $62 to the ATH of $147. Post that, however, the 12th ranked alt has spent more time consolidating or correcting.

On December 14, despite the state of the broader market AVAX’s rally seemed to pick up, amid news of Circle launching its stablecoin, USDC on Avalanche. The arrival of USDC to the Ethereum-killer smart contract platform is expected to give a push to the network’s DeFi ecosystem.

Network getting more stable

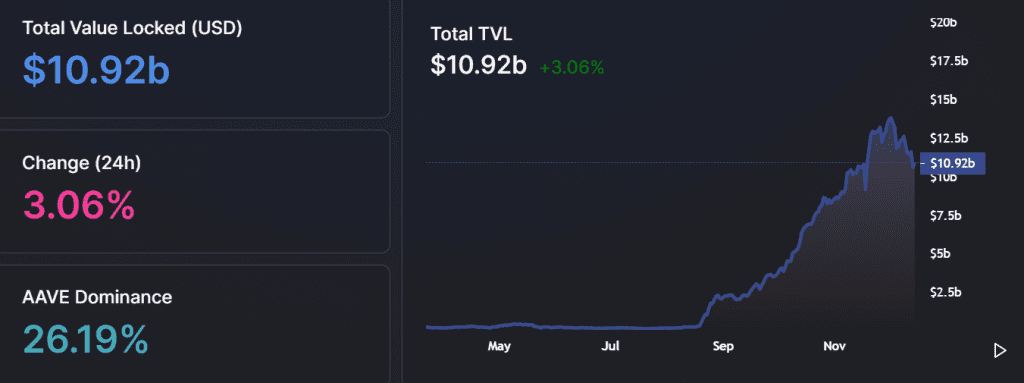

The total value locked (TVL) in Avalanche has seen an over thirtyfold growth in the last year. The DeFi ecosystem on the blockchain received a good boost after the network’s $180 million incentive program- ‘Avalanche Rush’ initiative. The growing TVL was also indicative of the growing institutional interest in the blockchain.

Interestingly, the 11th ranked coin LUNA saw a rally in the first week of December and Terra’s growth in the stablecoin sector aided its growth over the last month. Now with the same happening for AVAX, the alt stands a decent chance of rallying in the remaining year.

Fiat-backed stablecoins are often credited for triggering a spike in the network’s on-chain activity and driving developers to build their projects on the blockchains.

Healthy on-chain growth

Apart from the altcoin’s dominance in the DeFi space and its rise in TVL AVAX’s rising active addresses too were indicative of rising participation on the blockchain. Avalanche’s Daily Active Addresses reached an all-time-high on December 14 alongside rising prices.

Further, the on-chain activity has also been pretty sound of late. The daily transaction count on Avalanche’s C-Chain, for instance, has seen healthy growth. This meant that more and more people were using AVAX’s network to carry out their transactions.

Price-wise however Avalanche still needed to establish itself above the $95 mark as it oscillated 35% down from its ATH at $89.32 at press time.

AVAX’s RSI too finally saw an uptick after a continuous downtrend since the end of November. With AVAX establishing itself above $100, the same could give a boost to AVAX’s price trajectory alongside USDC’s arrival on Avalanche.