The Stellar network has witnessed some significant ecosystem upgrades in the last six months. However, within the same period, the network’s native coin, XLM, told a different story.

In a newsletter published on 29 June, the Stellar network informed its users of some of the developments it made in the last six months. According to the newsletter, leading cross-border P2P payments platform MoneyGram launched its crypto-to-cash service on Stellar within the last six months. Furthermore, customers of Mercado Bitcoin could access USDC issued on the Stellar network since May 2022.

With these developments and many more within the Stellar blockchain, let’s look at how the XLM performed.

Six long months of decline

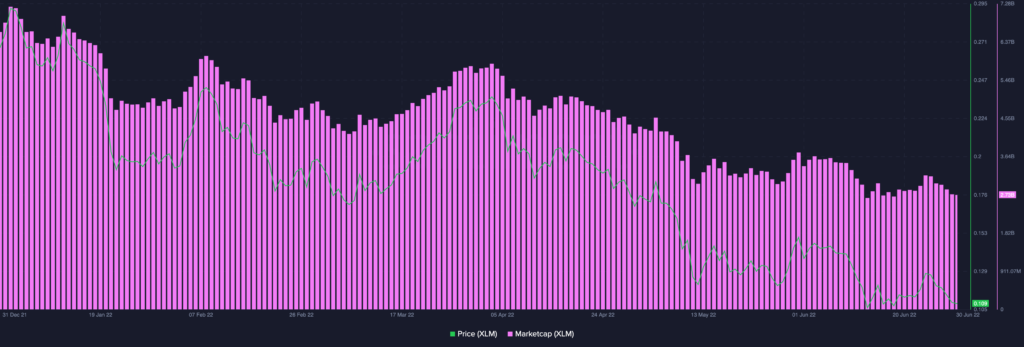

XLM started the year at an index price of $0.27. However, over the six-month period, it declined by 60%. At the time of writing, it exchanged hands at $0.1077. As expected, the market capitalization also saw a drop from $6.62 billion, which it started the year with, to $2.69 billion at press time.

In the last 24 hours, the coin’s price posted a 0.45% decline. At press time, increased selling pressure was spotted with the Relative Strength Index (RSI) at 39.60 in a downward curve.

The position of the MACD also indicated the commencement of another bear cycle. Down by 88.62% from its all-time high, the token, at press time, was trading at its November 2020 lows.

On-chain analysis

In the last six months, XLM saw a decline in its social volume. Pegged at 89 at the time of writing, this metric dropped by 66% within the period under the review.

On the other hand, the social dominance rallied to a high of 0.43% by 25 May, after which it has plummeted. During press time, the metric marked a position at 0.158%.

With the series of developments to the Stellar chain in the last six months, the growth in developmental activity on the network per data from Santiment was not surprising. Since the beginning of the year, this metric has been on an upward trend growing by 167%.

Furthermore, standing at 44 during press time, the percentage supply of XLM held by the whales fell by 17% in the last six months.