StormGain Review: Pros & Cons

Pros

- Only charges trading fees on profitable trades

- It has an efficient cloud-mining feature

- Offers high leverage of at least 300x

Cons

- It has limited assets

- It lacks automated bots

StormGain is a cryptocurrency trading platform that has been gaining popularity in recent months. In this review, we’ll give you our honest opinion on whether or not StormGain is worth your time and investment. So, whether you’re a seasoned crypto trader or just starting out, read on for a detailed StormGain review!

What Is StormGain?

StormGain is a centralized crypto trading platform founded by Alex Althausen. When Althaussen analyzed the crypto space, he realized there was a pressing need to make digital currency trading more lucrative for traders. Therefore, in 2019, the StormGain team launched StormGain as an all-in-one advanced crypto trading platform.

Since it first hit the market, StormGain has lived up to its name, taking the digital trading world by storm and gaining traders impressive rewards. As a centralized platform, StormGain has developed multiple features that make trading simpler and more lucrative. In total, StormGain has three outstanding features.

StormGain Features

StormGain Trading Platform

The first feature traders enjoy on StormGain is the trading platform. Here, traders have access to cryptocurrency trading signals that help them gauge the profitability of their trades.

The trading platform also offers risk management instruments to stop trades before they incur heavy losses or increase trading amounts when there is a higher likelihood of generating profits.

StormGain Crypto Exchange

The other popular StormGain feature is the decentralized crypto exchange. Although StormGain is a centralized platform, it has a built-in decentralized crypto exchange to help traders easily swap crypto tokens. On this exchange, traders can even use credit cards to purchase crypto, which makes it very convenient.

The exchange has two versions, fast and advanced. The fast exchange version is not so different from conventional currency exchanges. With fast exchange, you select the coin you have and the coin you want to convert it to. The platform then generates the exchange rate you need to pay and notifies you how much of the new currency you will receive.

However, when it comes to advanced exchange, you can specify at what point in the future you wish to trade a given coin. For instance, you can trade Bitcoin for Ethereum once the price of Bitcoin drops and that of Ethereum rises. This form of future exchange gives traders more capacity to generate profits from exchanging crypto.

StormGain Wallets

Lastly, StormGain is also popular for its in-built wallet feature. StormGain is home to several crypto wallets. The platform hosts at least six digital asset wallets, including ones for Bitcoin, Ethereum, Bitcoin Cash, Tether, LiteCoin, and Ripple.

These wallets make it easier for traders to store their digital assets without leaving the platform, making StormGain an extremely convenient alternative. Clients can also compare the prices of various cryptocurrencies or analyze a coin against stablecoins like Tether (USDT). Overall, the wallet feature provides a faster, more efficient way to hold, exchange, and trade digital assets.

To access the wallets, traders need to install and sign in to Stormagain’s Android or iOS application. Alternatively, traders can use the desktop version, which is available for Windows, Mac, and Linux systems.

StormGain Trading Options And Order Types

StormGain is a crypto trading platform dedicated to making sure traders can make the most out of the volatility of the crypto market. One of the ways that the platform makes this possible is through trading options and order types. Let’s analyze StormGain’s most popular trading options and order types.

Trading Options

Crypto trading options are contracts that enable a trader to buy or sell a particular asset at a set price within a set period. On StormGain, there are three common trading options, spot, futures, and leverage trading. Here’s a breakdown of what each entails.

Spot Trading

Spot trading is the most common type of option for crypto traders. Typically, it involves buying or selling crypto at a readily available price, hence the name “spot trading.”

When carrying out a spot trade on StormGain, a trader bids the number of cryptocurrencies they want or have and how much they want to spend or make on buying or selling them. Bids are recorded in a public ledger called an order book.

For spot trading, the trading platform analyzes the order book to find a matching bid as soon as a bid is made. For instance, a trader who wants to sell ten bitcoins at $2000 each will have their bid matched to a trader who wants to buy bitcoins at the same price.

Once the trading platform matches the bid, the transaction is immediately initialized. The buyer pays money for the cryptocurrency, and the seller gives up their cryptocurrency in exchange for money.

Futures Trading

Futures trading is almost the opposite of spot trading. While spot trades happen on the spot, futures trading happens after a set period. Let’s break that down a little.

When traders participate in futures trading, they set a time frame, say one month, and a bid price. The traders speculate that a particular cryptocurrency will either increase or decrease in value during this period. At the end of the set time, the trader whose prediction is correct gets the bid price, and the trader who speculates incorrectly loses their bid.

This is the other difference between spot and futures trading. While spot traders exchange the actual asset, futures traders only profit from speculation. For this reason, trade futures trading is highly preferred by traders who want to avoid the risk of owning crypto assets that constantly fluctuate in value.

Leverage Trading

Leverage trading, also known as margin trading, is a crypto trading strategy in which traders borrow money from the exchange or from other traders to increase their trading stake.

For instance, a trader who has $500 but wants to trade $1000 can leverage trade and borrow the additional $500 from StormGain. To do this, they would have to lock up a given amount of money as collateral and then place leverage on the amount they have. So, in this case, they would leverage 2x to get the $1000 they needed.

Leverage trading is a highly lucrative trading strategy. Because traders multiply the amount they are willing to trade, their profits are equally multiplied. StormGain is one of the most popular exchanges for margin trading because it offers up to 300x leverage. This translates to 300 times the profit.

At the same time, however, leveraged trading is extremely risky because losses are multiplied by the leverage. So, 300x means a trader will suffer 300 times the loss. For this reason, margin trading is only advisable for highly experienced crypto traders, and even then, they should only spend money they are not afraid of losing.

Order Types

Orders are instructions that traders issue to trading platforms to get them to perform certain trades. StormGain has two main order types, market and limit orders. Here’s a breakdown of each.

Market Orders

Market orders are placed when traders want to open or close a trade immediately after submitting their order. This means the trader will buy or sell a particular cryptocurrency at the available market price once they place their order.

This order type is a favorite for traders who want to make instant trades. Market orders are normally very efficient when trying to buy or sell an asset urgently. Although they may not guarantee profits because prices may fluctuate right after an order is executed, market orders guarantee that a trade will take place.

Therefore, they can help dispose of assets that are about to make losses or acquire assets that are about to rise in value.

Limit Orders

The other order type on StormGain is the limit order. As their name suggests, limit orders set limits that must be met before a trade is executed. Traders have a chance to decide when the trading platform can officialize a particular trade by setting a price limit. Simply put, when a cryptocurrency hits a certain price, a limit order performs the instructed trade.

Limit orders are a great way to deal with the fluctuations of the crypto market. Limiting orders give traders more control over their trades and the profits or losses they make from them. For instance, StormGain allows traders to set a take profit order, a type of limit order that executes a trade as soon as there is an opportunity to make profits.

There are also stop-loss orders that are executed when a loss hits a set amount to prevent the trader from making further losses.

Additional Revenue Streams on StormGain

Besides its trading options, StormGain also has a reputation for helping crypto enthusiasts make a little extra cash.

The two additional revenue-generating streams on StormGain are Bitcoin mining and the Refer a Friend program.

Let’s review each stream and how you can make the most of it.

StormGain Mining

When people hear about Bitcoin mining, they often picture power-intensive mining rigs that cost a fortune to install and are painfully slow at generating new coins. But, this is mostly a thing of the past. Unless it’s an entire mining company like BitFarms, Bitcoin mining is easily accessible through cloud mining.

StormGain mining uses the platform’s equipment and cloud systems to generate the hashes needed to mine Bitcoin. This easy-to-access technology is accessible through the StormGain app and requires no power-draining hardware resources on the miners’ end to work.

It takes a miner about 10 USDT worth of bitcoin to be able to withdraw their newly-mined bitcoin. However, StormGain offers mining rewards just four hours after a successful mine.

As soon as miners mine a coin, StormGain takes about four hours to give mining rewards.

How To Start Mining Bitcoin on StormGain

Mining Bitcoin through StormGain’s cloud mining system is an easy and affordable way to get into Bitcoin mining.

Here’s a quick guide on how to get started mining Bitcoin on StormGain.

- Click on the StormGain login button to access your account and navigate to the ‘Bitcoin Miner’ page.

- Click on the Mining option on the navigation bar.

- Tap on the green Bitcoin icon to start mining.

- You can increase your mining speed by actively trading other cryptocurrencies on StormGain.

Refer a Friend Programme

Besides Bitcoin mining, StormGain users can also benefit from the platform’s referral program. This feature enables clients to refer their friends and acquaintances to sign up on StormGain and earn rewards for their efforts.

These rewards include 15% of what referrals withdraw in USDT. The referrals also earn three USDT as soon as they sign up. To enter the loyalty program, all you need to do is to sign up for a StormGain account, copy the referral link provided, and share it. You are enrolled in the program as soon as the first new client registers using your link.

Although this is only a summarized explanation of the loyalty program, it is an impressive offer to earn passive in StormGain. However, it’s best to visit the StormGain Refer a Friend page on the platform’s website to better understand the applicable terms and conditions.

Supported Currencies and Payment Methods

StormGain supports at least 20 cryptocurrencies. These include Bitcoin, Ethereum, DogeCoin, Shiba Inu, LiteCoin, Ripple, and stablecoins like Tether and XAUt.

Besides the range of cryptocurrencies it supports, StormGain also supports a variety of payment methods. The most popular payment method on the platform is credit cards. StormGain has advanced features that allow users to buy crypto directly using their credit cards.

But, apart from credit cards, this platform also supports multiple crypto wallets and SEPA bank transfers for countries in the European Union.

StormGain Fees

When using StormGain, crypto traders are subject to deposit, transaction, and withdrawal fees. StormGain deposit fees depend on the deposit channel used. Traders who deposit funds using crypto wallet transfers are not subject to any fee.

For debit and credit card deposits, there’s a 3.5 to 5% charge on the amount being deposited. However, traders residing within the EU can get free credit card deposits if they undergo StormGain’s rigorous verification process.

StormGain is one of the most considerate trading platforms where transaction fees are concerned. Unlike most crypto exchanges, where every transaction incurs a fee, StormGain only charges transaction fees for profitable transactions.

This means users don’t have to pay anything until their transaction earns them some profit. StormGain traders have to pay a fee of 10 to 20% for profitable transactions, depending on the trading pair.

Withdrawal fees on StormGain vary depending on the coin in question. The fee required is normally displayed in the withdrawal request window when making the request. However, for residents of the EU who have SEPA accounts, withdrawing crypto from StormGain is absolutely free.

StormGain Commissions

Besides transaction fees, StormGain also charges trading commissions. These commissions are the interest rates that the trading platform earns for performing a given trade.

StormGain features three types of trading commissions that apply to different types of trade. Let’s analyze each of them and what they entail.

- Exchange commission: This commission applies when converting one digital currency to another. The exchange commission is charged at conversion time.

- Transaction commission: This commission is charged on leveraged trades. When traders open or close a leveraged trade, the exchange imposes a transaction commission which serves as a lending rate for the given trade.

- Financing rate: A financing rate is an interest associated with loans that traders receive from the trading platform. If a trader borrows a loan, they are charged a finance rate, and if a trader offers a loan, they are set to receive the financing rate as a reward. The finance rate is payable at specific intervals during the day.

Security

StormGain is one of the most secure cryptocurrency platforms globally. This three-in-one trading platform is a member of the Financial Commission’s Blockchain Association. The commission ensures its members uphold the highest possible standards of commercial conduct.

Besides that, StormGain also applies necessary protection protocols like two-factor authentication and encrypted transactions to ensure the safety of the assets in their possession is not compromised. Similarly, StormGain stores most of its crypto assets in hardware wallets as a secondary protective strategy. Cold wallets are fully immune to cyber attacks, making them more secure.

StormGain Alternatives

Despite its unique features and how much it simplifies profit-making in crypto, StormGain faces stiff competition from other platforms. Let’s review the best StormGain alternatives.

OKX

OKX is better than StormGain in multiple ways. First, it offers a wider range of crypto assets. While StormGain only supports about 20 cryptocurrencies, OKX supports about 343 cryptocurrencies.

This platform is also known for its incredibly low transaction costs, ranging from about 0.10% or lower for transactions. Although critics argue that non-profitable StormGain transactions go uncharged, thereby making StormGain more affordable, OKX doesn’t have as many commission charges on certain trades, making it more affordable than its competitor.

On the flip side, OKX is not a certified crypto trading platform like StormGain. In fact, U.S. residents have no access to OKX. To add to this, StormGain is better than OKX because while the latter is only a trading platform, the former is a three-tier crypto trading solutions provider equipped with a trading platform, an in-built exchange, and multi-currency wallets.

eToro

Another platform that gives StormGain a run for its money is eToro. This multi-purpose trading platform is not only available for crypto traders. EToro also doubles up as a multi-asset brokerage firm, giving people a chance to engage in other investment opportunities like stocks,

Exchange Traded Funds (ETF) and Contracts for Difference (CDF).

Like StormGain, eToro also has intuitive trading signals that simplify trading for its users. The platform’s trading feature allows traders to predict patterns easily and even copy trading strategies from seasoned investors.

EToro also has superior security features compared to StormGain. The platform protects users from Distributed Denial of Service attacks and stores its crypto assets in cold storage wallets to prevent losses stemming from cyber attacks.

However, StormGain has the upper hand when it comes to affordability. While StormGain only charges transaction fees for profitable trades and commissions on certain transactions, eToro charges conversion fees for changing any currency to USD and then charges extra trading fees of 0.75% to 5.0%, depending on the currency being rated. eToro also charges a $10 inactivity fee for accounts that haven’t traded for 12 months.

How to Create a StormGain Account

To enjoy the benefits that StormGain offers, you need to create a StormGain account. This is an easy seven-step process that you can follow on your PC regardless of your operating system or browser. Here are the step-by-step instructions on how to create a StromGain account.

- Visit StormGain’s website and click on the Get Started button.

- Enter all the required details and check the Agree checkbox to agree to the platform’s terms and conditions.

- Click on the Create an Account button.

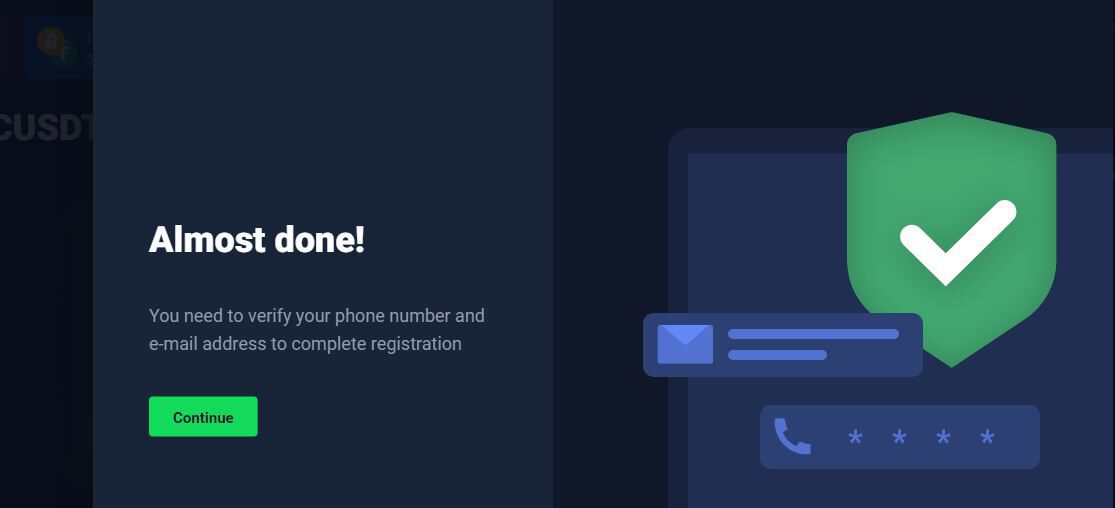

- On the next tab, click the Continue button to verify your phone number and email address. This is an important security step called two-factor authentication, so ensure you fill in the correct details.

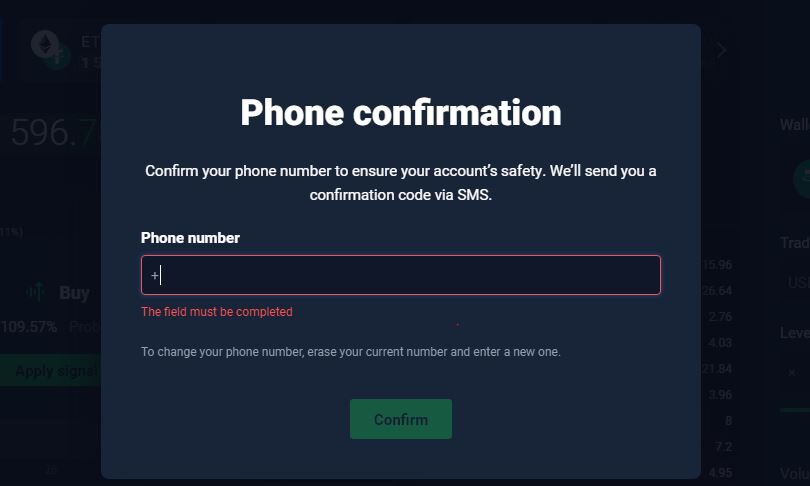

- Enter and submit the correct phone number that StormGain can use to send you a code should you lose access to your account.

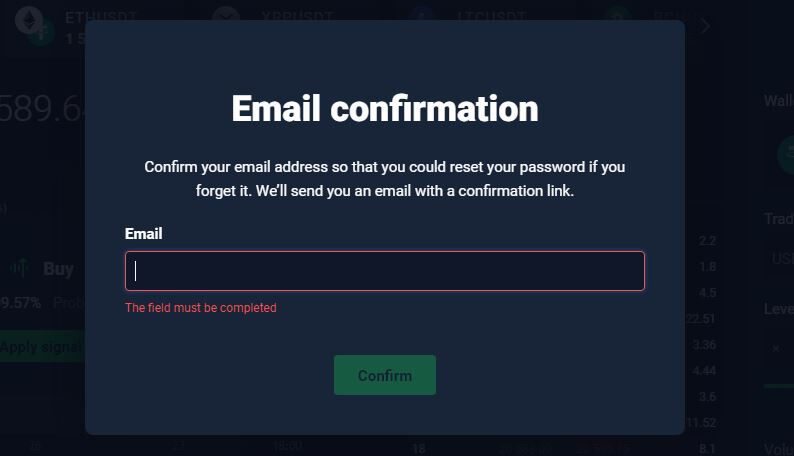

- Enter the email you signed up with.

- Go to the email account, find the verification email from StormGain, and read and follow the instructions to verify your account.

- If all this is successful, you’ll see a confirmation pop-up. Click the Get Started button to access your StormGain dashboard.

FAQs

1. Is StormGain Legit?

StormGain has a legitimate cloud mining system for mining Bitcoin. This system is built entirely on StormGain’s hardware, so all users need to use it is to create a cloud mining account. As a miner, you.

2. How Do You Make Money with StormGain?

There are multiple ways of making money on StormGain. The most common way is to trade crypto through the platform’s trading feature. You can also opt to mine Bitcoin and receive rewards for your efforts. Alternatively, you can earn through StromGain’s Refer a Friend program, where you earn when people join the platform using your referral link.

3. How Long Does it Take to Mine One Bitcoin on StormGain?

Mining Bitcoin on StromGain takes at least 4 hours for a single reward. However, you need to mine the equivalent of 10 USDT in Bitcoin to be able to withdraw the profits earned.