Bitcoin has bounced back strongly in the last 48 hours gaining 8% on the weekly chart. Today, the BTC price is up by another 5% moving past $31,500. The recent price rally comes as Bitcoin tries to catch up with the U.S. equity market after strong decoupling last week.

Bitcoin has given a strong breakout on the daily chart. This could be the start of its journey towards $38,000.

Very nice daily candle for #bitcoin!

Could this be the start of the relief rally up to 38k? pic.twitter.com/U7r5JQf9eK

— Lark Davis (@TheCryptoLark) May 30, 2022

Trending Stories

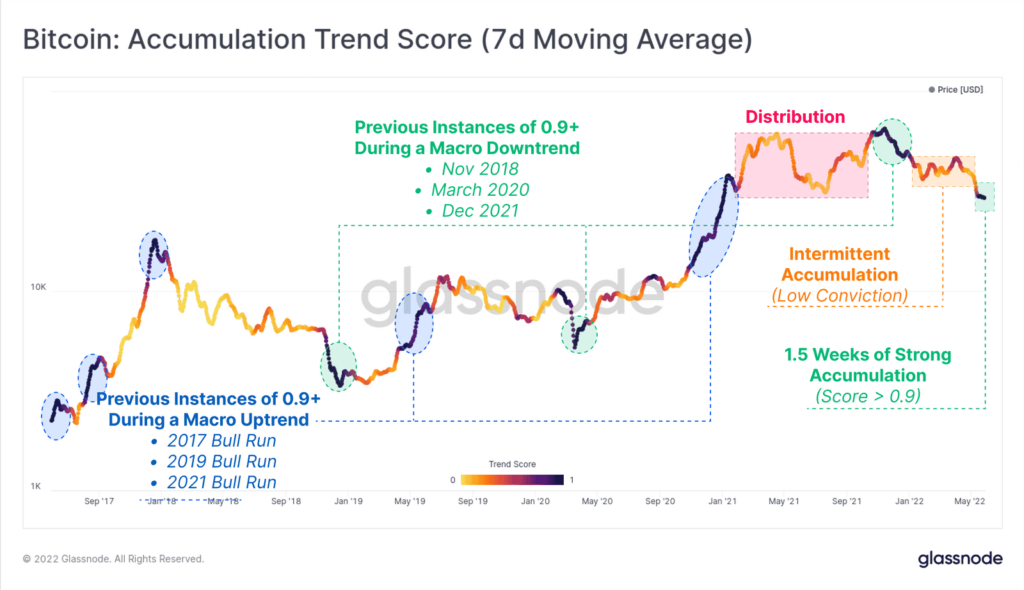

On-chain data from Glassnode shows that after Terra’s liquidation of more than 80,000 BTC, Bitcoin has once again come under a strong accumulation zone. In its recent report, Glassnode writes:

The Accumulation Trend Score has seen a noteworthy shift in behaviour. For almost 2-weeks, it has returned near perfect score above 0.9. This indicates that existing entities on the network are adding significantly to their holdings.

Bitcoin Accumulation Divided Into Two Groups

Bitcoin HODLers have been at the forefront of buying the dips during the recent price correction. But a look at the wallet cohorts shows two major groups accumulating Bitcoins. this includes entities with <100 BTC and entities with >10k BTC.

Glassnode has a look into the aggregate wallet balances and found strong demand from < 100 BTC entities. The LUNA foundation liquidated 80,081 BTC during the Terra collapse. The < 100 BTC cohort bought 80,724 BTC after the Bitcoin sell-off by Terra.

The other cohort contributing towards high Bitcoin accumulation are the whales with over 10K BTC holdings. Glassnode explains: “Over the course of May, these entities have added 46,269 BTC to their balance, and note that this includes the distribution of 80k BTC from the LFG wallet”.

The long-term holders continue with strong accumulation at dips. However, these entities spent nearly 77K BTC during the recent sell-off as shown by Glassnode. On-chain data shows that the long-term holder supply is returning to an ATH of 13.48 million BTC.

The data provider expects the long-term Bitcoin supply metric to surge further over the course of the next 3-4 months. HOLDers might soak up more going ahead.