The broader market has begun correcting to find a more suitable level to bounce back from. However, Axie Infinity (AXS) and SushiSwap (SUSHI) seem to be running a little too far below their +6% drawdowns at press time.

DeFi hotshots shot down

For AXS, the events that transpired a few days ago (Ronin hack) make sense and explain its bearishness. It doesn’t work for SUSHI, however – The second biggest DEX this week with volumes worth $269 million.

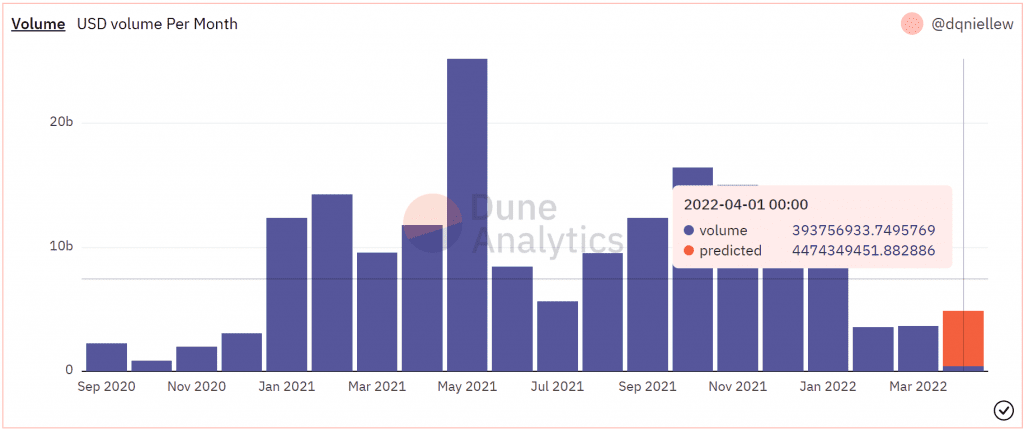

Regardless, this is just another addition to SUSHI’s already diminishing investor interest. For example, the monthly volumes transacted on the chain are just slightly above the figures previously seen.

This month’s prediction for the volume is expected to cross $4.4 billion, even though SUSHI only noted $3.65 billion worth of transactions last month. But, there is a chance of this prediction coming true because on-chain metrics are indicating the same.

SushiSwap monthly volume | Source: Dune – AMBCrypto

First of all, there has been a notable increase in the number of transactions conducted on the DEX, relieving the declining usage of the platform.

And, along with this increase in transactions came the increase in volume. Weekly numbers have been climbing the charts thanks to its recent bullishness, with its price action reinvigorating positive sentiment across the market.

SushiSwap DEX weekly volume | Source: Dune – AMBCrypto

One minor concern going forward will be the number of users on the DEX. Between January and April, for the most part, new people joining the DEX haven’t registered a crazy rate of growth. Worth noting here that March performed better than February in that aspect.

On the contrary, in April already, the number of new daily users has slipped to its lowest level in 4 months. In fact, the metric in question had a reading of just 470 users, at the time of writing.

SushiSwap average daily new users | Source: Dune – AMBCrypto

Investors, on the other hand, have been growing consistently. Going forward, SUSHI might be looking at some consolidation since the market might have to cool down after the RSI approaches the overbought zone.

The altcoin has a long way to go, especially since it is yet to recover all its year-to-date losses.

SushiSwap price action | Source: TradingView – AMBCrypto