On 4 November, it was announced that the first ever stableswap on SushiSwap was being deployed through Polygon. With significant volatility surrounding SUSHI, this new update may cement SushiSwap‘s position in the long run.

We are pleased to announce that the first ever StableSwap on @SushiSwap is deployed on @0xPolygon and features a USD+/USDC Gauge Pool. 💪

Earn passive yields from USD+ in addition to $SUSHI incentives & swap fee – yields on yields are here! 🔥#USDPlushttps://t.co/8jZ7IQyVcn pic.twitter.com/xIPHYDynWj

— Overnight.fi (USD+) – Vanguard of DeFi (@overnight_fi) November 4, 2022

____________________________________________________________________________________

Here’s AMBCrypto’s Price Prediction for SushiSwap [SUSHI] for 2022-2023

____________________________________________________________________________________

The stableswap features a USD+/USDC Gauge Pool and at press time, its annual percentage rate (APY) was at 209.22%. Its current liquidity was at $127,000 and had depreciated by 5.19% over the last 24 hours. However, its volume had shown growth during the same time period.

Despite the launch of this stableswap, SUSHI‘s total value locked (TVL) remained the same throughout October according to DefiLama. Furthermore, at the time of writing, SushiSwap’s TVL stood at $591.01 million.

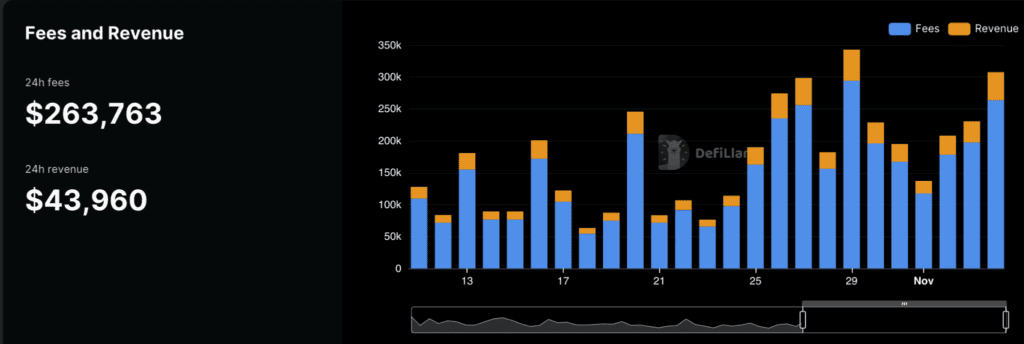

Fees and revenues

The fees generated by the DEX continued to grow over the past few weeks. As can be seen from the image below, the fees collected by SushiSwap had increased significantly. In the last 24 hours, the total fees collected by SushiSwap was at $263,000 and the total revenue generated was $43,000.

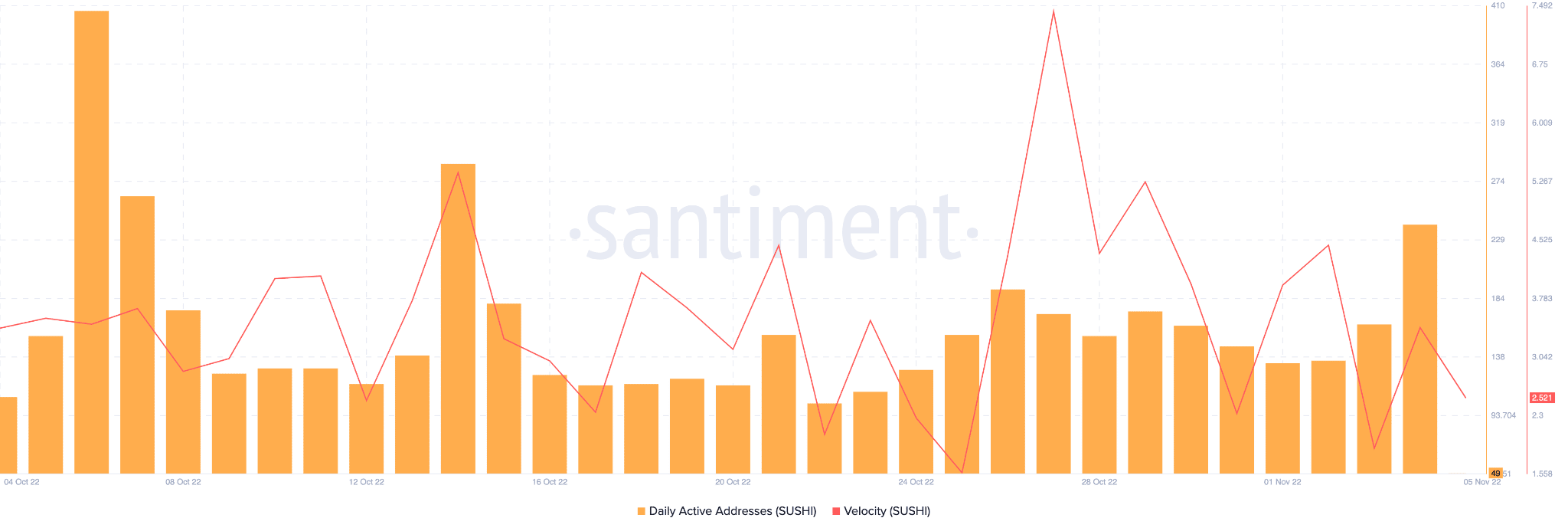

Although the fees and revenue generated kept on growing, the average number of new users being added on SushiSwap continued to decline. From the image below, it can be observed that the number of new users being added per day declined over the past two months.

Furthermore, along with the new addresses decline, the daily activity for SUSHI also declined over the past month. Additionally, its velocity decreased over the past few days as well. This indicated that the frequency with which the tokens were being transferred from one address to another had reduced.

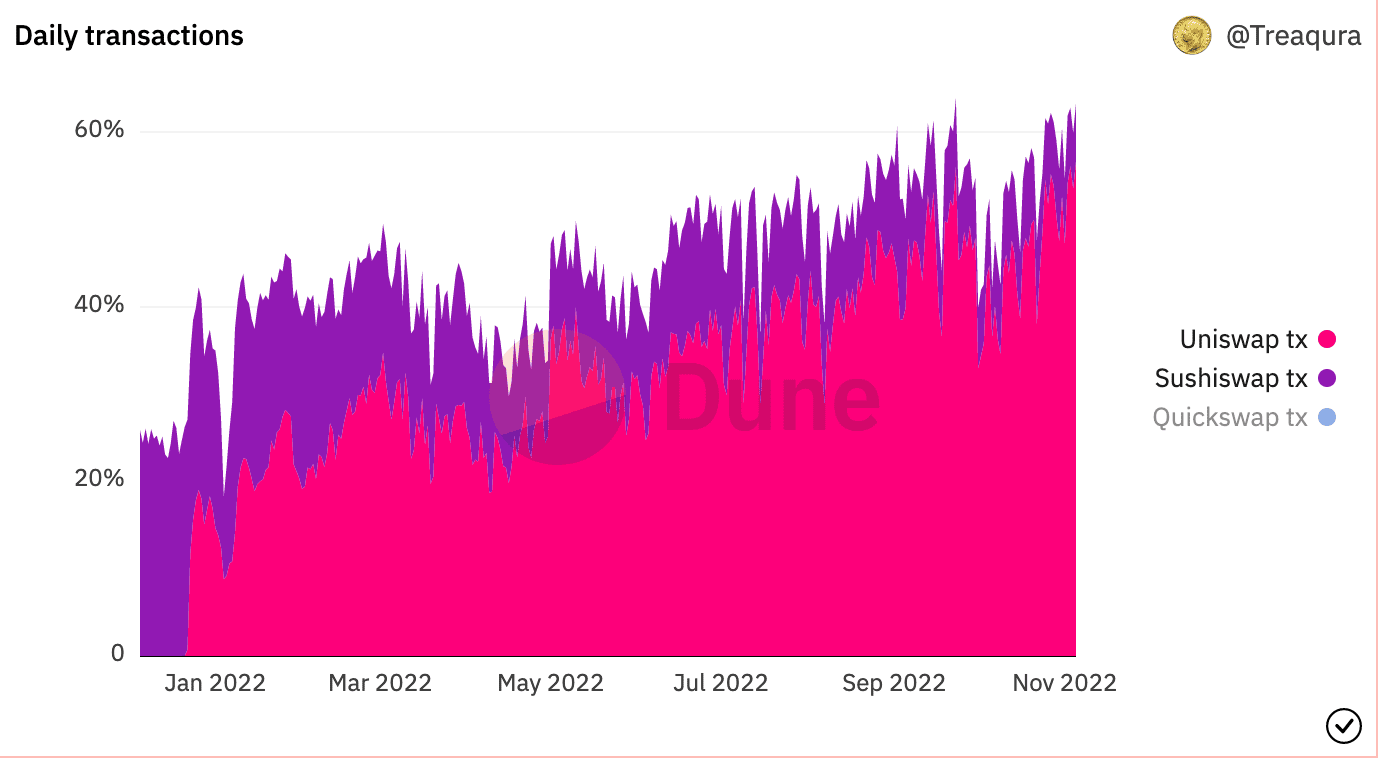

Even with the launch of new protocols, SushiSwap still had a long way to go before it could outcompete other DEXs.

UNI vs SUSHI

The number of transactions on SushiSwap paled in comparison to the frequency of transactions on Uniswap. As can be witnessed from the image below, the number of transactions being made on Uniswap outweighed the number of transactions being made on SushiSwap by a large margin.

It remains to be seen whether SushiSwap’s recent development will improve its chances of competing with other DEXs. At the time of writing, SUSHI was trading at $1.92 and had appreciated by 10.04% over the last 24 hours according to CoinMarketCap. During the same time period, its volume also appreciated by 53.50%.