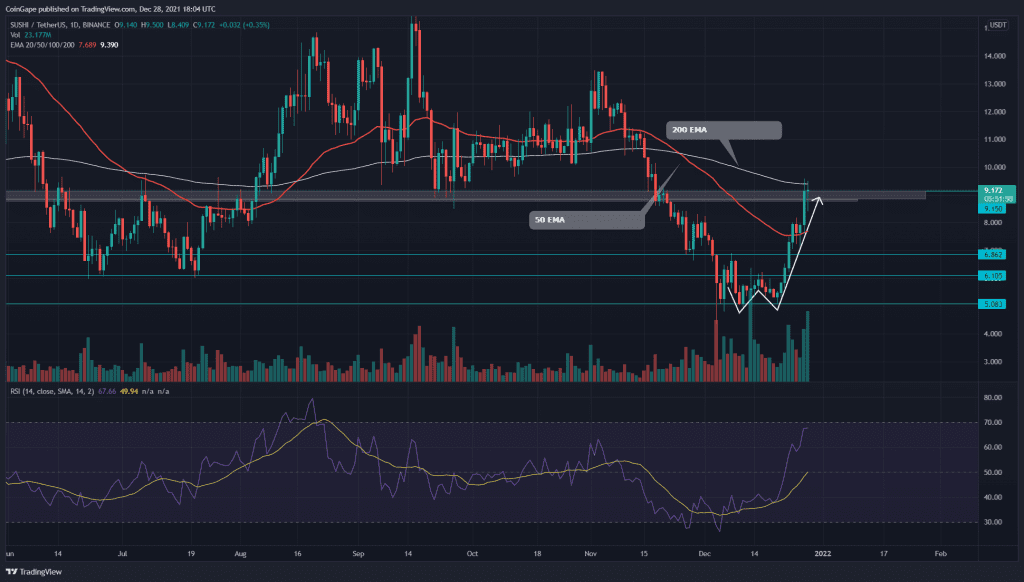

The SushiSawp price action shows a struggle to maintain the bullish trend due to multiple bearish factors becoming more and more influential. However, there is overwhelming bullishness that can overcome any minor retracements in the daily chart.

Key technical points to ponder:

- The SUSHI token price struggles to overcome the 200 days EMA supply pressure.

- The intraday trading volume in the SUSHI token is $1.18 Billion, indicating a 100% gain.

Source- Tradingview

In our previous coverage of SushiSawp technical analysis on December 14th, the token price breached the $6 support zone, and downfall to $3 was suspected. However, the coin price managed to overcome the bearishness.

Completing a double bottom pattern on December 21st and breaking above the neckline at $7, the SUSHI coin price continues the bull run to the $9 mark. However, the existing zone between $8 to $9 still remains influential and might cause a trend reversal.

The coin price shows a struggle to rise above the 200 days EMA despite breaking above the 50 and 100 days EMA in the past couple of days with absolute ease. Moreover, the RSI indicator (65) hints at a reversal as the slope approaches the overbought boundary.

SUSHI/USD 4-hour time frame chart

Source-Tradingview

The SUSHI token price continues the rally resonating in the rising channel pattern showing new higher high and higher low spots in the 4-hour chart. However, the recent struggle to rise above the $9 resistance level can mark a bearish fallout.

Moreover, the higher price rejection candle formed closes below $9 and hints at a bearish takeover of the trend. Nonetheless, until the price action remains within the channel, traders can find bullish opportunities at support dips.

The price action indicates resistance levels at $11.5 after the $9 horizontal level in the daily chart. Meanwhile, the previous bullish reversals mark support levels at the $8 and $6 support zone.