SushiSwap, one of the leading DEX’s in the crypto space, was a victim of the bear market like many others. However, a new Messari report suggested that SushiSwap may be showing some growth in terms of transactions and revenue.

.@uniswap key metrics looking 🟢 over the last seven days according to our Protocol Metrics feature. pic.twitter.com/g6XMGNnQqj

— Messari (@MessariCrypto) October 22, 2022

____________________________________________________________________________________

Here’s AMBCrypto’s Price Prediction for SushiSwap for 2022-2023.

____________________________________________________________________________________

The leading crypto analytics firm, tweeted about this development on 22 October. As per the data provided by Messari, SushiSwap witnessed growth on multiple fronts in the last seven days. Furthermore, Sushiwap’s revenue grew by 61.52% since the last week. Growth was also observed in Liquidity Pool transactions and Trading volume.

Moving on to some not-so-pleasant issues

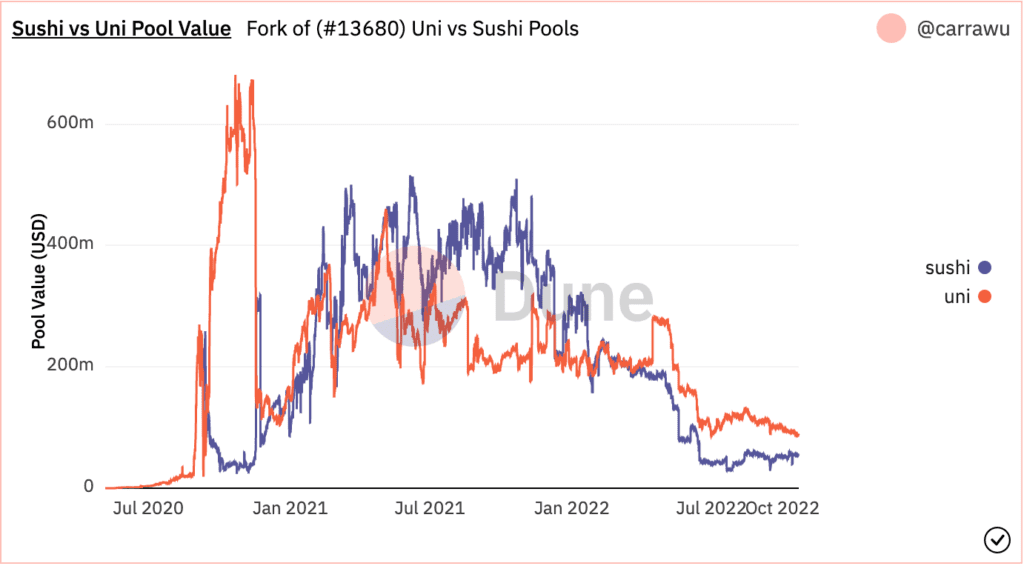

Despite the growth that SushiSwap observed, it still lagged in certain domains. As can be seen from the image below, SushiSwap failed to compete with Uniswap when it came to pool values. Over the last few months, Uniswap managed to show significant dominance over SushiSwap in this regard.

Despite both positive and negative factors being at odds with each other when it came to SushiSwap, its TVL remained relatively stable. Despite the slight depreciation in terms of TVL over the past couple of months, the overall movement of SushiSwap’s TVL was flat since the last few weeks. At press time the total value locked by SushiSwap stood at $491.47 million.

One of the things that could be getting in the way of SushiSwap’s growth could be the decline in the number of new users being added to the network. As can be observed from the image below, the average number of new users per day on the SushiSwap network continued to decline since September.

To improve its chances of success in the future, SushiSwap may want to show improvements in this area.

Coupled with that, there were other bearish signs against SushiSwap as well.

Some bear invites on the way

In the past few days, the number of daily active users on the SushiSwap network witnessed a decline. Furthermore, there was a sharp decline in network growth as well. A decline in network growth would indicate that the amount of new addresses that transferred SUSHI for the first time declined. This could infer that new addresses might be losing interest in SUSHI.

At the time of writing, the SUSHI token was trading at $1.33 and had appreciated by 2.22% in the last 24 hours according to CoinMarketCap. Its market cap had observed similar growth as well however, its volume depreciated by 20.40% in the same time period.