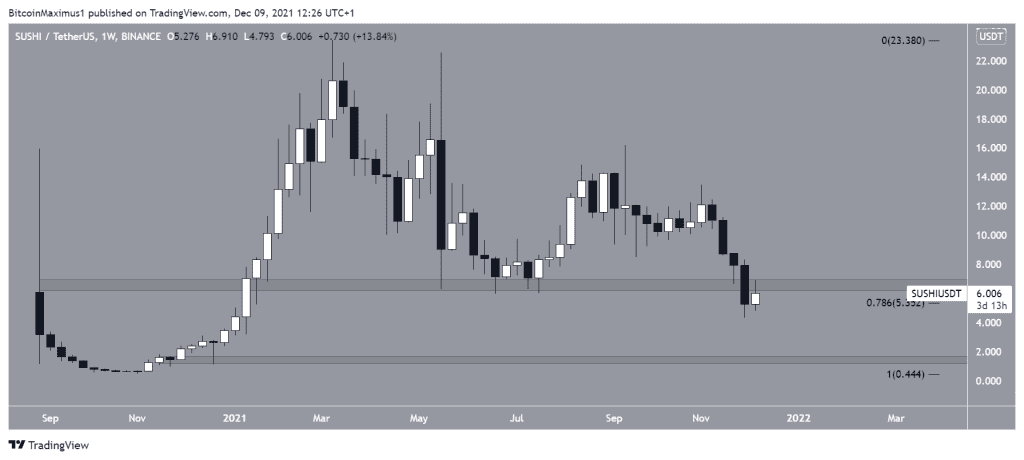

Until SushiSwap (SUSHI) manages to reclaim the $6.50 horizontal area, the long-term trend is considered bearish.

The weekly chart shows that SUSHI has fallen below the $6.50 area, above which it had previously traded since Sept.

While it is trading just above the 0.786 Fib retracement support level at $5.30, the $6.5t0 area holds crucial importance, thus the breakdown is an extremely bearish sign.

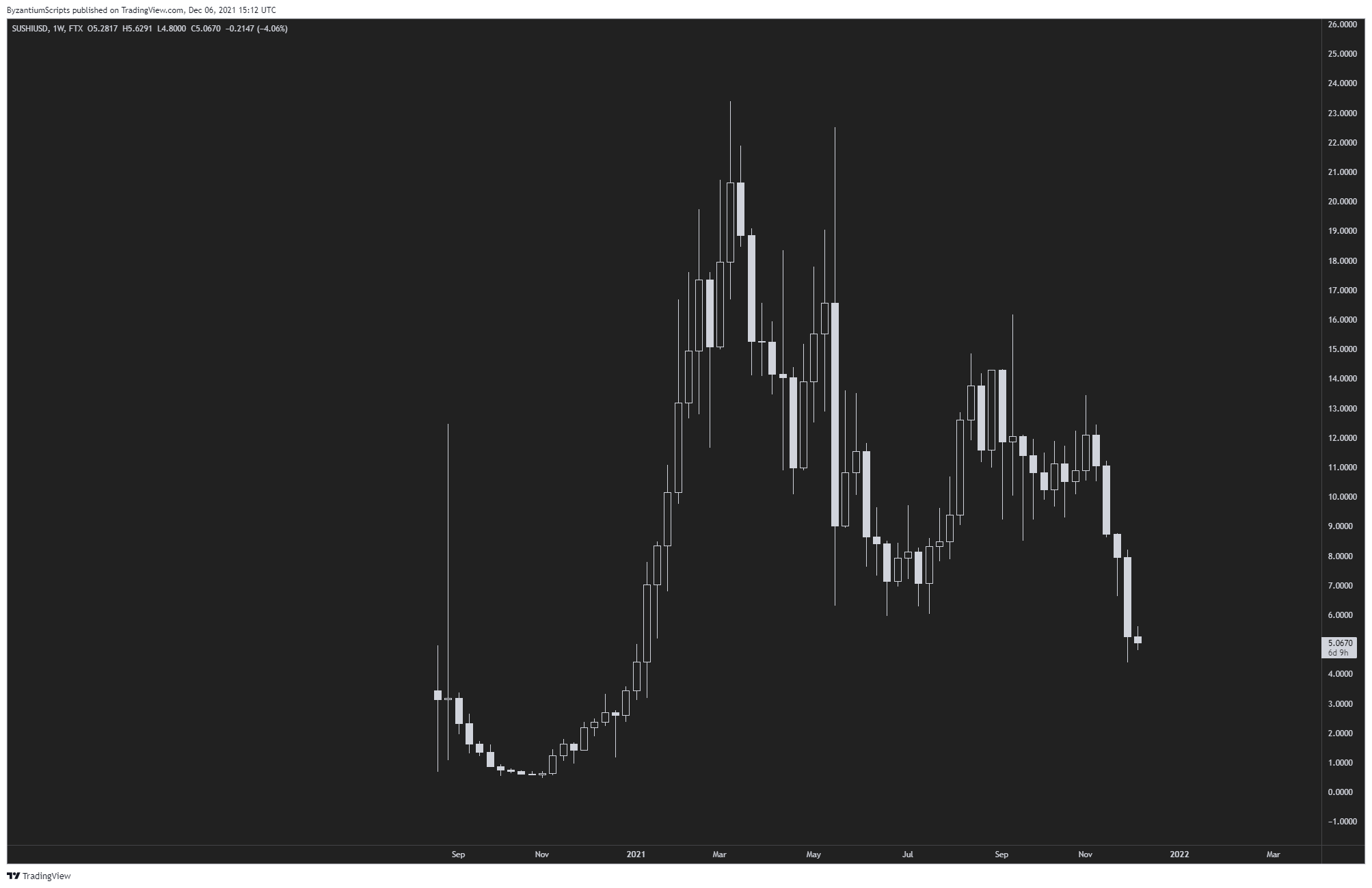

Cryptocurrency trader @ByzGeneral outlined a SUSHI chart, stating that the token is likely to continue its descent.

As outlined above, if SUSHI fails to reclaim the $6.50 area, the next support would be all the way down at $1.40.

Descending wedge

The daily chart shows that SUSHI has been falling since May 18, when it had just reached a new all-time high price of $22.53. The downward movement led to a low of $4.33 on Dec 4. The token bounced afterwards.

The bounce validated a descending support line that has been in place since late May. Since SUSHI is also following a descending resistance line, it is possible that it is trading inside a descending wedge, which is considered a bullish pattern.

However, technical indicators are still bearish. The MACD, which is created by a short- and a long-term moving average (MA), is negative and decreasing. This means that the short-term MA is moving slower than the long-term one. On a more positive note, its histogram has created three consecutive (green circle) higher momentum bars, a sign that the MA is beginning to move faster.

The RSI, which is a momentum indicator, is below 50. This is also a sign of a bearish trend.

Therefore, the daily time-frame provides a generally bearish outlook.

Short-term SUSHI movement

The shorter-term two-hour chart shows that SUSHI is trading inside an ascending parallel channel. It has been doing so since the Dec 4 low.

The ascending parallel channel is considered a bearish pattern, meaning that a breakdown from it would eventually be expected.

Furthermore, SUSHI is trading in the bottom portion of the channel, after validating the middle as resistance (red icon).

As a result, a breakdown from this pattern would be the most likely scenario.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.