Interest in Synthetix Network Token (SNX) has spiked tremendously on social media as SNX gains a mere 4% on the daily chart; but with on-chain indicators glimmering can SNX start a rally any time soon?

After Synthetix founder Kain Warwick submitted a proposal to turn off SNX’s high yield returns and cap its supply at 300 million tokens, the project has managed to garner decent social attention.

In fact, recently SNX made its way close to the critical resistance level the coin has been trying to battle for some time. While a move above the $2.5 resistance mark can lead to high short-term gains some on-chain metrics pose a mixed picture for SNX’s future.

Sellers still dominating

The Synthetix decentralized trading ecosystem is built on the Ethereum network and enables traders to issue. Synthetix is an open-source protocol that enables users to trade on-chain synthetic assets in the form of ERC-20 smart contracts.

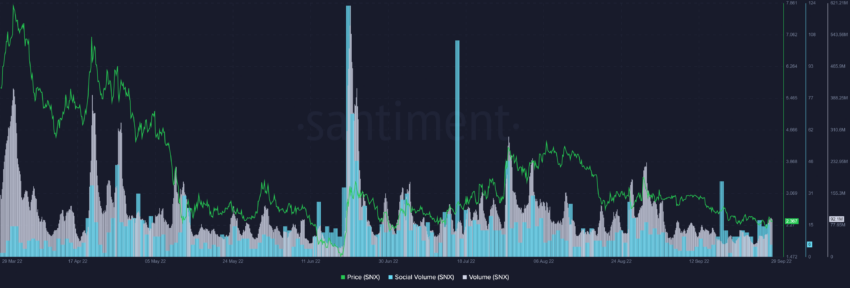

Over the last few days, Synthetix-related mentions on social media spiked in tandem with the social volumes. Social volumes saw a close to 80% uptick over the last two days.

Additionally, a rise in trade volumes too presented a higher retail interest in the coin. The 68th-ranked altcoin’s trade volumes stood above $91million noting a 56.64% rise over the last 24 hours.

A look at SNX’s 1-day price chart presented that the coin saw a bullish reversal on Sept. 28, supported by high trade volumes. Additionally, on its daily RSI finally picked up from the oversold levels rising to the 32 mark at press time. Despite the recent daily gains, RSI still showed that SNX sellers dominated buyers.

Profit taking weakens price action

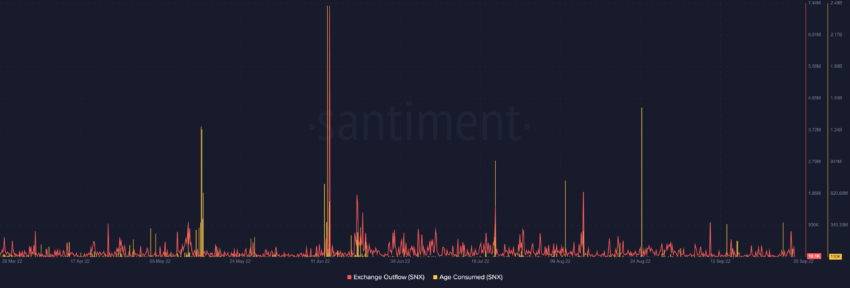

Data from Santiment highlighted an anomaly in the exchange outflows noting a spike on Sept. 28 presented tokens moving away from exchanges to wallets which is usually a bullish signal.

On the contrary, a sudden spike in Age consumed presented that some profit taking may have ensued leading to older coins moving. The age-consumed metric is often used to spot local tops, but it can also be used to see signs of dormant tokens moving with the intention of pushing up prices.

Lastly, 1-day MVRV for SNX noted a major pullback further highlighting that profit taking at the higher price level was noted.

For now, with bearish indicators outweighing bullish signals seems like SNX could be in for a short-term pullback.

For Be[In]Crypto’s latest Bitcoin (BTC) analysis, click here

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.