This is an opinion editorial by Dan Ashmore, financial analyst, journalist and contributor to Bitcoin Magazine.

Europe

Within financial and macroeconomic circles, it can sometimes feel like the USA is the only country in the world. Inflation data is accepted as the CPI reading in the U.S. The stock market is the S&P 500. The currency is the ever-dominant dollar.

On this note, you don’t need me to tell you that the market environment right now in the U.S. is abject. Inflation is printing 40-year highs, the Federal Reserve is yo-yoing between hawkish and super-hawkish while sentiment is free-falling.

However, looking at all this mayhem as a European, something jumps out. While it’s jarring to see how bad things are in the U.S., what is even more terrifying is that it’s worse in Europe. It feels like the likelihood of a crisis is increasing by the day — that is to say, if we aren’t in one already. And taking a holistic view, it sums up why Bitcoin could offer a solution for the future.

Eurozone

Last week, $1 became more valuable than €1 for the first time in history. With Americans struggling to grapple with 9.1% inflation, at least their dollars are appreciating against euros. And while this is bad news for U.S. exports, a weakening euro and strengthening dollar causes very real problems for Europeans — and also correlates with a weakening of many emerging economies’ currencies.

Perhaps a more illustrative display of the dollar’s strength is that of the DXY Index, which measures the value of the dollar against a basket of foreign currencies (this basket does also include the euro). The DXY has been on an absolute surge this year, as the graph below shows.

Why Is The Dollar So Strong?

In times of uncertainty, investors dump risk-on assets and flee to safety. This means volatile assets see a wave of selling while safe-haven assets such as cash and gold experience inflows. But not all cash is created equal. And in the fiat universe, one currency is the clear king of them all: the U.S. dollar.

Time and time again throughout economic crises, when the economy wobbles and investors jump risk-off, the dollar appreciates due to its status as the world’s reserve currency. Being the strongest of any fiat money, it thrives amid market turbulence and uncertain times.

Look no further than March of 2020, an extreme example of how uncertainty and fear can suddenly rock markets. It became clear at this time that the COVID pandemic was more impactful than originally thought, the WHO declaring it a pandemic on March 11, 2020. Over the course of a 10-day period, the dollar jumped 8%.

Monetary Debasement

So the dollar has actually been immensely strong in this current period, despite mass debasement — a show of strength typical of recessions.

However, the below graph shows that this dollar strength is only relative to other fiat currencies. When graphed against real goods — gas, eggs, chicken breasts and bread, let’s say — one needs ever increasing numbers of dollars to purchase these goods.

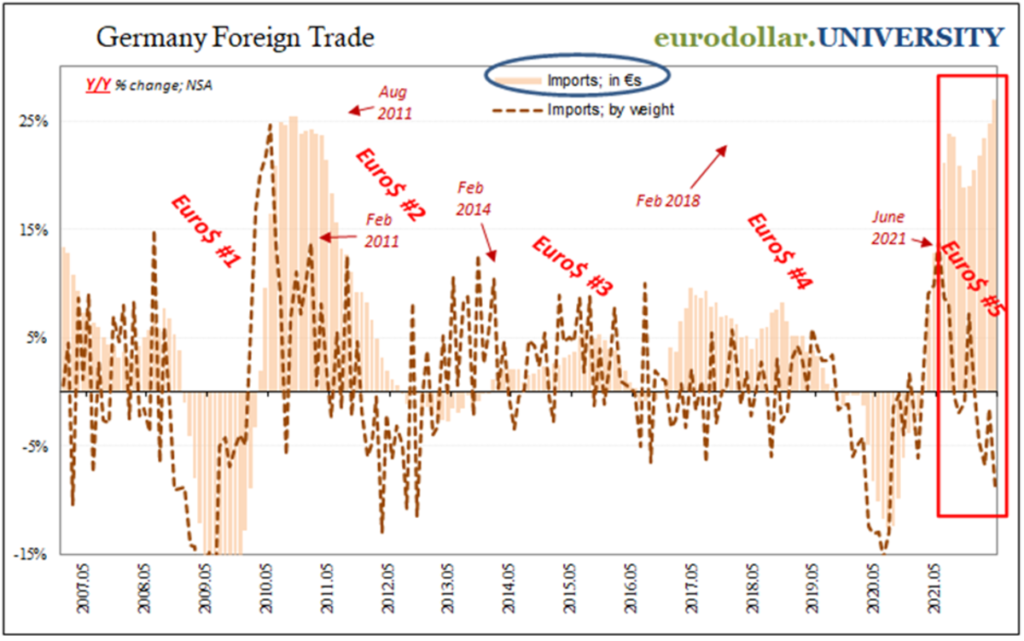

If you’re American, you’re likely aware of the difficulty that this is causing, as wages struggle to keep up with price increases and the standard of living drops across the country. Now imagine being European, with your currency plummeting even further against the dollar, while you are still fighting similar levels of inflation. The below is a great graph from Jeffrey Snider demonstrating that Germans paid 35% more for 9% less imports. That’s a pretty wild statistic highlighting the sheer scale of the movements here and Europe’s plight.

Emerging Economies

How about a country such as Ecuador? I visited it last month, during which protests broke out over a variety of issues, including the cost of living. Transport routes were blocked as food supplies were cut off from cities, with prices rocketing to scarcely believable levels. Five people were killed, fires were set ablaze around the country and millions of dollars worth of damage was caused to an economy already in dire condition — and is likely now facing a long-term blow to the burgeoning tourism industry it had fought so hard to cultivate.

This is scary. People dying, mass unrest, political turmoil — it’s a harrowing reality of the situation that we find ourselves in with inflation tightening its grasp.

Oh, and Ecuador uses the U.S. dollar, following the collapse of their sucre currency in 1999, a victim to the dirty human habit of hyperinflation.

With inflation now approaching double digits in the U.S. and Europe, is it preposterous to imagine scenes like the Ecuadorian protests in these regions soon?

Eurozone’s Worries

But back to Europe. Let us not forget that this is a region which suffered its own monetary crisis less than a decade ago, when there was serious doubt about whether the euro would continue to exist.

As an Irish person, I am well aware of our contributions to that mess. We endured one of the worst banking crises in history. To illustrate this for American readers, the Irish government was forced to nationalize Anglo Irish Bank in 2009 when it was revealed they had €34 billion in losses (in January 2009 dollars — that amounts to $50.5 billion today).

For context, the U.S. economy is 60 times bigger than Ireland’s, a little island in the Atlantic with a population of only 5 million people. Multiplying this bank’s $50.5 billion in losses by 60 gives $3 trillion. Lehman Brothers — who you may have heard of as the poster boys of banking failure — went under with $619 billion in debt, one-fifth of this $3 trillion figure.

Us Irish were bad, but it was worse elsewhere. 5,000 kilometers east of us (or a little over 3,000 miles, for you Americans), Bank of Cyprus customers had 47.5% of any deposits over the insured amount of €100,000 confiscated in what was known as a “bail-in” in order to shore up the banking losses — something that in the context of a bitcoin wallet, would be incomprehensible. Further restrictions were put in place across the country to prevent a mass run on the banks from occurring.

Greece may have been the worst of all, with systemic misreporting of government debt and deficits covering up a quagmire of financial incompetence that ended up plunging the economy into the longest recession of any advanced mixed economy to date.

Throw in Portugal, Italy and Spain and the euro was a currency on its knees, requiring bailout after bailout to keep economies running. As I type this sentence on my keyboard, I’m still paying taxes to clear off the Irish bailout — at €67.5 billion, equivalent to over 40% of our GDP.

But hey, Germany kept us afloat, the most powerful economy in the eurozone pulling up the stragglers and (just about) saving the day. Bailouts, I suppose, did their jobs.

But today it’s different.

What Is Different About 2022?

A common metric to gauge the health of the eurozone is the spread between German and Italian 10-year bonds. Diverging bond yields are a scourge on the eurozone because it eats away at the very concept of a unified currency (for a more in-depth review of this, see this article published by Invezz.com analyst Shivam Kaushik last week). I have plotted this divergence of the Italy versus Germany spread, now at 2.29% after being at parity one year ago.

Further accentuating the difficulties of the eurozone is the rate policy, which is significantly behind the U.S. Federal Reserve regarding interest rate hikes. The 50-bps hike by the European Central Bank (ECB) last week, Europe’s first hike in 11 years, meant that rates are only now out of the negative range — at a fat 0%. And this, in conjunction with the yield divergence above, signals the problem.

A unified currency containing countries like Germany and Italy throws up massive problems when hikes are required to rein in inflation. Countries such as Italy have enormous debt burdens and are already either on the verge of recession, or already mired in one. So, what happens when the ECB raises rates, increasing the interest burden of those countries saddled with bloated debt liabilities? It plunges those economics into an even deeper recession.

On the flipside, not raising rates practically guarantees the inflation crisis getting even worse — which obviously doesn’t suit those countries with healthier balances — say, Germany. Without hiking rates, the plummeting euro and rocketing food prices will just … keep going, I guess.

But with inflation spiraling to the level where the ECB’s hand has been forced, recessions are now staring nations in the face across the continent. But there is a difference this time. Germany is not going to be able — nor willing — to bail out the stragglers. The German inflation and energy crisis makes this a remote possibility at best, meaning that there is nobody to step in to save the day for the next round of Ireland, Cyprus, Greece, Portugal, Spain, Italy … OK you get my point.

Global Debt

All this mayhem, of course, is accentuated by the debt situation — something which the U.S. is no stranger to. I took a visit to the U.S. debt clock in New York last month, a somber visual tracker of the live debt. At $31.5 trillion, it’s a staggering amount but the only question that really matters is … how will it be repaid?

Well, the only way to do this is to monetize the debt. And what that means is to continue printing to clear it. The U.S. can mint more dollars, as the debt is denominated in the very same currency that it has the ability to print. An unfair agreement, admittedly, but one that guarantees they will be able to pay the debt back. Of course, the trade-off is a debased dollar.

Which again, for countries like Italy, is not an option because of … the euro. You know, they don’t control their own monetary policy, with it being a shared currency and all that.

Fool me once, I’ll bail you out. Fool me twice, I’ll bail your mate out. Fool me three times, and it’s time to raise the white flag on this whole euro thing. Or the expression goes something like that, anyway.

Bitcoin

This takes me right round to that odd orange currency that we all love so much. What is happening in Europe is exactly the reason why Bitcoin’s fundamentals are so salivating as a hedge — but also, ironically, a summary of why it is lagging so much in the current climate.

This is a currency that can’t be debased like the U.S. dollar. This is a currency that has a hard cap of 21 million coins — unlike the euro. This is a currency that can’t be confiscated, unlike Cypriot bank deposits. It is a currency where straggling Greek and Irish economies can’t drag it to the brink, where sovereign (fiat) debt burdens don’t matter.

But right now, in 2022, this is also a nascent technology and an extremely volatile asset. Meaning that as rates get cut and liquidity is pulled out of the economy, it moves like a risk-on asset, dropping violently, despite this pull in liquidity reining in the inflation that so many argue it should hedge against.

So no, bitcoin is not an inflation hedge — and it’s tough to argue otherwise. But the interesting part is when you draw that investment horizon out and assess it amid the wider macroeconomic picture, changing the question to whether it will one day act as that monetary debasement hedge that it fails to be right now.

Most hadn’t even heard of this asset 10 years ago. It didn’t even exist during the Great Financial Crisis. But Satoshi Nakamoto referencing a newspaper headline reporting on one of those colossal European banking failures — “The Times 03/Jan/2009 Chancellor on brink of second bailout for banks” — symbolizes just what a currency with a hard cap, outside the control of money printers, bankers, governments and economists can do. It can represent value, and a way to jump off the train should it ever sink (have I mixed up metaphors there?).

The U.S. dollar is actually the most immune of all the fiat currencies. It is the world’s reserve currency and it spikes in times of turbulence. It has none of the problems of the eurozone, nevermind the currencies of emerging markets.

So if you think that the (debasing) dollar presents as an argument for Bitcoin, take a trip to Europe. It’s getting scary … again.

This is a guest post by Dan Ashmore. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.