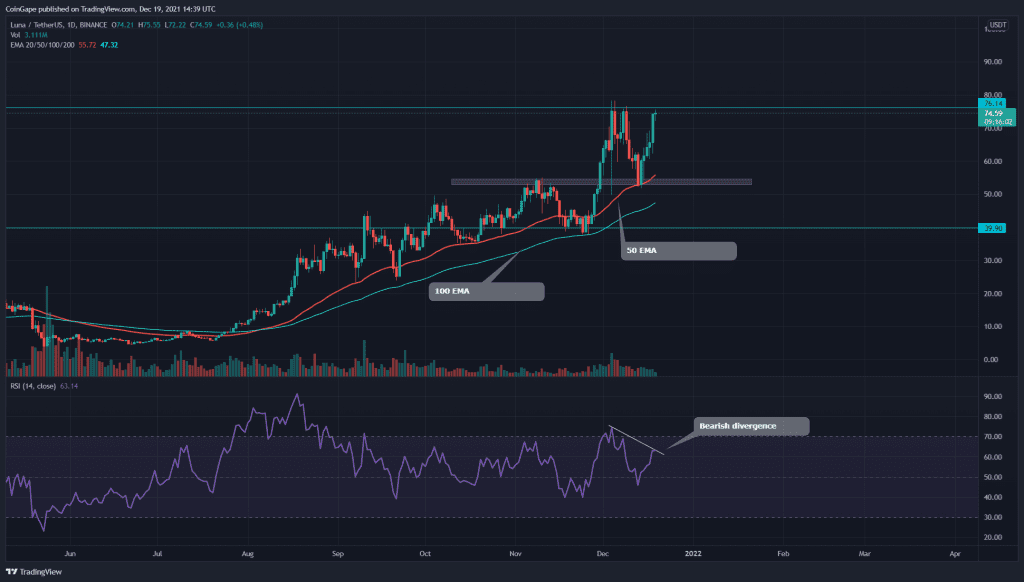

The LUNA coin indicates a steady uptrend with new higher highs and higher lows in its technical heart. The coin has recently gone through a correction phase which obtained good support from the $54.5. The price displays V-shaped recovery, which will soon retest the overhead resistance of 77%

Key technical points:

- The LUNA coin price obtains strong support from the 50-day EMA

- The daily RSI shows bearish divergence concerning the coin’s price action

- The intraday trading volume in the LUNA coin is $2.13 Billion, indicating a 6.12% loss.

Source- Tradingview

The last time when we covered an article on LUNA/USD, the coin price bounced from the $54 support with an inside-day candle. The pair provided a strong follow-up candle which breached its nearest resistance level of $63. After showing sufficient sustainability for this breakout, the rally continued and will soon challenge the ATH resistance of $75.

The crucial EMAs (20, 50, 100, and 200) maintain a bullish alignment in the daily time frame chart. The 50 EMA line provides dynamic support to the coin price, while the 100 EMA covers the extended retracements.

The daily Relative Strength Index (63) indicates a bullish sentiment. However, its chart also displays a bearish divergence suggesting some weakness in this rally.

LUNA/USD 4-hour time frame chart

Source- Tradingview

The current price of the LUNA coin is $74.7, with an intraday gain of 0.67%. The overhead resistance holds the key to the potential growth of this coin. Therefore, the crypto traders should wait for the price to breach this resistance before entering a new long position.

On the contrary, the bearish divergence in RSI cannot be ignored, and the coin price also poses a threat for rejecting from this resistance, which would plunge the pair to the $55 mark.

As per the traditional pivot level, the coin traders can expect the $92.5 and $84.9 to play an important role. Whereas the support levels are at the $73.4 and 65.5 marks.