Terra (LUNA) has validated it corrective structure by bouncing on Jan 31 – but is it possible that this could be the catalyst for a considerable relief rally?

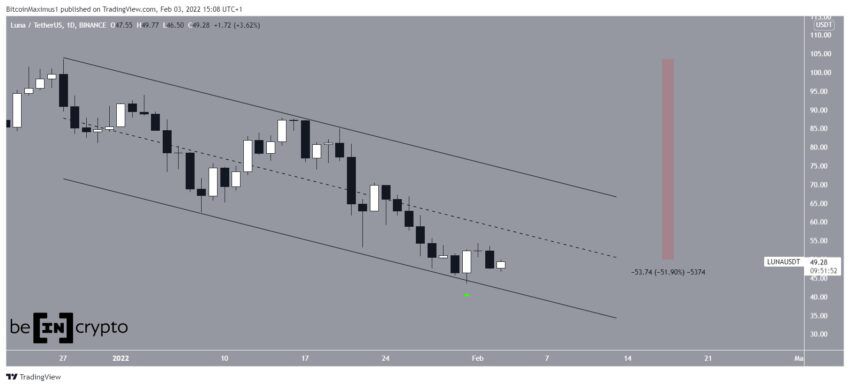

LUNA has been decreasing since reaching an all-time high price of $103.60 on Dec 27. The downward movement has been contained inside a descending parallel channel.

On January 31, the token bounced at the support line of the channel (green icon), validating the structure in the process. In addition to this, it created a bullish engulfing candlestick.

However, LUNA has yet to create a higher low, which would indicate that an upward movement is expected. Measuring from the all-time high, it has so far decreased by 52%.

Short-term movement

Cryptocurrency trader @TheEuroSniper tweeted a chart of LUNA, stating that the token could increase all the way to $54.

The two-hour chart shows that LUNA has bounced at the 0.618 Fib retracement support level (white) after briefly deviating above it. It is now approaching a descending resistance line that has been in place since January 23.

If it manages to break out, the next closest resistance area would be at $54. This is the 0.382 Fib retracement resistance level and a horizontal resistance area, increasing its significance.

LUNA wave count analysis

The most likely wave count indicates that LUNA has completed wave three of a five wave upward movement (white) that began on Jan 2021. Therefore, it is likely in wave four, which is corrective.

There are several possibilities as to the sub-wave count that would complete wave four, the most likely being a flat (black) or a triangle (red correction).

While it is not yet certain which will transpire, both indicate that a considerable bounce will occur prior to another fall which would complete the correction.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.

What do you think about this subject? Write to us and tell us!

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.