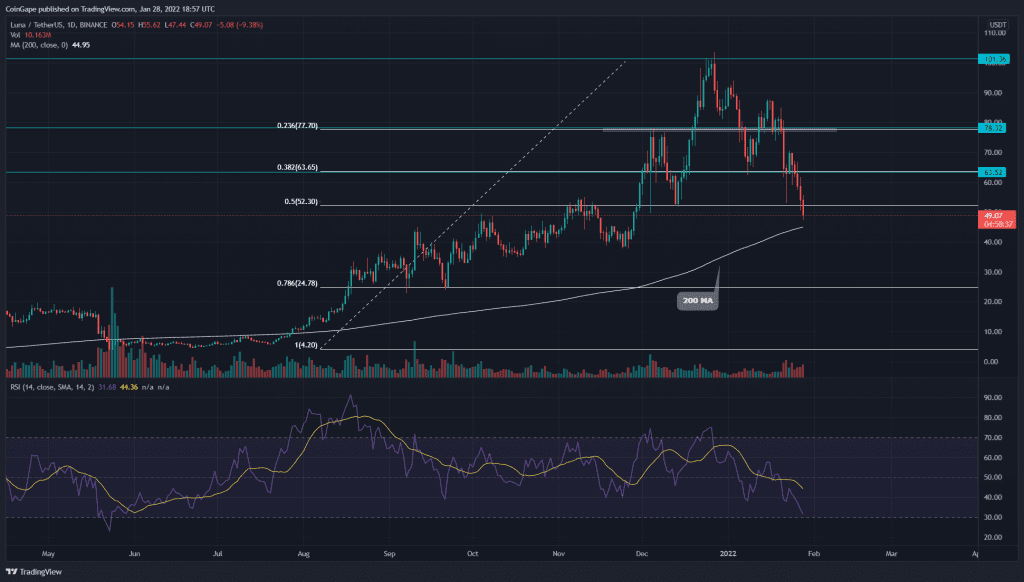

The aggressive selling has tumbled LUNA price 45% in just two weeks. The LUNA/USD chart shows a bearish breakdown from two-month low support of $54, teasing to continue its correction. If the sellers maintain this momentum, the coin price will soon drop 30% to the $36.8 mark.

Key technical points:

- The daily-RSI Slope approaches the oversold region.

- The LUNA price would soon retest the 200-day MA

- The intraday trading volume in LUNA/USD is $3.4 Billion, indicating a 37% gain.

Source- Tradingview

In our previous coverage of Terra technical analysis, the coin price was struggling to rise above $80. However, the intense sell-off all over the crypto market propelled the coin price below two crucial support of $65.5 and $54.

The LUNA price slides below the 0.5 Fibonacci retracement level with a huge bearish candle. A daily-candle closing below this support should confirm this fallout, indicating a further downfall.

The downsloping of 20 and 50 MA projects the bears are dominating. Moreover, the coin price steadily approaching the 200 MA from above threatens a bearish crossover.

The daily-Relative Strength index slope crashed to the 30% mark and could enter the oversold region.

LUNA Price Could Drop To The $35.6 Mark

Source-Tradingview

Source-Tradingview

The LUNA/USD pair is currently trading at $78.2, projecting a 10.8% intraday fall. The crypto traders can expect a retest to the new flipped resistance of $54. If the sellers could sustain the price below this level, the pair could plummet to the $35.6 mark in around two weeks.

The ADX(38) slope rising indicates the sellers are gaining momentum again.

The traditional pivot level displays remarkable confluence with the LUNA chart level indicating overhead resistance levels at $54 and $65.7. And the Support levels are $45 and $35.6.

Source-

Source-