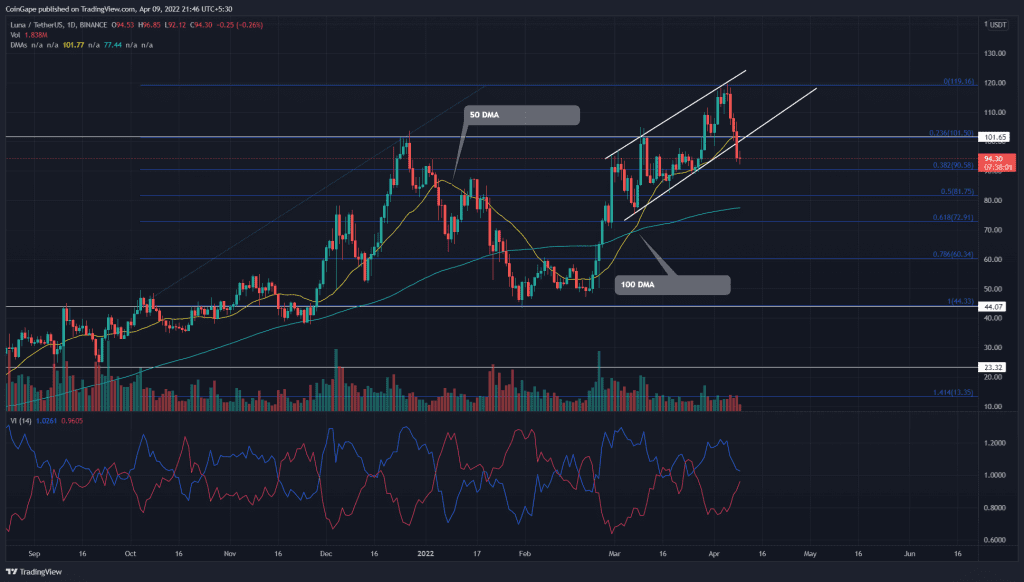

The Terra(LUNA) price reverted from the $120 mark with four consecutive red candles. The minor retracement pierced the $100 psychological support, registering a 21.5% loss. This freefall triggered a fallout from the channel pattern, encouraging further price correction.

Key points:

- The LUNA price gives a fallout from a channel pattern

- The LUNA buyers lost $100 support.

- The intraday trading volume in the LUNA is $2.7 Billion, indicating a 1.6% loss.

Source- Tradingview

The LUNA/USDT pair represented its march rally resonating inside a rising channel pattern. Under the pattern’s influence, the altcoin gave a decisive breakout from the $100 resistance on March 29th.

The post-retest rally drove the altcoin by 16.6%, reaching its new All-Time High of $119.18. however, the coin price turned down from the resistance trendline and nosedived below the shared support of $100, 20 DMA, and support trendline.

Furthermore, the aggressive traders who bought above the $100 mark got trapped in this fakeout, and their liquidation may drive the price even lower. Today, the LUNA price is 1.6% down and nearing the $0.382 Fibonacci retracement level at $90.

As per the FIB levels, the coin price could witness strong demand at 0.5 FIB level at $81.6, followed by 0.618 FIB level at $72.6

- Resistance levels: $100 and $120

- Support levels: $90 and $81.6

Technical indicator

Vortex Indicator: The VI+ and VI- slopes nearing a bearish crossover could encourage sellers to extend the correction rally

DMA: The recent price drop breached the 20 DMA dynamic support level. However, 50 DMA aligned with 0.382 FIB level, and 100 DMA near $81.6 support may bolster buyers to continue the bullish rally.