LUNA price fell for the fifth straight session in a row, exuding extreme bearishness with a nearly 23% fall. This momentum is expected to continue as the bulls failed to sustain the key support levels. Investors can expect more downside in the asset.

- Luna’s price continues its downward movement on Friday.

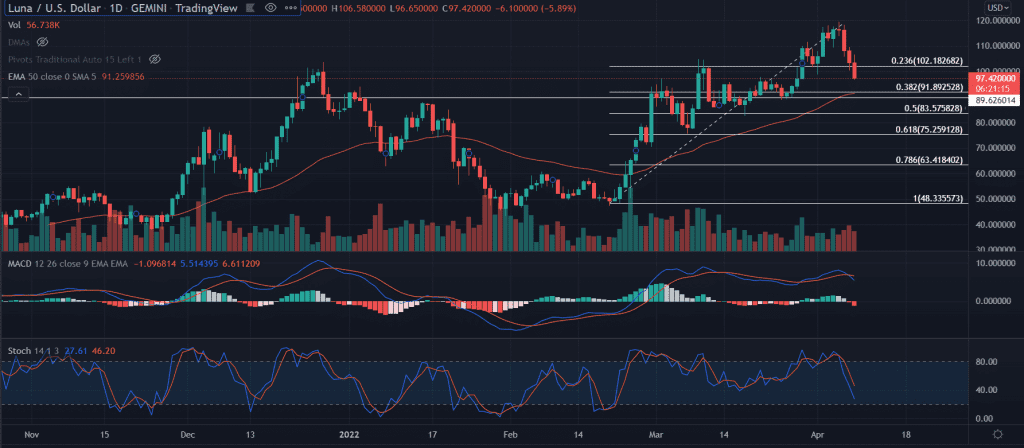

- A break below $100.0 targets 0.382% Fibonacci retracement next.

- The momentum oscillators remain mixed warning of aggressive bids.

As of publication time, LUNA/USD exchanges hands at $98.99, down 5.75% for the day. Further, the 24-hour trading volume of the ninth-largest cryptocurrency holds at $2,647,636,246 as per the CoinMarketCap.

LUNA price moves south

LUNA’s price surged 170% after tagging the lows near $43.0 in late January. The price tested all-time highs at $119.05. However, the recent uptick that led to the massive gains in the token failed to push through. As a result, LUNA sellers took over, leading to a 23% retracement so far.

Now, the price is heading toward the $0.382% Fibonacci retracement level near $0.90. This also coincides with the 50-day EMA (Exponential Moving Average). Hence, a crucial level to sustain. A failure to hold will result in the continuation of the downside move.

In that case, the next target could be located at the lows of March 18 at $82.0.

On the other hand, a demand zone exits near $92.0. So if the buyers are able to hold a reversal is very much likely. On moving higher LUNA’s price would tag Thursday’s high around $109 followed by the all-time highs of $119.49.

Technical indicators:

RSI: The Relative Strength Index breaches below 50 with a sharp move. This indicates immense selling pressure.

MACD: The Moving Average Convergence Divergence depicts increased bearish momentum as slides below the midline.