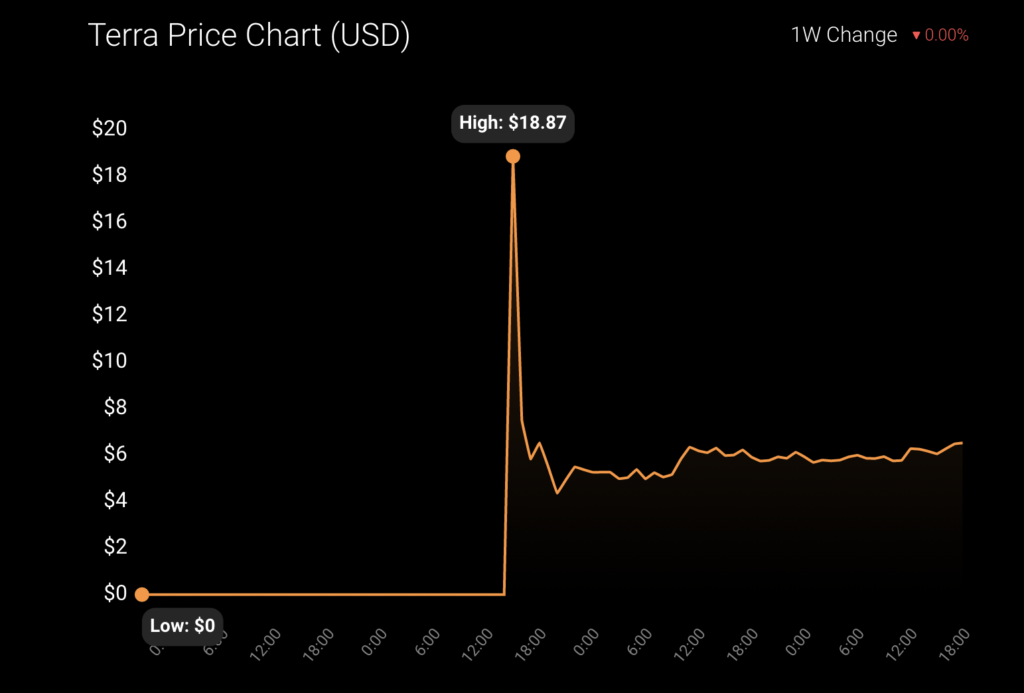

Since the re-launch of the Terra ecosystem via Terra 2.0 on 28 May, the price of Terra (LUNA) has dropped by almost 70%. In the first 30 minutes of trade, the price skyrocketed from $0.30 to $20. The high, however, was short-lived, as the price dropped to barely $5.30 in the next three hours.

Source: Coinstats

On CoinMarketCap, the old LUNA has been renamed Terra Classic (LUNC), and a second listing for the new Terra (LUNA) has been added. New LUNA tokens, also known as LUNA 2, are being airdropped to investors who previously held Luna Classic (LUNC), TerraUSD Classic (USTC), and Anchor Protocol UST as part of Terraform Labs creator Do Kwon’s resurrection plan.

All under the revival plan

Do Kwon confirmed the relaunch of Terra 2.0, the company’s new chain that intends to resuscitate LUNA and TerraUSD ecosystems. Hard forking the existing blockchain and reissuing LUNA tokens to existing investors based on a snapshot taken before the death spiral bled the LUNA and UST markets – Effectively resulting in unrecoverable losses for investors part of Kwon’s Terra resurrection plan. Unfortunately for Terra and Luna advocates, the ship is already sinking.

At this point, the rapid drop appears to indicate a lack of confidence in Do Kwon’s rebranding going forward. Many investors are suggesting on Twitter that they are instead attempting to recoup a tiny percentage of their previously lost funds and walk away from the project.

Lark Davis, for instance, recently told his 988,000 Twitter followers,

“Zero plans to buy $luna 2.0, but I will dump any airdrop if I receive something on Binance.”

The price was consistent for several hours at $6-$7, but it is still declining. Many investors have lost faith in the Terra ecosystem following the tragic events of the last few weeks. Ergo, selling pressure on the new chain is understandable. Furthermore, without the UST stablecoin on the new chain, the LUNA token’s main purpose is to regulate the ecosystem.

On 31 May, Binance will commence a multi-year distribution of LUNA to eligible users, as well as list the token for trade in its Innovation Zone. The latter, a designated trading zone for volatile and high-risk assets. Understandably, some have forecast further slaughter once the Binance drop goes live.

LUNA’s social presence

The massive price decline since the airdrops started a few days ago has prompted a barrage of memes, jokes, and general derision on crypto-Twitter.

Few were delighted with the outcome, having lost thousands of dollars only to get a fraction of that loss in fresh tokens that had already been dumped by most recipients.

Despite having a strong community all these years, LUNA’s social media dominance has also been affected drastically after the crash. According to Santiment, over the last month, the active users on Telegram came down. However, its Twitter followers have increased. In the last 5 days, its followers increased from 1.13 million to 1.17 million, at the time of press.

The price of Luna 2.0 is now around $6. According to some genuine Terra and LUNA owners, the airdrop allowed them to recoup a decimal-place percentage of their initial investment. However, based on previous holders’ reactions, there is some skepticism about the new project from Do Kwon.

So, where to now?

One must consider the project’s reputation, which has suffered as a result of the LUNA catastrophe. Many in the community no longer believe Terraform Labs’ vision, which could indicate a lack of attraction for investors and a general lack of interest in the project owing to skepticism. Terraform Labs will have to put forth a lot of effort to regain the community’s trust.

If we believe this is the case, we can estimate that $6 billion will be re-invested in the project, resulting in a price of $6 per unit.

The internet has seen guesses and forecasts as low as $0.50 and as high as $100. However, a reasonable starting price might be around $5, especially since it will be listed on almost all major crypto-exchanges.