The TerraUSD (UST) stablecoin recently overtook Binance USD in market capitalization, becoming the third-largest stablecoin. The total market value of the token is now $17.50 billion, slightly above BUSD’s $17.46 billion.

However, actual trading in UST appeared to be lagging its peers, with 24-hour volumes coming in at $261 million, the fifth-highest among major stablecoins. The token’s volumes were a fraction of those seen by larger peers USDT and USDC, and even lagged those of smaller peers BUSD and DAI, according to data from Coinmarketcap.

The volumes indicate that UST’s increasing market capitalization is linked more to its reserves and token circulation, as opposed to actual demand for the token. Currently, the Anchor Protocol (ANC), Terra’s largest DeFi platform, holds nearly two-thirds of UST supply through staking and deposits.

Why did UST market capital rise?

Terra community the Luna Foundation Guard (LFG) has been steadily increasing the reserves which back UST. A key aspect of this is by burning LUNA tokens to mint UST. Given that UST has a fixed 1:1 peg against the dollar, the creation of more tokens does not directly affect its price.

Rather, minting new UST tends to increase the token’s market capitalization, as opposed to the usual deflationary effects of creating new tokens.

Trending Stories

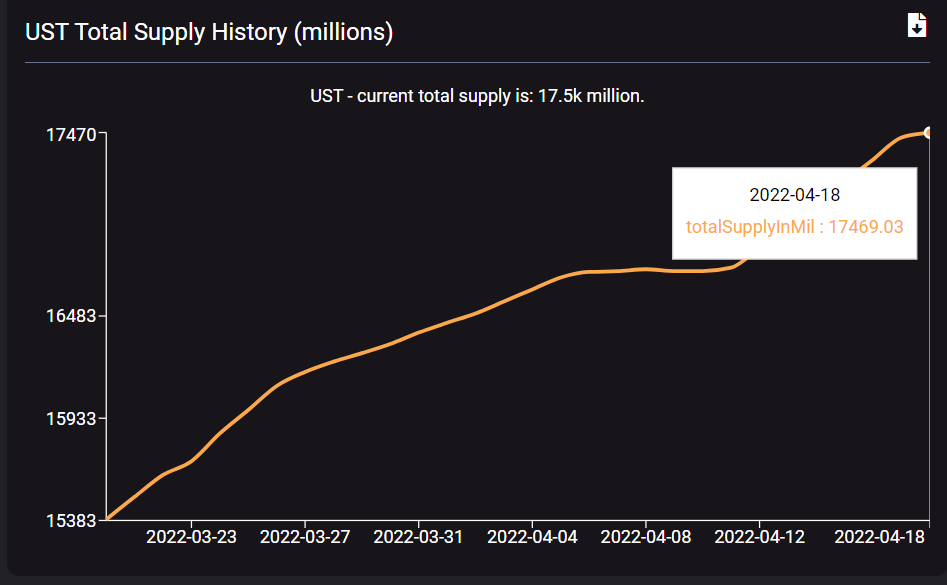

Data from Terra Analytics shows that over the past week, total UST supply increased by about 800 million tokens- corresponding with an $800 million jump in market capital. LUNA’s burn rate during that period was also steady, barring the release of 10 million tokens from non-circulating supply.

What does it mean?

The data indicates that despite constant minting, Terra founder Do Kwon’s goal of making UST the most widely used stablecoin is far from achieved. Constant efforts by the LFG to bolster their reserves have also put some price pressure on LUNA, which tumbled 14% last week.

Questions over ANC’s sustainability have also arisen, particularly over the protocol’s market-beating 20% yield. A surge in deposits has weighed on its reserves, and could lead to a serious liquidity crunch- destabilizing UST’s peg.

But ANC has taken measures against such a scenario, recently voting in favor of dynamic yields. The protocol has also added support for other blockchains to bolster its liquidity.