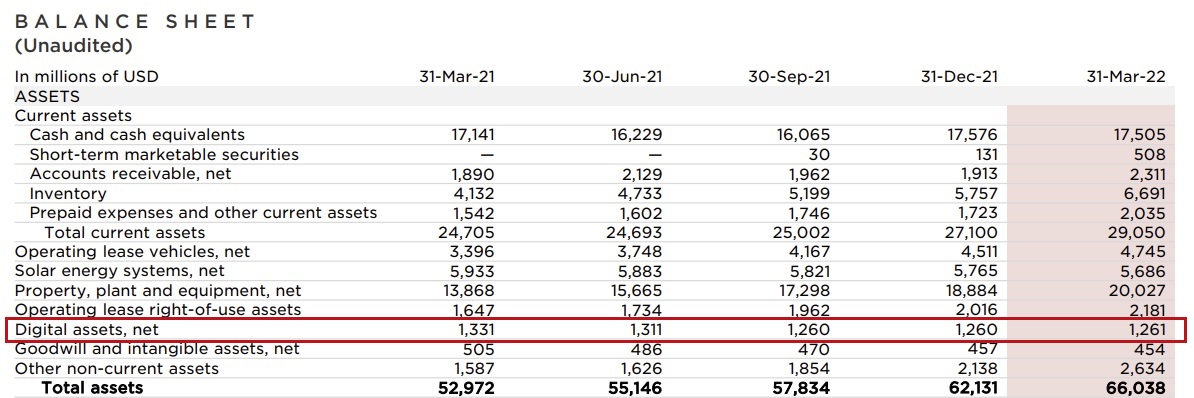

Elon Musk’s electric car company, Tesla, is hodling bitcoin. The company’s balance sheet shows $1.261 billion in digital assets. Tesla has neither purchased nor sold any crypto assets since the first quarter of last year.

Tesla Continues to Hodl Bitcoin

Tesla released its earnings results for the first quarter of 2022 Wednesday. Elon Musk’s electric car company reported another record quarter of sales and profit exceeding Wall Street estimates despite inflation pressure.

The company’s revenue rose 81% to $18.76 billion from $10.39 billion a year ago. Its earnings jumped 658% from $438 million in the previous year to $3.32 billion in the first quarter of this year. “I’ve never been more optimistic and excited in terms of the future than I am right now,” Musk said during Wednesday’s earnings call.

Amid record profit, Tesla’s balance sheet shows net digital assets of $1.261 billion.

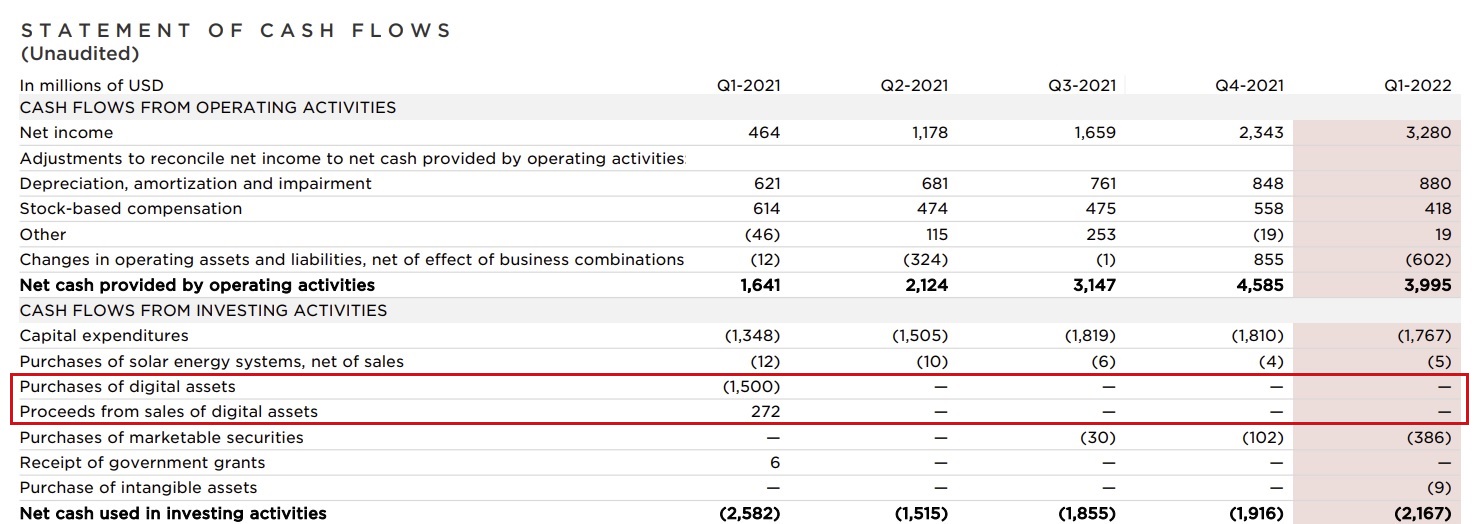

Tesla’s statement of cash flows still shows that the company’s only purchase of digital assets happened in the first quarter of last year when it bought $1.5 billion worth of BTC. The only sale of digital assets also happened in the same quarter.

In January, Tesla began accepting the meme cryptocurrency dogecoin for some merchandise. However, the company has yet to bring back bitcoin as a payment option.

Musk has said that he sees bitcoin as a store of value whereas dogecoin is better suited for transactions. He previously revealed that he personally owns bitcoin (BTC), ether (ETH), and dogecoin (DOGE) — and will not sell them.

The Tesla boss has recently made an offer to buy Twitter Inc. with the aim to make “significant improvements” to the platform. The offer followed him taking a 9.2% stake in the social media giant. Musk has reportedly secured $46.5 billion to buy Twitter.

What do you think about Tesla hodling bitcoin? Let us know in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Read disclaimer