Tesla billionaire Elon Musk has offered to purchase Twitter for $41.4 billion, according to a Securities and Exchange Commission (SEC) filing published on Thursday. Musk also explained in his note that he believes Twitter should be a private company and he decided he wants “to acquire the company and take it private.”

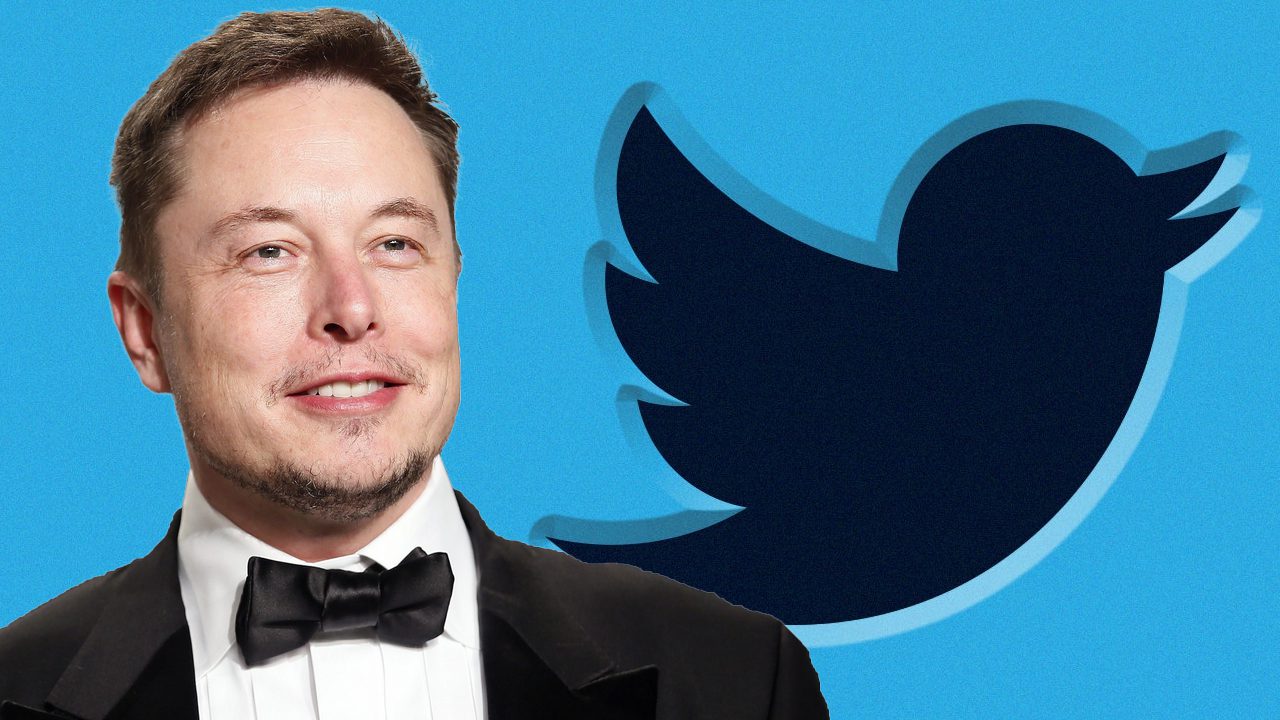

Elon Musk Offers to Purchase Twitter — Musk Believes ‘Free Speech Is a Societal Imperative’

During the first week of April, Bitcoin.com News reported on Tesla’s Elon Musk acquiring a stake in Twitter and at the time, analysts said it could lead to a buyout. Following the acquisition of a 9.2% stake in Twitter Inc., Musk promised he would push for significant improvements on the social media platform. The billionaire also pondered integrating dogecoin (DOGE) payments into Twitter so it can be a payment option for the Twitter Blue subscription service.

I made an offer https://t.co/VvreuPMeLu

— Elon Musk (@elonmusk) April 14, 2022

Now, ten days later, Musk is offering to purchase Twitter Inc. for $41.4 billion in a recently filed SEC filing published on Thursday. The letter is directed to Bret Taylor, Twitter’s chairman of the board and Musk stressed that he believes he can unlock the social media platform’s potential.

“I invested in Twitter as I believe in its potential to be the platform for free speech around the globe, and I believe free speech is a societal imperative for a functioning democracy,” Musk said in his letter. “However, since making my investment I now realize the company will neither thrive nor serve this societal imperative in its current form.”

The Tesla executive continued:

Twitter needs to be transformed [into] a private company. As a result, I am offering to buy 100% of Twitter for $54.20 per share in cash, a 54% premium over the day before I began investing in Twitter, and a 38% premium over the day before my investment was publicly announced. My offer is my best and final offer and if it is not accepted, I would need to reconsider my position as a shareholder. Twitter has extraordinary potential. I will unlock it.

Musk’s Offer to Buy Twitter Is His ‘Best and Final’ Offer

In addition to the letter, Musk left a voice text about the possibility of purchasing Twitter to the company as well. He said he spent several days thinking about it and he decided he “wants to acquire the company and take it private.” Musk also asked if Bret Taylor was “available to chat” and said that the offer was his “Best and Final.”

“I am not playing the back-and-forth game,” Musk added. “I have moved straight to the end. It’s a high price and your shareholders will love it. If the deal doesn’t work, given that I don’t have confidence in management nor do I believe I can drive the necessary change in the public market, I would need to reconsider my position as a shareholder. This is not a threat, it’s simply not a good investment without the changes that need to be made. And those changes won’t happen without taking the company private. My advisors and my team are available after you get the letter to answer any questions.”

Of course, Democrats did not like Musk’s offer at all, and some of them even called the offer a “threat.” The left-leaning Greg Sargent said: “Now that Musk is threatening to take over Twitter, don’t forget that he relied on government to get his dreams off the ground but then sank into the worst sort of anti-government demagoguery when Dems wanted to tax billionaires and help millions of others.” The Democrat Lindsey Boylan remarked: “It alarms me how few people know that Elon Musk is funded by the same government he belittles and undermines.”

What do you think about Elon Musk looking to purchase Twitter for $41.4 billion? Let us know what you think about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Read disclaimer