Tezos (XTZ) price is still trading close to its lower long-term support level at the $1.30 mark; But with developments happening in its ecosystem, XTZ investors are hopeful of a breakout.

Over the last week, Tezos price broke below the multi-year support line of $1.35. Even though XTZ’s price tried to make a few bullish strides, bears remained in control, with the larger price trend predominantly tilting towards bearish since Sept. 12.

Tezos (XTZ) price continues consolidation

Tezos price noted a 25% pullback in August, followed by another 15% pullback in September. From a technical point of view, XTZ price flashed bearish signals, as the Relative Strength Index showed sellers were dominating the market.

On the daily timeframe, XTZ price remained well below its key resistance level of $1.5, despite bouncing off its weekly low of $1.35 on Oct 17 and 18.

A recent Messari report presented that during Q3, Tezos recouped some of the losses with a 31% bear market rally. However, the 31% price gains didn’t hold due to the larger crypto market’s bearish momentum.

Notably, throughout Q3, revenue-centric metrics for Tezos were down substantially as XTZ’s revenue dived to $191,000, presenting a 60% drop QoQ. XTZ had a circulating P/S ratio of 2,181x, while transaction fees saw a 58% drop.

XTZ’s TVL and development activity spark hope

Tezos released the 11th protocol on September 23, while its next protocol upgrade is scheduled for mid-Q4. The next upgrade is set to introduce Smart Contract Optimistic Rollups (SCORUs).

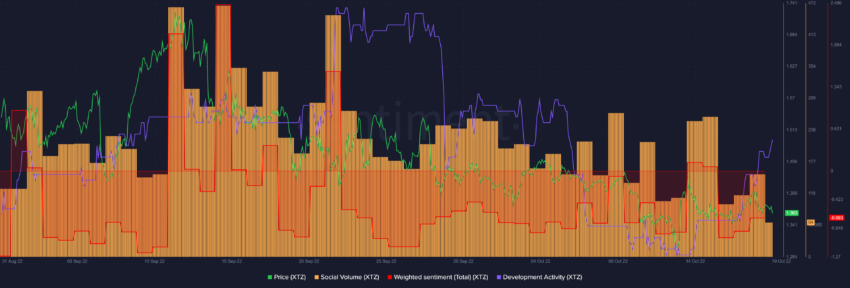

Notably, the developments in Tezos’s ecosystem have been reflected in the coin’s development activity which is in a considerable uptrend. Even though the price continued to consolidate, the coin’s development activity started rising on Oct. 14.

However, low social volumes and a negative weighted sentiment presented that there was not much noise around the project.

Nonetheless, a bullish trend could be seen in XTZ’s DeFi total value locked (TVL) as TVL appreciated by almost 185% from $14 million to $40 million in a matter of 10 days.

A rise in TVL could be indicative of institutional interest rising in the project and could act in favor of XTZ bulls.

Going forward, if XTZ price breaks and holds above $1.50 resistance, a good retail push can send the coin to as high as $2. However, an invalidation of the bullish thesis can send XTZ price down to the lower $1.2 price range.

Disclaimer: BeinCrypto strives to provide accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. You comply and understand that you should use any of this information at your own risk. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.