Within the Asian market, the crypto market grew drastically and showcased a unique insight. In just a year, the market saw a 706% increase. Thus, it represented 14% of all crypto transactions around the world, and Thailand, indeed, made headlines.

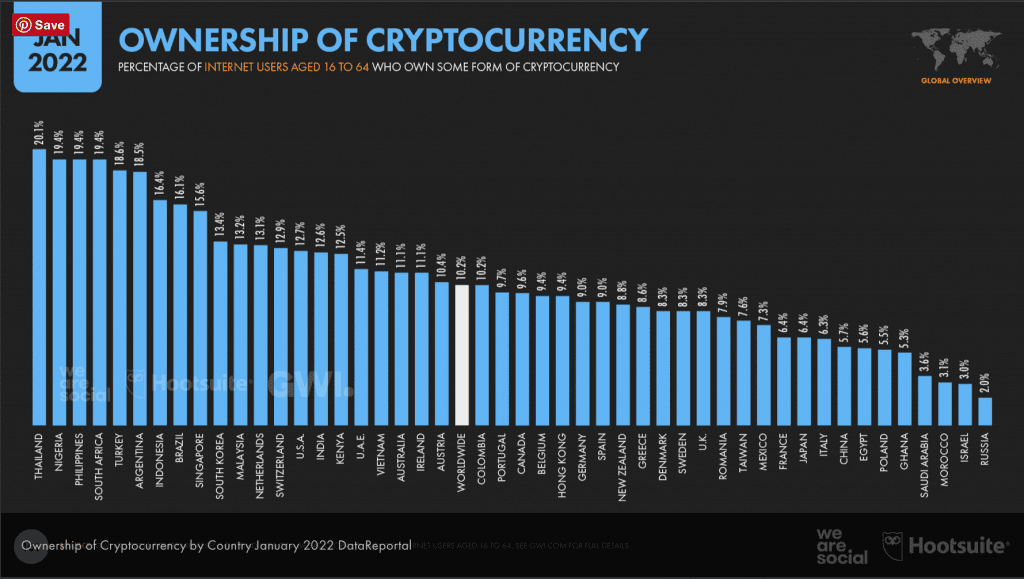

Chainalysis‘ report indicated that the crypto market of Central and Southern Asia and Oceania, CSAO, received as much as $572 billion in just a year, from July 2020 to June 2021. More than 1 in 10 working-age internet users owned some form of “crypto”. This figure rose to more than 2 in 10 in Thailand.

Source: Datareportal.com

Thai users held more than $3 billion worth of cryptocurrencies this year. A massive increase compared to just a few years ago. Infact, in 2021, transaction volume increased by about 600% from November 2020 to April 2021.

Do all things come to an end?

Indeed, the rising crypto adoption met a major obstacle here in the region. From 1 April, 2022 Thailand would prohibit the usage of digital assets as a means of payment for goods and services.

According to a report by Bloomberg on 23 March, Thailand regulatory board issued rules to ban digital assets for payment of goods and services. This new development will come into play at the start of next month. In a joint press release, the Thailand Securities and Exchange Commission (SEC) and the Bank of Thailand (BOT) said:

“Business operators — including crypto exchanges — must not provide such payment services and are barred from acting in a manner that promotes digital assets to pay for goods or services. However, the new regulation won’t affect trading or investments in digital assets.”

Until the end of April, companies and local businesses had to comply with the new rules. The development pricing units other than the Thai baht would increase the cost of economic activities.

The rising crypto adoption, indeed, met a major obstacle here in the region. As of April 1st, Thailand would prohibit the usage of digital assets as a means of payment for goods and services. At the same time, it reduced the efficiency of monetary policy transmission.

Cryptocurrency operators should halt advertising, soliciting or establishing a system to facilitate payment of the same. Instead, they must warn clients against the use of digital assets for payments. The new regulations even went to the extent to threaten cancellation of accounts if found guilty of breaching these rules.

This move falls in line with regulators’ concerns that digital assets pose. It could impact the country’s financial stability and the overall economy.

Has it been a good ride?

The timing of the developments above is an interesting one. Significantly, just starting this month, Thai’s finance ministry cabinet relaxed the tax burdens of Thailand’s crypto investors from April 2022 until the end of 2023.

In addition, the cabinet approved tax relief measures, including the exemption of a 7% value-added tax (VAT) on cryptocurrency trades on regulated exchanges, to promote the crypto industry.