THORChain [RUNE], Lido Finance [LDO], and Synthetix [SNX] were the top performers on 3 August as the DeFi ecosystem steered the crypto market back to greens.

While others also recovered, the revival of these DeFi tokens was superior. On 3 August, RUNE was 11.51% up. LDO posted 13.46% gains while SNX registered an unprecedented 13.14% hike as per CoinMarketCap.

Even though all the top cryptocurrencies had not overcome the red levels, the DeFi protocols had already taken charge with a wide gap. So the question is- has any major event put DeFi on the front pedal?

Here we go

For RUNE, protecting user funds seems to be the priority since removing its IOU tokens across the Binance Smart Chain and Ethereum chain.

According to its latest update, RUNE was working towards developing nodes that could halt transactions on the network if they detected any suspicious activity.

Today THORChain node operators practised “Code Red”.

Each node can pause the network for 1hr if they spot anything suspicious. Any other node can unpause.

Nodes have the most at stake and globally monitor the network 24/7.

This feature protects user funds. Onwards. $RUNE pic.twitter.com/otqLWk73DS

— THORChain (@THORChain) August 2, 2022

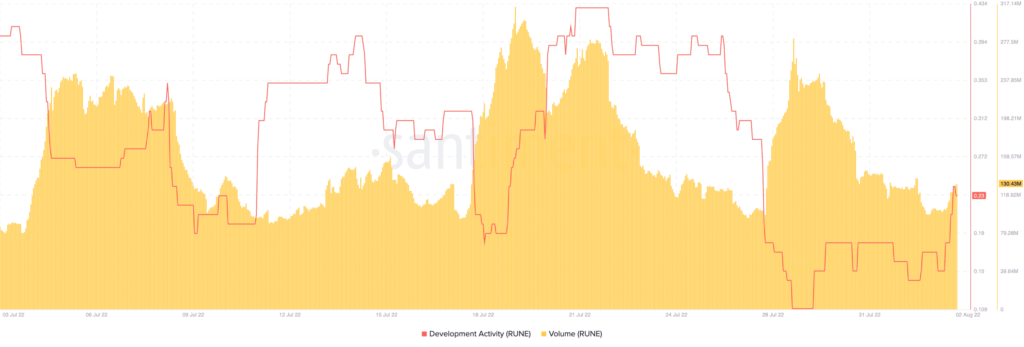

As expected, this increased the development activity on the THORChain network. As per Santiment data, RUNE’s development activity increased from 0.15 on 1 August to 0.23 at the time of this writing.

Additionally, the trading volume has increased over the last 24 hours of press time, with a 69.51% increase to $171.44 million. If this continues, RUNE could follow another bullish run.

It looks like a similar case with LDO as there has been increased development activity.

Well, before the Solana exploit, LDO had announced that it was piloting a partnership with Solana for its operators.

In an effort to broaden validator onboarding opportunities in the Solana ecosystem, Lido is piloting a small onboarding round for Lido on Solana specifically for operators not currently running mainnet nodes.

For more detail: https://t.co/VAyayts9PV

— Lido (@LidoFinance) August 2, 2022

Although the development activity had increased, its new levels were not so massive.

Even so, the market cap uptick has been quite impressive.

While the SNX increase has not followed any recent development, it seems closer to hitting the $4.25 price it reached on 28 July. At press time, the SNX trading price was $3.90.

Who else?

Apart from the RUNE, LDO, and SNX trio, other DeFi protocols seem to be on the same page. At the time of this writing, Uniswap [UNI] had increased 13.75% to $9.21, while Curve DAO Token (CRV) rallied 10.21% to $1.40.

Despite the price rise across the DeFi ecosystem, it might not reflect any confirmation that bullish sentiment was guaranteed.

Investors across the tokens could make a good decision if they considered these modest increases as levels that could retrace at any point.