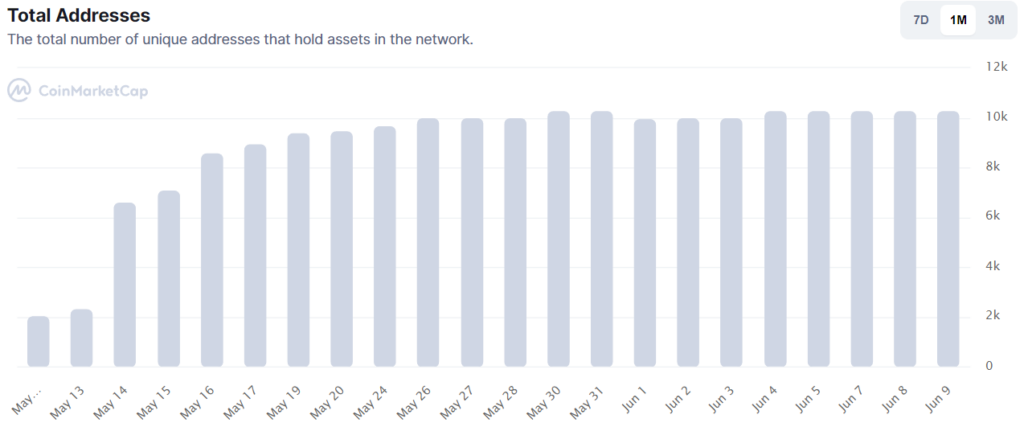

- Data from CoinMarketCap now shows that more investors are stocking up on the LUNC.

- In just the last month, the number of unique addresses holding the LUNC token has grown by over 500%.

- At the time of writing, the total number of unique addresses holding the collapsed LUNC token stands above 10,000.

Terra’s Luna Classic token (LUNC) and its accompanying stablecoin, UST, caused investors to run for the hills following its total collapse. However, data from the crypto market tracker, CoinMarketCap, now shows that more investors are stocking up on the token.

Following the de-pegging of UST from the US dollar on May 9, resulting in the collapse of Terra’s original LUNA, a hard fork was implemented. This incident led to the rebranding of the original Terra token to LUNC and launching of a new token, LUNA.

Data from CoinMarketCap shows that, over the course of the last month, more users have continued to hold the LUNC token. In just the last month, the number of unique addresses holding the LUNC token has grown by over 500%.

Even though the total number of addresses that have held the LUNC token grew by a significant number last month, the price per LUNC token appeared to have been searching for newer lows.

A month ago, when the token’s trouble began, LUNC sold for around $61.2 per LUNC token. However, the token registered a 100% decline to eventually trade for $0.000066 per LUNC token.

At the time of writing, the total number of unique addresses holding the collapsed LUNC token stands above 10,000, whereas the number was in the 2,000s just a month ago.

During the course of the last 30 days, LUNC did reach some highs on the social front. On May 13, LUNC saw a high of 21.62% in its social dominance. This corresponded with a 95% uptick the same day. However, the price was soon brought back down again by bears.