Decentralized finance, or simply DeFi, is ever-evolving, dynamic, and community-driven. The desire to offer the best options for its global, quality-insistent base distinguishes this sub-sphere from legacy systems.

At peaks, the Total Value Locked (TVL) by DeFi protocols spread across various smart contracts was north of $260 billion. Notably, a big part of DeFi comprises decentralized exchanges or DEXes. These portals adopt a unique approach, overhauling how token swapping occurs to eliminate intermediaries for a peer-to-peer operation where users remain in charge of their assets.

By Q2 2022, over 100 DEXes were active in various smart contracting platforms to serve their ballooning user base. However, while critical to adoption and inclusion acceleration, there are huge limitations, especially on liquidity.

Ethereum is the first smart contracting platform and the most dominant network for deploying dApps in DeFi. According to trackers, Ethereum’s DeFi dApps had a TVL of over $70 billion in mid-May 2022. DEXes dominated a big chunk of this. It explains why upcoming and periphery networks, regardless of their scaling, are eager to bridge to Ethereum and jump-start their seeding of liquidity to their core DEXes.

The Role of Liquidity DEX Aggregators in DeFi

DeFi innovators deployed liquidity DEX aggregators to overcome these challenges, enabling users to quickly swap tokens by bringing together different DEXes under one roof.

Theoretically, aggregator DEXes save resources and improve efficiency since they eliminate the hassle of traders shuffling between dApps in search of tokens. Moreover, it is fitting considering the vastness of DeFi and how diverse chains employ different standards to launch fungible tokens, presenting hitches.

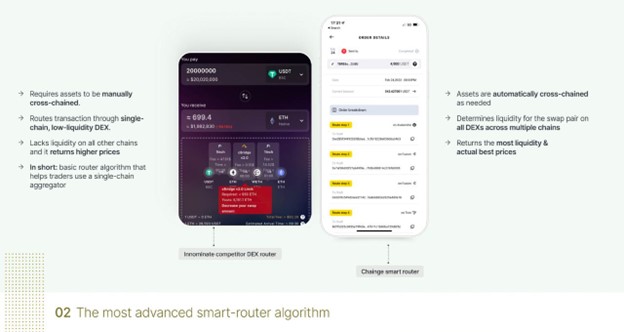

The problem is that though the benefit of liquidity aggregating DEXes cannot be watered down, they are able to only aggregate liquidity one chain at a time and are bogged by liquidity challenges.

The Chainge Finance Solution: Cross-chain Aggregation and Best Swapping Rates

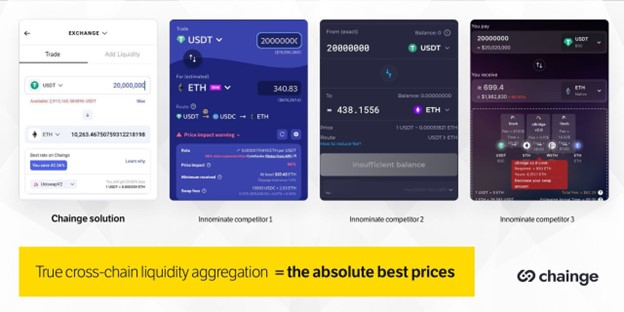

Chainge Finance is aware of these obstacles and has released what is, in effect, the first cross-chain liquidity aggregating DEX. Their platform links liquid DEXes across multiple chains enabling users to conveniently swap from a single portal with enhanced liquidity, reducing slippage, transaction costs, and time. The Chainge Finance app user interface is easy to use and navigate for all user classes, regardless of their experience, further simplifying trading.

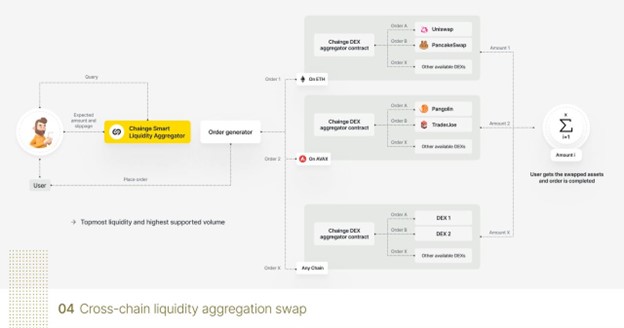

When swapping, Chainge crawls all active integrated DEXes supporting the tokens in question and finds the best transaction rates at minimum slippage. Once it identifies which active DEXes can enable trade, the protocol automatically splits the order between the DEXes and across all integrated chains to return the best pricing for the end-user.

The DeFi platform is remarkably liquidity-efficient because it uses an advanced, one-of-a-kind smart router in the sphere that can aggregate liquidity from multiple chains at the same time. This tool incorporates the patented DCRM technology and a swap pathfinder algorithm for cross-chain swapping while considering liquidity levels.

Let’s demonstrate. Suppose a trader places an ETHUSDC order, here is what happens in the backend:

Once the order is placed,

- The Chainge DEX algorithm searches the local database containing all DEXs integrated with the supported chains for the USDC and ETH pair.

- Chainge finds the DEXs with the lowest slippage rates for the specific pair and determines the best chain(s) to transfer the assets to

- The assets are automatically sent to the target chain(s) and the predetermined amount of USDC is split among the DEXs then swapped

- The user receives the max amount of ETH he could possibly get for his USDC in a couple of minutes, outranking any other potential DEX involved in the operation.

Over 400k Users Leverage the Chainge Finance Protocol

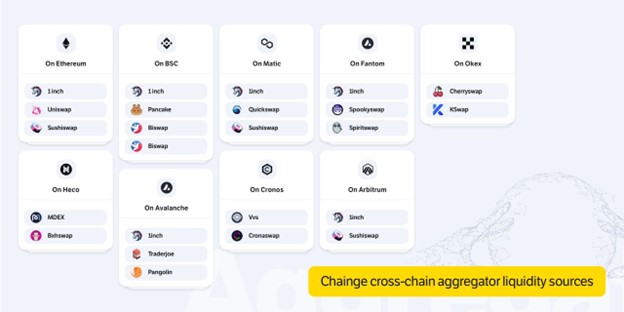

Chainge Finance has already aggregated liquidity across 9 chains, 20 popular DEXes and 1 aggregator: 1inch. Although the dApp is available on mobile, potentially limiting the number of whale traders, they plan to launch a desktop application in the course of the year. The Chainge Finance app is currently used by more than 400k users and commands an impressive TVL of over $160 million and a total aggregated liquidity exceeding $40bn.

Change currently aggregates liquidity across 9 chains from 20 DEXs & 1 aggregator:

ETH: 1inch, Uniswap, Sushiswap

BSC: 1inch, Pancake, Biswap, Apeswap

HECO: Mdex, Bxhswap

AVAX: 1inch, Traderjoe, Pangolin

MATIC: 1,inch Quickswap, Sushiswap

CRO: Vvs, Cronaswap

ARB: 1inch, Sushiswap

FTM: 1inch, Spookyswap, Spiritswap

OKT: Cherryswap, KSwap

Users are drawn to this platform also because of its impressive asset management toolset. For instance, Chainge has integrated a wallet, a spot, futures, and Options DEX trilogy complete with time-framing and escrow modules that can be utilized by traders.

All these tools are complementary to the cross-chain liquidity aggregating DEX delivering its goals of offering the best swapping rates for all users via high liquidity portals, benefiting end-users.