Is this attack on Tether part of The Wall Street Journal’s general campaign against bitcoin and crypto? Or did the newspaper feel the impulse to get in on the Tether FUD action a few months too late? Did Tether competitors pay for this article or is it an organic piece of journalism? The WSJ article titled “Tether Says Audit Is Still Months Away as Crypto Market Falters” elicits several questions. Tether’s answer even more so.

And we’re here to analyze both.

The Wall Street Journal’s No Mercy Attack

The newspaper starts its investigation with obvious truths, “Market observers have long questioned whether the firm’s reserves are sufficient and have been demanding audited information.” Nobody can dispute that. “The company has been promising an audit since at least 2017. An audit is “likely months” away, said Paolo Ardoino, chief technology officer of Tether Holdings Ltd.”

However, the company puts out a reserve report every now and then. Does it not? Well, the WSJ differentiates what we get from what is needed.

“Instead of a full audit, Tether, like other leading stablecoins, publishes an “attestation” showing a snapshot of its reserves and liabilities, signed off by its accounting firm.”

And quotes this violent statement by John Reed Stark, former head of internet enforcement at the Securities and Exchange Commission.

“Tether needs an audit that’s akin to a corporate colonoscopy, that tells investors everything about what’s in their reserves.”

How can Tether recover from this? Keep reading to find out.

Perceived Problems With Tether’s Accounting

Where you aware of the recent changes in Tether’s institutional partners?

“In July, Tether switched accountants, from a small Cayman Islands-based firm to BDO Italia, the Italian member of the global BDO network. That firm, though, is a separate legal entity from BDO in the U.S.”

Well, in the article “Tether Responds to Disinformation in WSJ Article,” the company strongly supports the institution.

“BDO, a very reputable and independent Top 5 audit firm, is not a “Tether accounting firm”, as erroneously written by the WSJ. BDO will continue to have unrestricted access to any relevant information to perform their work and Tether will continue to share its attestations, despite continuous attempts by the media to disparage its reputation.”

However, the WSJ perceives imprecision. Their major problem seems to be with the fact that Tether has undisclosed cryptocurrencies as part of its reserve, and we all know how volatile those are. According to the newspaper, this is a risk because Tether’s accounting cuts it too close to insolvency.

“On Aug. 25, its $67.7 billion of reported assets outweighed its $67.5 billion of liabilities by just $191 million, according to its website. That means a 0.3% fall in assets could render Tether technically insolvent.”

Tether’s response to this is not a denial. “To attack Tether’s reserves, when this margin also applies to other stablecoins on the market, further highlights an agenda by the publication,” their article says. According to Tether, the WSJ’s article’s aim is to damage the company’s reputation. A hit piece, no more no less. Plus, they insinuate they’ve been under attack and resisting effortlessly:

“Any reference to a margin of failure existing in Tether’s business model, assumes that the WSJ subscribes to the false short-seller narrative which suggests that short-selling Tether is even remotely possible.”

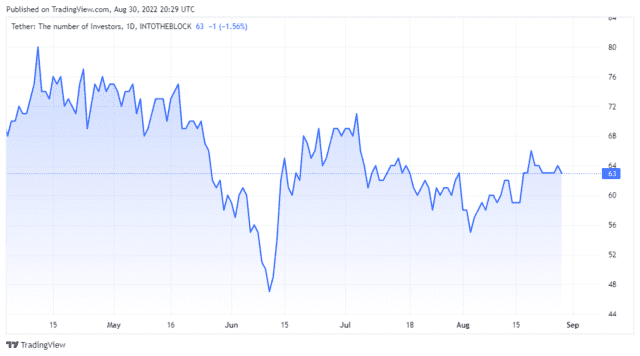

Tether, number of investor on Intotheblock | Source: TradingView.com

Tether Answers More Questions

One of the weirdest and more insidious parts of the WSJ article is that it compares Tether with bankrupt cryptocurrency lending platforms Celsius and Voyager. None of those issue stablecoins, so, why is the newspaper putting them in a balance? The only possitive thing about Tether the newspaper says is that it “redeemed $7 billion of customer funds in 48 hours during the recent crypto crash without any problems.”

Tether wasn’t having those numbers, and responded:

“Tether stands by the fact that it was able to easily redeem over USD 16B of the issued token in recent months.”

Besides that, the company attacks “Perhaps the WSJ has confused Tether with some of its competitors.” Admits “we have not had an audit and they know we are working towards one,” only to reveal that none of its competitors has had one either. “Rivals have allowed mainstream consumers to believe they are “safer” because they have been “audited,” but no such audit has occurred.”

Tether also defends its T-Bills reserve by claiming that “US Treasuries have been the premier safe asset worldwide.” And claims to be a profitable business, “Tether has never disclosed any equity despite being profitable for several years.”

In any case, using stablecoins implies counterparty risk. Even though Tether did a good job defending against the Wall Street Journal, should you trust your savings to a company? We’re not in the sixties, a global asset that doesn’t require trust already exists. Why would you Tether if you can Bitcoin?

Featured Image by Mariia Shalabaieva on Unsplash | Charts by TradingView