Disclaimer: The findings of the following analysis are the sole opinions of the writer and should not be considered investment advice

MATIC has broken above the range it established in late January. It was trading just below a near-term support level at $1.82, and a move above this level could see some gains in the next couple of days. The price neared a band of resistance in the $1.9-$2.05 area, which would likely see selling pressure enter the arena.

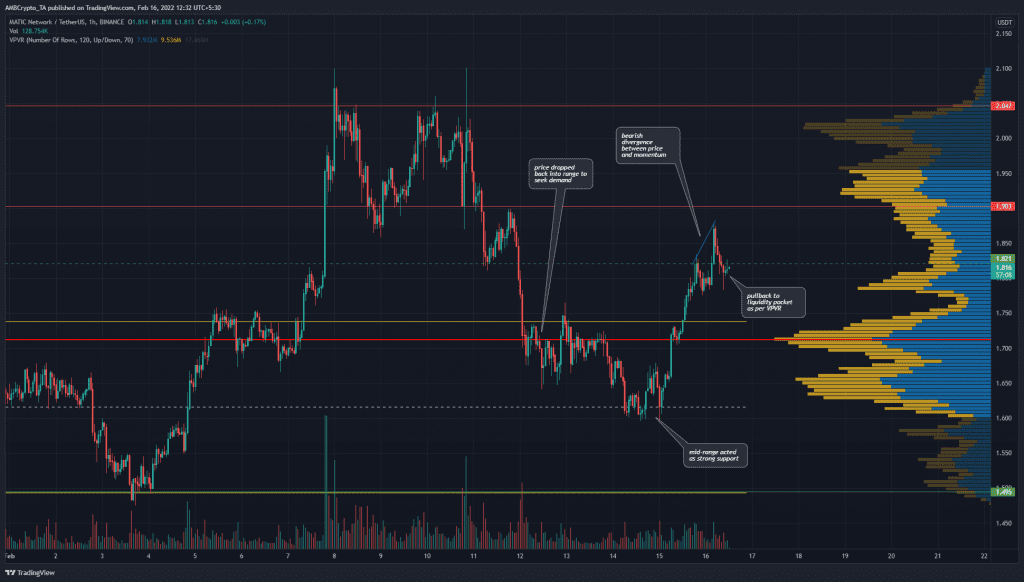

MATIC- 1 hour chart

A range was observed for MATIC from $1.495-$1.74 (yellow). Last week, the price rose to $2.05 on two separate days but was rejected from that resistance level on both occasions. The price was forced to drop towards the range and even went as deep as the mid-point of the range in search of demand.

A bullish reaction was observed at mid-range and MATIC had climbed to $1.82, at the time of writing. It did display a bearish divergence between price and momentum, which saw a minor dip to $1.78 in the hours prior to writing. According to the Volume Profile Visible range, the $1.78 area was a pocket of decent trading volume over the past couple of weeks.

This makes it a logical area where buyers are likely to step in.

Rationale

Momentum shifted from weakly bearish in the past few days to strongly bullish once the price saw a positive reaction at the $1.6-mark. Both the RSI and the Awesome Oscillator managed to climb above their respective neutral levels and pictured bullish momentum over the past couple of days. As mentioned, a bearish divergence saw a minor dip to $1.78.

The Chaikin Money Flow moved back under the +0.05 level in recent hours. this suggested that there was no significant capital flow in either direction at the time of writing.

Conclusion

Bitcoin held on to the $43.8k-support level at the time of writing and could be heading towards the $46k-$48k area in the next few days. This could see a bullish reaction from MATIC and push it towards $2.

The $1.82 is a short-term support level, and if the price can climb above, it is likely to move towards the $2-area. To the upside, the VPVR displayed resistance in the $1.9-$2 area.