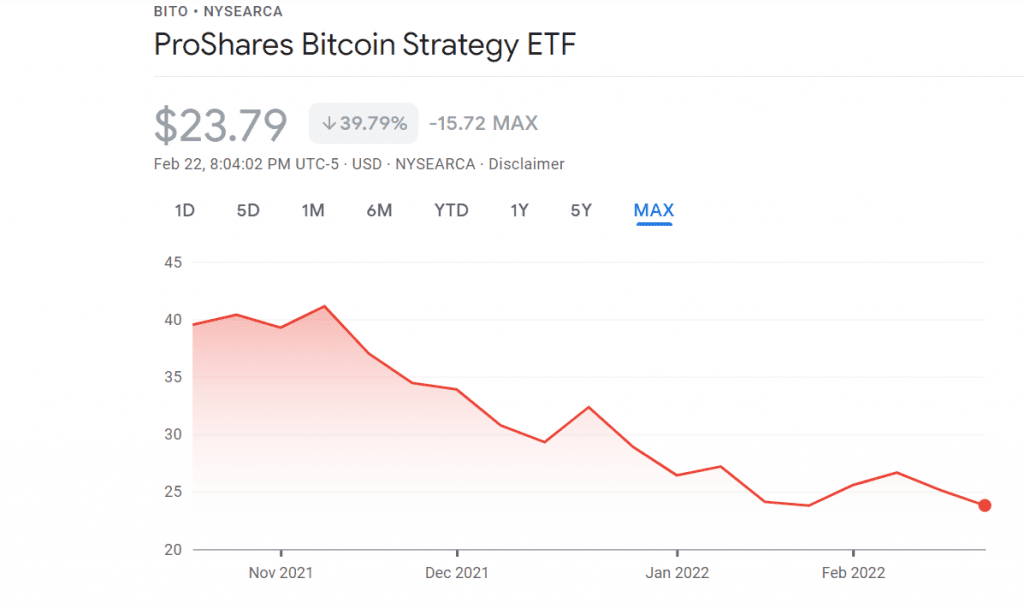

While Bitcoin Futures Exchange Traded Funds (ETFs) launched with full fervor and record-breaking numbers in October last year, their performance has since dwindled thanks to the larger market’s depreciation. For instance, the ProShares Bitcoin Strategy ETF (BITO) was down 5.26% from yesterday’s close, at the time of writing.

Furthermore, its value has dropped by over 45% since its initial launch.

Source: Google Finance

Now, while this is in line with Bitcoin’s own weak performance during this time, an analysis of the two assets has revealed an even greater correlation.

According to a recent report by Arcane Research, Bitcoin’s price has been following a cyclical pattern. One where most BTC gains since 2021 have occurred in the first half of the month.

However, what’s more interesting is the role Futures-based Bitcoin ETFs have played in this trend as fund inflows have tended to follow a similar cyclical pattern. The report found that inflows have been concentrated to the days and weeks following the rolling weeks, while activity simmers down during the rolling weeks.

Bitcoin Futures contracts have an expiry date and traders tend to roll over the front-month contract into a further-out month in order to avoid the expenditure associated with the settlement of the contracts.

However, rolling over has its own costs and an investor seeking to allocate into the ETF might wait until the Futures have been rolled to avoid these costs, according to Arcane Research. This could explain the lull in capital inflows during the rolling weeks for BTC ETFs.

What’s more, these disparities tend to have a spillover effect on Bitcoin’s spot price, the report said.

“Market makers hedge across markets and growing BITO inflows directly impact buying pressure on CME, in turn impacting the spot market. If the trend of inflows post-roll remains, Bitcoin’s cyclical pattern might be sticky.”

It should be noted here that when fund inflows are low during front-month contract sell-offs, BITO also buys the next month and two-month contracts. This fuels a Futures contango, one where the Futures price is higher than spot prices.

This provides a “minuscule net exposure reduction” which is levied by both the house and arbitrageurs.

“This contango effect will likely have a very minuscule impact on the spot market. The key observation from BITO’s fund is the possible spillover effects caused by inflows following rolls, which could enhance the cyclical dynamics.”

Such spillover effects between BTC Futures ETFs and spot prices are one of the primary factors behind investment managers and traders demanding American regulators green-light a Bitcoin spot ETF. This would also remove the risk of contango, along with the costs and hassle of rolling over contracts.