Cosmos [ATOM] made it to the list of top inter-blockchain communication (IBC) protocol projects as of 18 October. According to the data at hand, ATOM’s weekly active users surpassed all other cryptocurrencies that made it to the list.

Top #IBC Projects by Weekly Active Users 🔥

🥇 $ATOM @cosmos

🥈 $OSMO @osmosiszone

🥉 $EVMOS @EvmosOrg$CRO @cronos_chain$LUNA @terra_money #CroFam @cryptocom$UMEE @Umee_CrossChain$SCRT @SecretNetwork$EROWAN @sifchain$MNTL @AssetMantle#IBCGang #Cosmonauts@MapOfZones pic.twitter.com/uqUus958dQ— Cosmos Daily ⚛️ (@CosmosATOMDaily) October 18, 2022

________________________________________________________________________________________

Here’s AMBCrypto’s Price Prediction for Cosmos (ATOM) for 2023-24

________________________________________________________________________________________

The IBC allows independent blockchains to directly communicate and trade assets with each other. Therefore, this development added much value to the blockchain as it represented the capabilities of ATOM.

The token’s price also corresponded to this development as it registered nearly 3% weekly gains. According to CoinMarketCap, ATOM’s press time price was $12.45 with a market capitalization of $3,564,241,363.

Several developments also in the ecosystem acted as the cherry on the cake and suggested a price surge in the near future. For example, 17 new projects were recently added to the Cosmos ecosystem, which looked quite promising.

Alpha Google Sheet Has Been Updated.

Check it out: https://t.co/KOpn45NUUQ

Added Updates:

➕ 17 New Cosmos $ATOM Ecosystem Projects.

➕ 30 New Projects Without Tokens.

➕ 29 Early Stage Projects on the $APT Ecosystem.🧵Total Projects: 290+ pic.twitter.com/vDgdB0Jb0S

— Airdrop Official🍥 (@its_airdrop) October 17, 2022

A sky full of Cosmos…

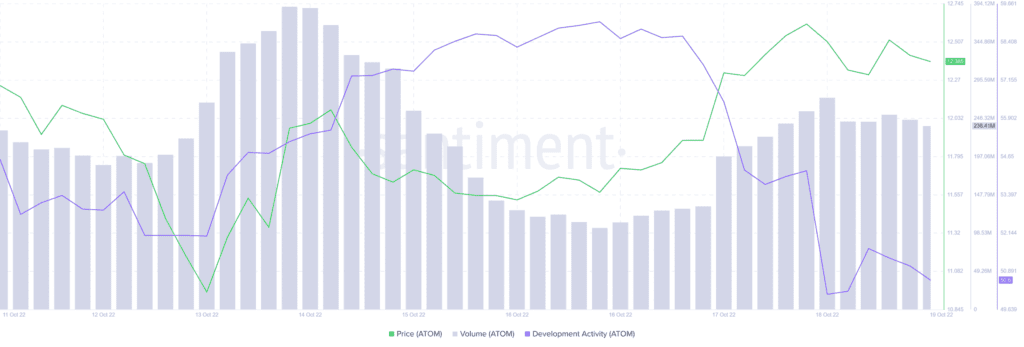

In addition to the aforementioned developments, ATOM’s metrics also painted a bullish picture for the coin. Several metrics suggested a price surge in the near future. For instance, after registering a decline, ATOM’s volume went up, which was a bullish signal.

ATOM’s Binance funding rate also witnessed a surge in the last few days, thus indicating higher interest from the derivatives market. Not only this, but ATOM’s social volume also spiked, representing ATOM’s popularity levels within the crypto community.

However, not everything was working in ATOM’s favor as its development activity went down considerably, which is a red signal as it indicates less effort from the developers in improving the blockchain.

… and bears apparently

A look at ATOM’s daily chart revealed that the bulls and the bears were fighting a battle. The Exponential Moving Average (EMA) Ribbon indicated a similar situation with the bears having a slight edge in the market. Moreover, ATOM’s Relative Strength Index (RSI) rested below the neutral position.

Nonetheless, other market indicators were positive and suggested a price surge in the coming days. The Moving Average Convergence Divergence (MACD) displayed an attempt to make a bullish crossover. ATOM’s Chaikin Money Flow (CMF) did manage to cross the zero line, but moved sideways at press time.