The brief rally in Bitcoin and the broader cryptocurrency market has come to a halt as all selling pressure mounts. Bitcoin’s (BTC) price has corrected more than 12% over the last week currently trading around $21,000.

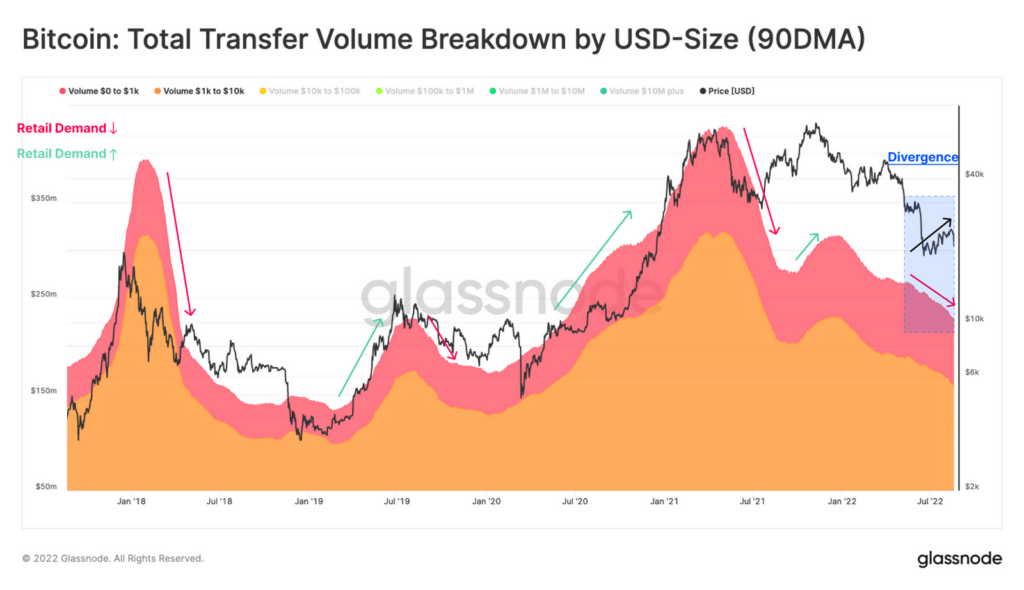

On-chain data provider has shared a detailed analysis explaining the underlying weakness during the relief rally. Glassnode points out that the participation of retail players was lacking during this relief rally citing the total number of small transactions with value less than $10,000.

As per the Glassnode data, when the BTC price jumped back to $24.4K, the transaction volumes for retail investors were still heading lower. This lack of retail demand marks the underlying weakness in the market.

Comparing Exchange Inflows and Outflows

On-chain data provider Glassnode explains the cyclical behavior of Bitcoin prices to the USD-denominated inflows and outflows at the exchanges. The data provider states:

Exchange flows have now declined to multi-year lows, returning to late-2020 levels. Similar to the retail investor volumes, this suggests a general lack of speculative interest in the asset persists.

Trending Stories

One thing is clear, with the lack of retail participation, the network demand and activity on the Bitcoin blockchain were lacking severely. Furthermore, Glassnode points out at the Net Realized Profit/Loss (90DMA) explaining that sellers are yet not exhausted in the recent bear market.

Looking at the last bear cycles of 2018-2019, the Net Realized Profit/Loss (90DMA) should return to neutral to suggest any price recovery.

Finally, Glassnode speaks of the Short-term holders’ SOPR (90DMA) which explains the ratio of investors’ selling prices relative to their buying prices. The important threshold here remains the cross-over of 1. Any break above it would indicate a return to profitable spending. As Glassnode explains:

Following the capitulation from the November ATH, short-term holders (top buyers) realized heavy losses, causing a sharp drop in Short-Term Holders SOPR (90DMA) below 1. This phase is usually followed by a period of low conviction, where the break-even value of 1 acts as overhead resistance.