With a downfall of more than 40% in the past week, the THETA price hangs close to $2.5. The increased selling pressure fuels the correction phase in action. Moreover, the extreme fear controlling the minds of investors threatens a bearish continuation. Will the downfall break below the $2 mark?

Key Technical Insights

- The THETA coin price falls 40% in a week to reach the $2.5 mark.

- The intraday trading volume in the Theta Network coin is $209 Million, indicating a 23.2% loss.

Source- Tradingview

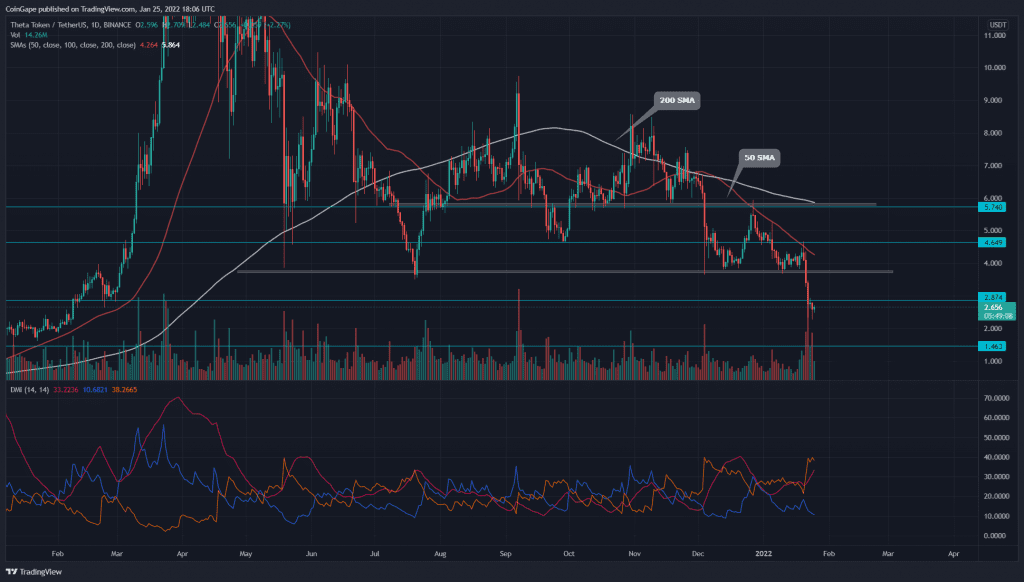

In our previous coverage of the Theta Network coin, the technical chart hinted at forming a double bottom pattern with crucial monthly support of $3.7 at its base. However, the buyers couldn’t rally the price higher than $4.6 as the selling renewed due to the sudden bloodbath in the crypto market.

- This recent free-fall plummeted the coin below two crucial support of $3.7 and $2.8, causing a 50% devaluation of THETA price in just three trading sessions.

- The network price breaks below all the crucial Simple Moving Averages (50, 100, and 200) in the daily chart. Moreover, the SMAs maintain a bearish alignment, with the 50-day SMA trying to provide dynamic resistance.

- The Directional moving Index shows the ADX line rising above 25%, indicating a solid trend momentum in action. With the spike in the -DI above 35% and a sharp fall in the +DI below 12%, the gap reaches a phenomenal milestone for a bearish trend. Therefore, the indicator reflects a solid bearish trend in action.

THETA Price Stabilizes Near $2.5 With Minor Retracement

Source-Tradingview

The Theta Network coin price stabilizes near the $2.5 horizontal level after a free fall creating multiple bearish engulfing candlesticks in the 4-hour chart. Moreover, the price action might pull back to this flipped resistance($2.8) in search of sufficient supply.

In the past 24 hours, the coin price rose by 7.84%, at press time, despite the 25% fall in intraday trading volume. However, the price remains far from the next resistance level at $3.27 and $4.15 ( Pivot Level and R1 Pivot Level). The support levels present below the $2.5 are at $2 and $1.55.