THETA, the 51st ranked cryptocurrency in terms of market capitalization according to online tracker Coingecko, is performing relatively well now as it stays on the green zone as far its short-term and long-term price monitoring is concerned.

- THETA is all green in the charts except for its year-to-date progress

- The altcoin is sitting on a 17.2% 14-day increase

- A test of the $1.2 resistance zone is likely to happen for THETA

At press time, the asset is trading at $1.16 and is up by 1.5% over the last day. On a weekly and biweekly timeframe, the crypto increased by 16.8% and 17.2%, respectively. Moreover, the past 30 days also saw the altcoin go up by 5.9%.

It is still enjoying some residual momentum from the rally that the crypto market did just few days ago but still has long ways to go if it hopes surpass or even to just get closer to its April 16, 2021 all-time high value of $15.72.

Nonetheless, THETA is still one of the better performers of the crypto space right now but interested buyers must first consider knowing even just a little of its price analysis before making the decision to accumulate.

Diving Into THETA Price Action

Over the last two months, the crypto market was filled with uncertainty and was also plagued by massive sell-off from different assets.

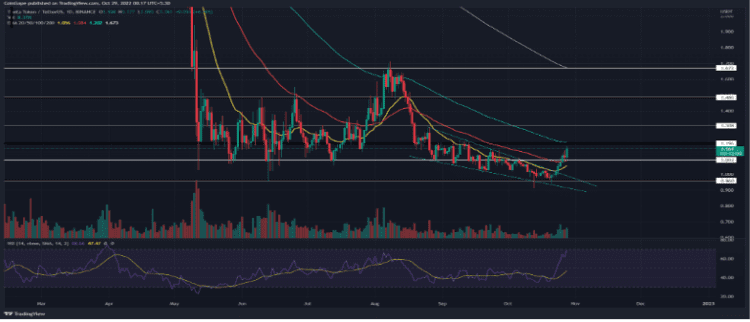

THETA managed to buckle down despite all of these and in doing so had placed its price in a falling wedge pattern as it was bullish but was eventually headed to an immediate correction.

Source: TradingView

During the last five days, the altcoin’s charts were filled with green candles as it went up by 15% on the way to testing the $1.2 marker.

Meanwhile, the asset’s Relative Strength Index (RSI) has entered the overbought zone, indicating the need to somehow put a stop to aggressive buying from traders in order to stabilize the price rally.

Moreover, during the recent crypto market rally, THETA price increased rapidly and, owing to its current pattern, needs to undergo correction before resuming its recovery and eventual upward movement.

Price Forecast for the Crypto Asset

As suggested earlier, the next few days will be painted in red for THETA as it is heading towards its impending price stabilization.

According to Coincodex, over the next five days, the asset will slightly decline to trade at $1.15. The sharp correction will happen within the next 30 days as it is likely to plummet all the way down to $0.58.

The token has 17 technical indicators that are giving off bearish signals and has settled in the Fear Region of the Fear and Greed Index.

Investors and prospective buyers, however, must remember that if THETA stays true to the nature of its pattern, it will try to bounce back and make a rally of its own after its price dump.

THETA market cap at $1.16 billion on the daily chart | Featured image from BlockchainReporter, Chart: TradingView.com Disclaimer: The analysis represents the author's personal views and should not be construed as investment advice.