Bitcoin mining company CleanSpark has acquired 3,843 cryptocurrency miners for consolidating its position in the market. CleanSpark purchased the Antminer S19J Pro Bitcoin miners for $5.9 million at a price of $15.50 per terahash.

The company revealed that the total number of machines bought since the beginning of the bear market is more than 26,500.

This deal is crucial as it takes place at a time when a lot of mining companies are selling their equipment or filing for bankruptcy.

Operations going bankrupt as mining costs rise

The mining industry is facing challenges on multiple fronts as a result of rising energy prices and the sluggish value of cryptocurrencies.

Furthermore, lawmakers and environmental advocacy groups have continued to call for tougher measures to be taken to mitigate the negative effects of mining.

On 22 September, Compute North, a leading crypto-mining data center, filed for bankruptcy in a U.S. court. When it filed its papers, the company owed up to $500 million to at least 200 creditors.

Core Scientific (CORZ), the world’s largest Bitcoin mining company, warned last week that if its financial situation did not improve, the unit might consider filing for bankruptcy in court. Its stock soon fell by 77% to 23 cents.

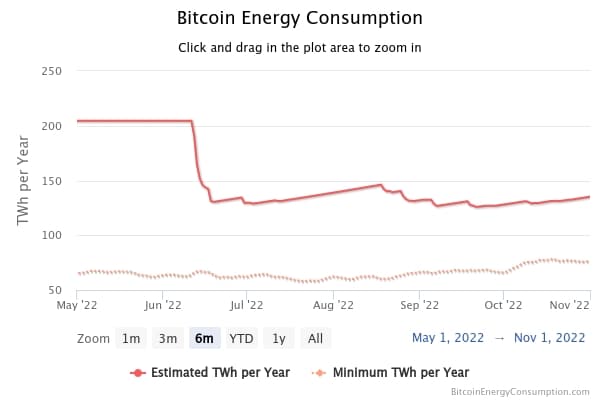

The global energy consumption due to Bitcoin mining reflects the price flow of Bitcoin. The current price fall also reflects in the drop in related energy consumption. As we can see, energy consumption follows the same patterns as the price of Bitcoin.

The relationship between mining and Bitcoin’s price is simple enough. Miners are motivated to mine coins more extensively when cryptocurrency prices rise.

As more people join the mining community, the price of mining hardware rises. A sustained market downturn, on the other hand, forces miners to abandon the process and close their doors.

In addition, a number of U.S. lawmakers are critical of the adverse environmental impact of cryptocurrency mining. During a Senate Banking Subcommittee hearing last year, Massachusetts Senator Elizabeth Warren called for cracking down on “environmentally wasteful” cryptocurrencies in order to combat the climate crisis.

“Bitcoin requires so much computing activity that it eats up more energy than entire countries,” she added. Warren is one of the many lawmakers who are critical of the impact of mining operations on the environment.

Sailing against the waves

CleanSpark CEO Zach Bradford said that the company has been able to invest in new hardware and increase its production due to its focus on sustainability, a strong balance sheet, and an operating strategy.

Executive Chairman Matthew Schultz believes that CleanSpark looks at Bitcoin mining as a “potential solution for creating more opportunities for energy development.”

CleanSpark has made a number of acquisitions in recent months. The company acquired a 36MW facility in Washington, Georgia, including 3,400 mining machines, in August.

It acquired 10,000 brand-new Bitmain Antminer S19j Pro units in September. Later, it finalized the acquisition of an 80MW facility in Sandersville, Georgia, including 6,500 machines, in October.