The world’s second-largest cryptocurrency ETH witnessed a greater fall over the last weekend following the Fed Jackson Hole meeting. As of press time, ETH is trading 7% down on the daily chart at a price of $1,451 with a market cap of $177 billion.

The recent ETH price correction has sent the cryptocurrency trading under two major supply zones. Citing data from IntoTheBlock, popular trader Ali Martinez explains:

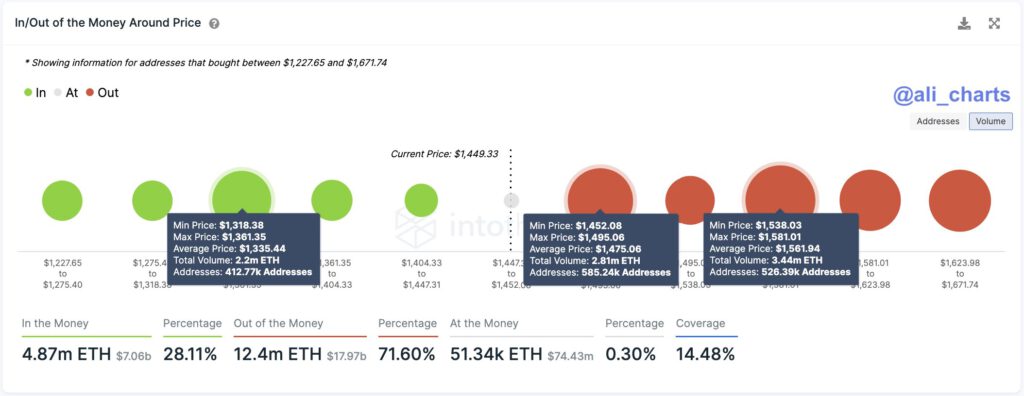

Ethereum trades below two significant supply zones. One at $1,475, where 585K addresses bought 2.81 million $ETH, and another at $1,560, where 526K addresses hold 3.44 million #ETH. The only considerable support level is $1,335, where 412K addresses purchased 2.2 million #ETH.

He further explains that the Ethereum network growth has been the lowest in over two years. This could mean a strong “bearish” momentum going ahead. Ali Martinez said:

Ethereum network growth hasn’t been this low in more than two years. The last time the # of daily new $ETH addresses was 49,700 was back in March 2020. A steady decline in the # of new addresses created on the #ETH blockchain tends to lead to a steep price correction over time.

Trending Stories

ETH Corrects Just Before Merge Upgrade

During the entire July and half of August, ETH made a strong pullback gaining over 90% from the bottom of $1,000 in June end. However, ETH has seen a strong 25% retracement from the peak and is currently trading under $1,450 levels.

This shows that the global macro factors have overshadowed the optimism surrounding Ethereum Merge. In a note last Friday, analysts at Bitfinex said:

“Ethereum’s drop ahead of the impending Merge is also of note as bearish sentiment appears to be taking hold across all so-called risk assets. The volatility that has become so characteristic of the digital token space shows no signs of abating.”

All eyes will be on the $1,335 level which has the last major supply zone. Falling under it could mean even greater correction.