The United States government like many others often confiscates a significant portion of Bitcoin (BTC) and other altcoins during their investigation and bursts. These confiscated batches of BTC valued in million are then auctioned off each year. The majority of these auctioned BTC and other altcoins are sold well below the market price, offering a perfect opportunity for buyers to make instant profit.

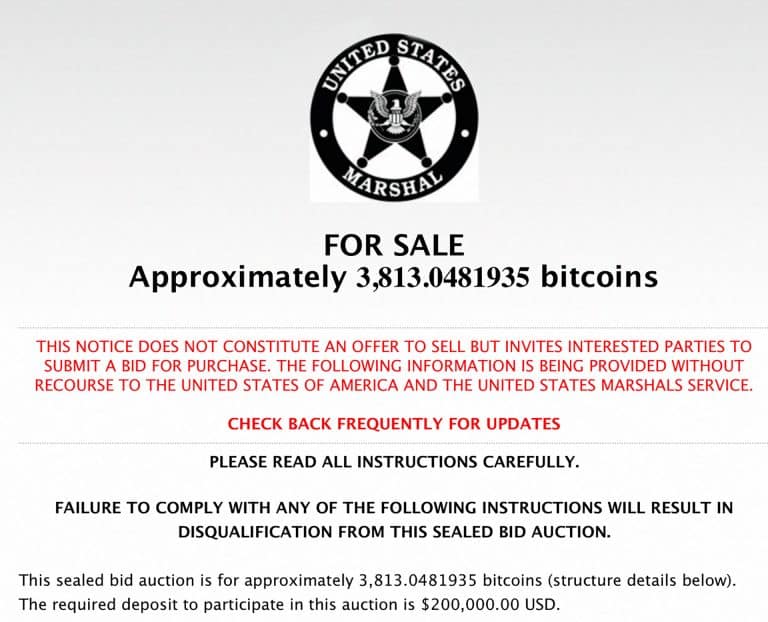

Once court proceedings involving crypto-assets finish, the U.S Marshals Service takes over the digital assets and is responsible for auctioning off the seized cryptocurrencies. According to a report published in CNBC, the U.S Marshals Services in total have auctioned off 185,000 bitcoins to date estimated to be well over $8 billion dollars.

The U.S Federal agencies seized $700,000 worth of crypto in 2019 followed by a $137 million bust in 2020 and in 2021 the U.S agencies have confiscated over $1 billion. Koopman, who worked with government agencies on the infamous silk road case said,

“In the fiscal year 2019, we had about $700,000 worth of crypto seizures. In 2020, it was up to $137 million. And so far in 2021, we’re at $1.2 billion,”

Another officer said,

“The fact that the Marshals Service is getting professionals to help them is a good sign that this is here to stay,”

How crypto regulations can change crypto seizures?

Today, governments around the globe are auctioning off confiscated Bitcoin and altcoins worth billions below the market price. However, as regulations come into place, many of the governments might not really sell it off. Take El Salvador for example, a small nation-state in Central America made Bitcoin a legal tender in September and the country has been buying BTC ever since during the dips. It holds over 1,000 BTC in its treasury as more get added over time from mining and direct purchases.

BTC is currently trading at $46,535 with a 2% decline over the past 24-hours. The top cryptocurrency has fallen nearly 30% from the top in October, and currently looking for a re-bounce from its consolidation phase.