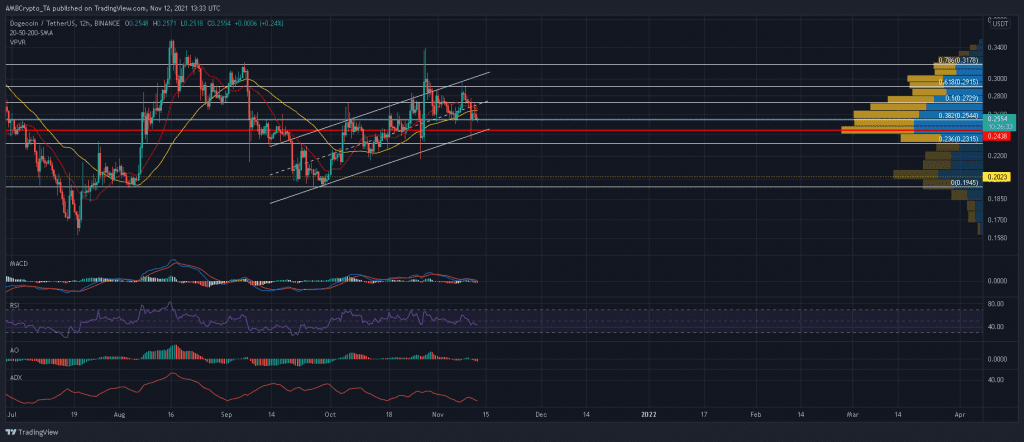

Since late-September, Dogecoin has traded within a steady up-channel, barring a false breakout on 28 October. With the 50-SMA (yellow) about to cross above the 20-SMA (red), DOGE could weaken below the 38.2% Fibonacci level and form a new low at the bottom trendline.

From there, chances of a breakdown would come to light if the broader market continues to witness outflows. At the time of writing, DOGE traded at $0.2554, down by 1.78% over the last 24 hours.

Dogecoin Daily Chart

The daily MACD and Awesome Oscillator traded below their respective half-lines. Which means, DOGE could slip below the 38.2% Fibonacci level, set up a new low between the Visible Range’s POC at $2.50 and the lower trendline at $2.40.

If this zone is breached, DOGE would be exposed to a possible 16% sell-off to a support region of $0.2023, provided bears are able to stretch advantage below the 23.6% Fibonacci level.

On the flip side, a bullish reversal can be expected as long as DOGE avoids a close below the 23.6% Fibonacci level. Once the next upcycle takes place, a new high can be expected above $0.30.

Reasoning

DOGE’s near-term trajectory looked weak due to bearish positions along the MACD and Awesome Oscillator. The RSI also traded below 50-45, although an ADX reading of 15 indicated the lack of a strong directional trend. This reading could disallow DOGE from excessive bleeding once an up-channel breakdown is observed.

Conclusion

According to the Visible Range Profile, DOGE had several defensive options should the price close below the immediate 38.2% Fibonacci level. However, the lack of strong support areas below the 23.6% Fibonacci level could trigger massive losses in the DOGE market, with the next viable defense present at $0.2023.

Considering the wider market correction, a better call would be to short DOGE once it closes below the lower trendline of its up-channel. Entries can be made at $0.241 and take profit can be set at $0.2023. Meanwhile, a stop-loss should be maintained at the 38.2% Fibonacci level, as DOGE could quickly turn the situation around following a recovery above this ceiling.