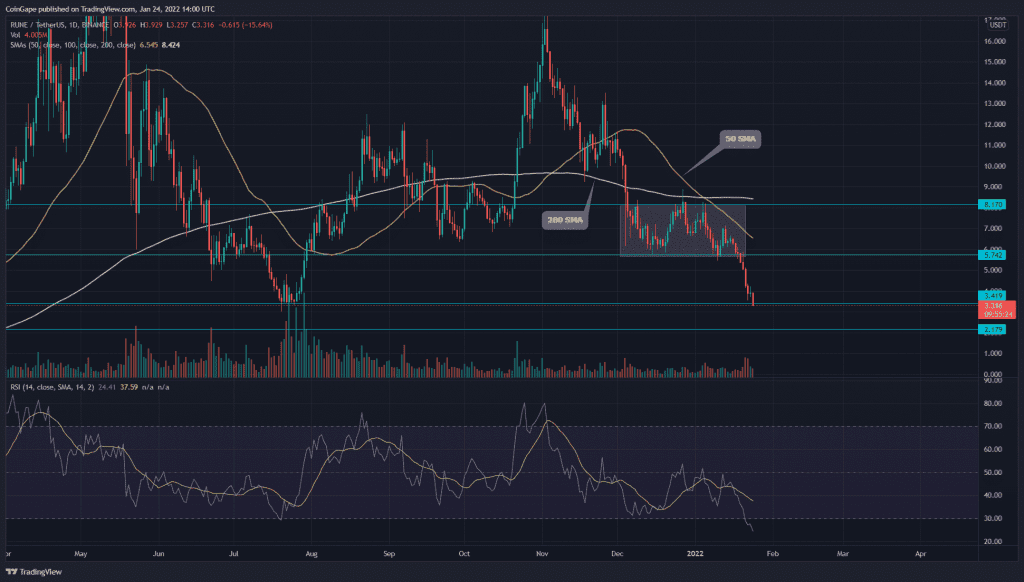

The panic selling in the crypto market has resulted in an extended correction in RUNE price. The coin lost its crucial support of $5.7, which majorly supported during December 2021 and early January. The RUNE price has devalued by 40% within a week and now challenges another key support of $3.35.

Key technical points:

- The daily-RSI slopes plummeted to the oversold region

- The intraday trading volume in the RUNE token is $66 Million, indicating a 1.85% hike.

Source- Tradingview

During the first half of January, the RUNE price continued to resonate in a narrow range extending from $8.1 to $5.7. Such consolidation phase represents a short break for price action before they continue their primary trend.

On January 19th, the token price gave a strong fallout from the $5.7 support, providing a selling opportunity for crypto traders. In just five days, the RUNE price lost 40% in value and plunged to the crucial support of $3.4.

The technical chart represents a bearish alignment among the crucial SMAs(20, 50, 100, and 200). These SMA lines could provide strong resistance during a possible bull run.

The daily-Relative Strength index(24) represents a sudden dip to the oversold territory, indicating the sellers might have pushed the token beyond its fair value.

RUNE Sellers Trying To Engulf $3.35 Support

Source-Tradingview

The RUNE/USD pair is currently trading at the $3.2 mark, indicating an intraday loss of 16.31%. The token price has dropped below six-month prior support of $3.35, suggesting the price will continue its downfall.

However, the crypto traders are advised to wait for candle closing below this support to confirm a fallout and a possible sell opportunity to the $2 mark.

The Moving average convergence divergence shows the MACD and signal lines provide a bearish crossover below the neutral zone(0.00), indicating a sell signal.

- Resistance level $4.7, $5.7.

- Support levels-$3.5, $2.1.