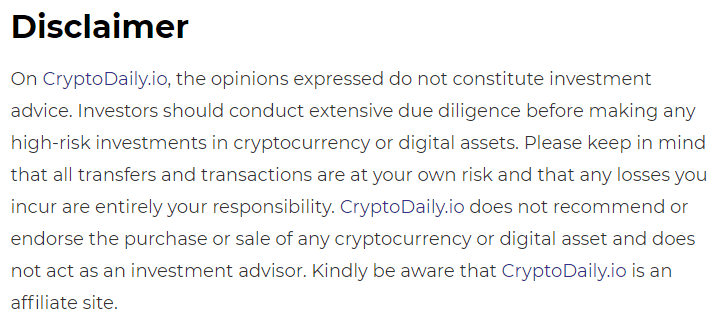

Thorus is an all-in-one cross-chain DeFi 2.0 Platform with an adaptable treasury system and a token holder-first approach that is built on the Avalanche network.

Introduction

Thorus is focused on the needs of token holders first. Every function of the protocol is intended to reinforce this mentality in some way. THO tokens are continually gaining value as a result of the ecosystem in which they operate!

Main Features

AMM

The project uses Uniswap 2 fork. The swap fee is 0.1% and is the lowest swap fee on Avalanche! It is Thorus’ main revenue stream.

The protocol will put 90% of this fee into the Treasury to support TVL, and 10% will go to LPs. To ensure stability and quick peg times, 20% of the 90% will go into the STATIK (stable coin) Reserve Fund.

Some Treasury funds will be used to generate outside yields, increasing THO’s buyback capacity and helping to raise the backing price. Also, as the Treasury grows in size, it becomes more stable over time as its holdings diversify!

Bonds

Bond utilization is a key feature that greatly benefits platform investors. Users can sell multiple assets to the platform and receive discounted platform tokens for 7 days.

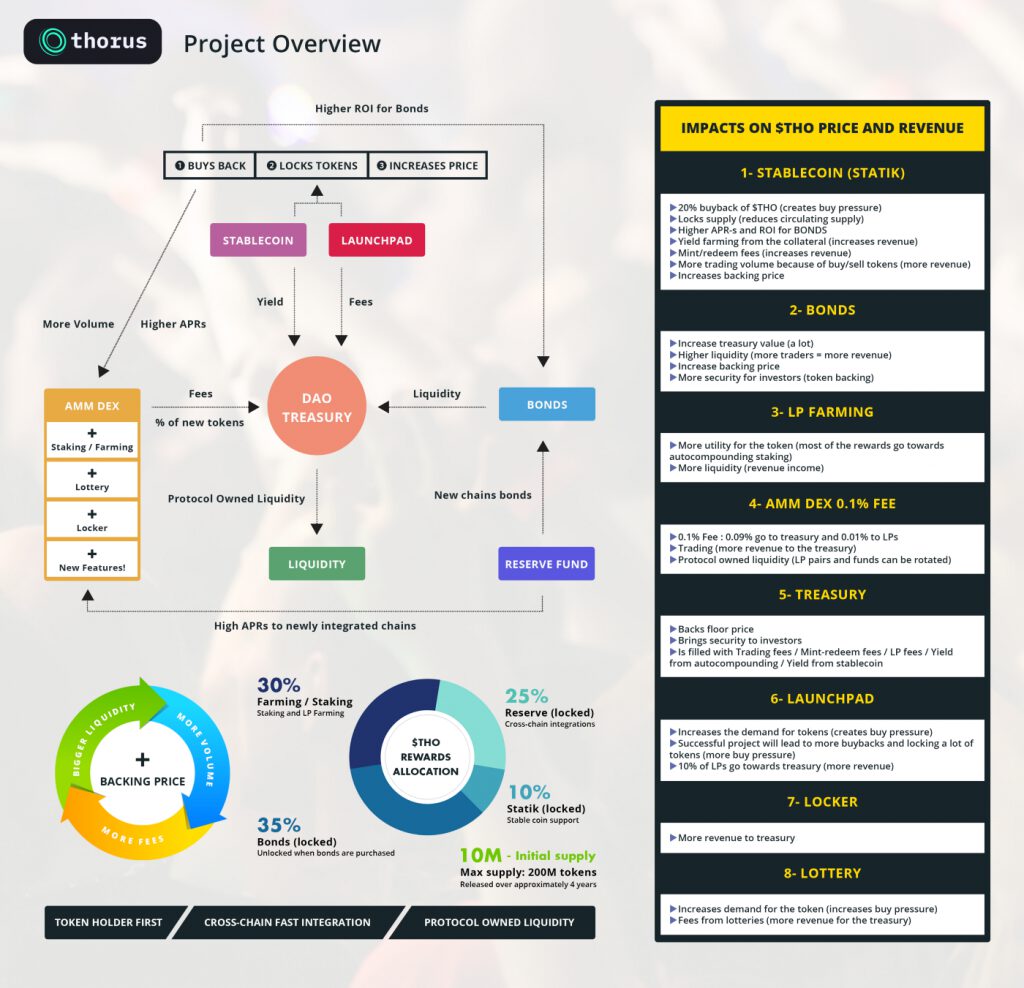

35% of all emissions will go to the platform’s bonding system. The tokens from this emission allocation will not be minted until the next bond purchase cycle. Thus, inflation is slowed until the TVL is sufficient to introduce the locked tokens.

Given this section’s finite distribution, significant and rapid TVL growth is expected, allowing for stable long-term developments. This POL model (aka Protocol Owned Liquidity) will also help create a backing price for the platform-specific token, which will help stabilize our stable coin and reduce wild price swings. This bonding process will also increase volume through our swap, generating revenue for the platform and supporting THO and Treasury.

Treasury

All platform utilities will contribute funds to the Treasury, ensuring the holders’ growth and long-term value. As such, the Treasury will serve as the focal point for this new protocol and investor-first approach.

The Treasury can automatically establish and maintain a backing price for the THO token by purchasing THO tokens at a predetermined backing price with funds from the bonding mechanism. This contributes to the stability of STATIK, the stable coin, and ensures that both tokens retain their value over time. Additionally, the larger the Treasury becomes through this POL model, the higher the backing price and value for the THO token, providing participants with price security!

Staking

In an effort to prioritize token holders, a large portion of the newly generated THO will be allocated to our auto-compounding single asset staking section.

Auto-compounding claims and compounds automatically your rewards several times a day, and therefore increase your APY (Annual Percentage Yield) in an exponential way!

To build protocol-owned liquidity, the Thorus dApp’s Staking section works continuously with the protocol’s other core features. Treasury collects fees for staking in the following ways:

Performed fees are collected every time the Harvest function is called and only applies to pending rewards (not deposits).

Harvesting manually triggers auto-compounding for ALL stakers. The person who triggers this function will get a reward. This bounty receives 0.05% of all pending rewards. This percentage is for pending rewards since the last Harvest call.

Staking requires no deposit fee!

Cross-chain

25% of THO emissions will go into the Reserve Fund. This Reserve will act as a bank for THO, allowing the project to quickly expand cross-chain. This allocation is what gives new chains their initial attractive APRs.

10% of THO will go to the STATIK stable coin. They are locked unless needed to hold the peg. If STATIK can easily overcome inflation and become fully collateralized, these THO could be used for future cross-chain expansion.

Thorus chose the Avalanche network to launch. Apart from being more resilient to market downturns, Thorus will also be more stable on the chain side. Once Thorus begins the cross-chain expansion, Thorus will dynamically reallocate the Treasury to chains with attractive return incentives. This increases the rate of return and enables Thorus to circumnavigate chain-specific slowdowns.

Additionally, The project can dynamically adjust the emission rates to the chain with the highest performance to generate additional TVL for the Treasury. For instance, if AVAX’s performance deteriorates and the bridged chain expands, they can divert more than the 20% allocation reserved for cross-chain expansion. As a result, they can maintain a competitive edge wherever it is most advantageous for the platform as a whole.

Tokenomics

Platform Token

Ticker: THO

Use Cases:

The platform itself will be divided into three distinct phases.

Phase 1 – The Inflationary Phase

30% will go to Farms, with 95% going to platform-specific pairs and single staking.

35% will be allocated to the platform’s bond offering. These tokens will be held in escrow until the following bonds are purchased.

25% will be allocated to the Reserve Fund, which will act as a bank for THO and enable rapid cross-chain expansion.

10% will be reserved for the STATIK stable coin. They remain locked unless necessary to retain the peg.

Phase 2 — The Consolidation Phase

After emissions cease, the consolidation phase will begin. At this point, the Treasury will have achieved complete self-sufficiency through various external investment strategies such as stable lending pairs.

Phase 3 — The Deflation Stage

With emissions eliminated and a robust Treasury investment model in place to continuously purchase THO, the price of THO will continue to rise as more supply is removed from circulation.

Stablecoin

Ticker: STATIK

Use Cases:

STATIK is a commerce-backed stable coin backed by 80% USDC and 20% THO.

STATIK is completely crypto-backed, as 100% of its collateral value is redeemable at any time. It does not, however, necessitate excessive collateralization on mint.

How it works

They control emission allocations to maintain a $1 peg during times of high realized volatility. The project looked at the effects of a 1.3 standard deviation market move on traditional derivative products, which closely mirrors the 20% risk STATIK carries.

Traditional market moves have an 80.6% chance of staying in the 1.3 range. In crypto, however, large moves of many orders of magnitude are not uncommon. As a result, the projects looked into replicating specific derivative-based tools to help stabilize STATIK.

Theta decay, DvegaDtheta (Veta), and overall Treasury correlation are three such instruments (Beta). STATIK’s price action is influenced by realized volatility, correlation, and platform-based inflation.

To learn more about the mechanism please read this docs.

In short, initially, 10% of all emissions will go into a Reserve Fund that will divert THO into STATIK during depeg. To start, this amount is fixed to create a larger balance. In the long run, the rates will be adjusted to reflect mint rates, realized volatility, inflation and price to peg ratios using the above formula. This optimizes emissions, reduces peg times, and allows for adjustable rates to be moved elsewhere on the platform to increase APRs.

Moreover, 20% of the Treasury’s swap fees will go to the Reserve, reducing the time to over-collateralization.

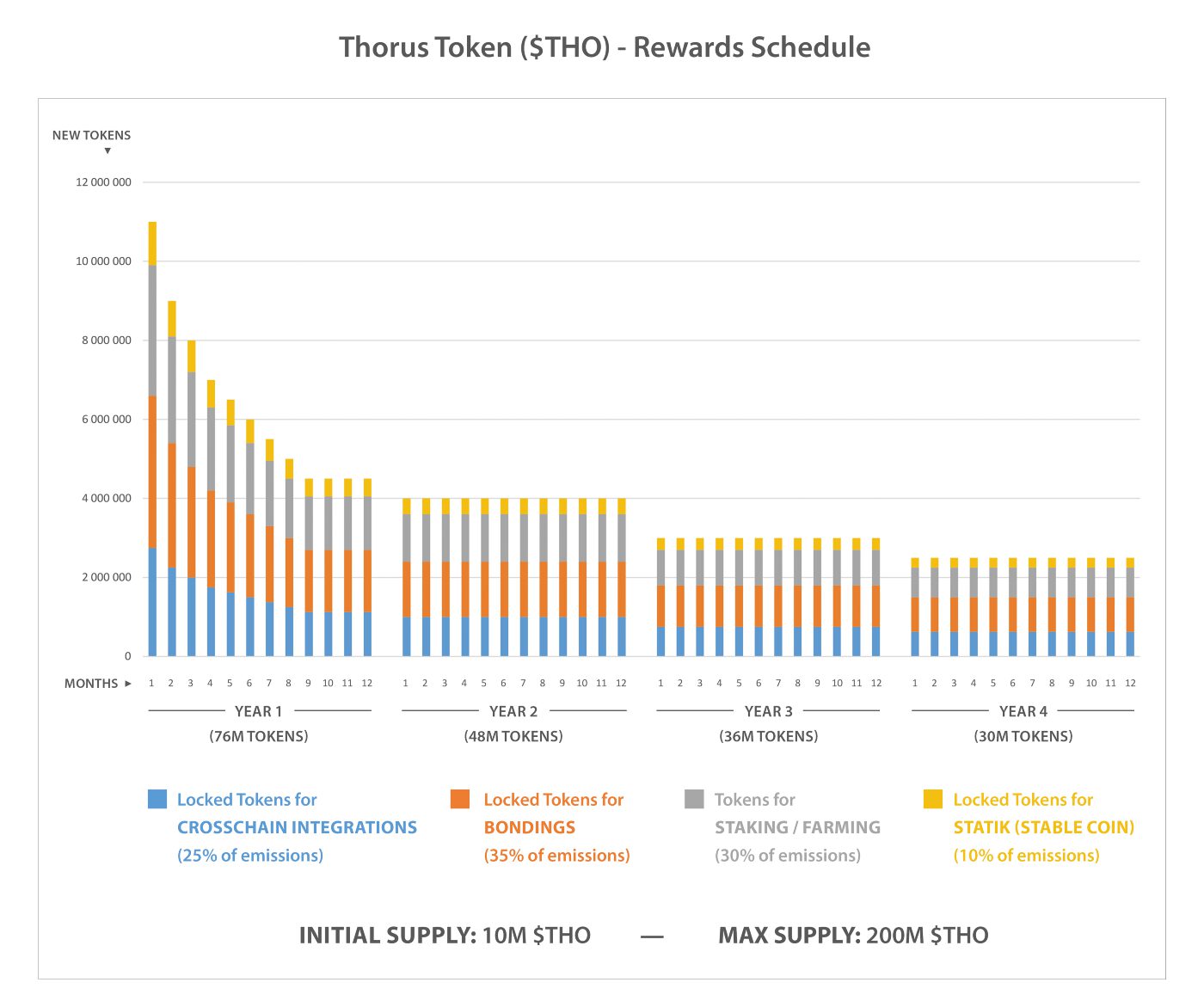

Roadmap

Learn More

Website: https://thorus.fi/

Twitter:https://twitter.com/ThorusFi

Medium:https://medium.com/thorus

Whitepaper:https://docs.thorus.fi/welcome/about-thorus

Discord: https://discord.gg/thorusfi

Reddit: https://www.reddit.com/r/thorusfi/

Telegram Announcements: https://t.me/ThorusFi

Github: https://github.com/ThorusFi

Youtube: https://www.youtube.com/channel/UCDTHaIVgPvwAwArmD0hcqrg