TiTi protocol, a multi-asset reserve stablecoin based on a decentralized Monopoly Auto Market Maker mechanism has closed its fundraising round that successfully raised $3.5 million.

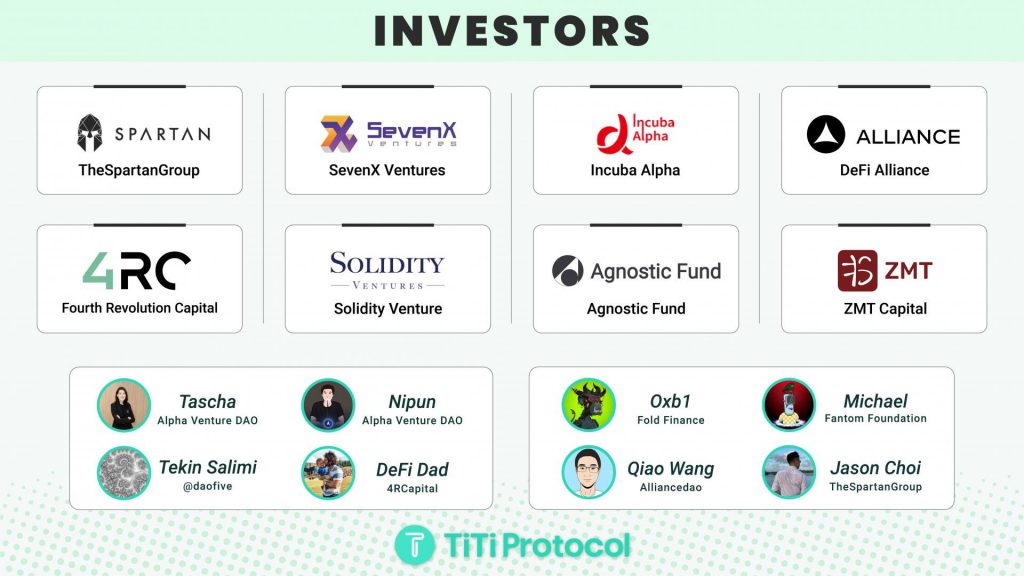

According to the TiTi team, this new funding will be used to work with world-class investors to build the future of decentralized finance (DeFi) through its first use to earn algorithm stablecoin. The funding round was led by Spartan Group and saw the participation of numerous industry investors, including SevenX Venture, DeFi Alliance, Incuba Alpha, Agnostic Fund, Solidity Venture, Fourth Revolution Capital (4RCapital), and many others. The fundraising event was also participated by numerous individuals such as 0xb1 from Fold Finance, Michael from Fantom Foundation, and Tascha and Nipun of Alpha Venture DAO.

TiTi protocol is a fully decentralized use to earn algorithmic stablecoin. As per the team, the TiTi protocol is more than just a stablecoin protocol, and the stablecoin protocol is just the beginning. The protocol seeks to provide diversified and DeFi services using stablecoin systems and autonomous monetary policies. TiTi Protocol aims to “bring a new type of elastic supply algorithm stablecoin solution to DeFi and Web3 that incorporates the Multi-Assets-Reserve mechanism.”

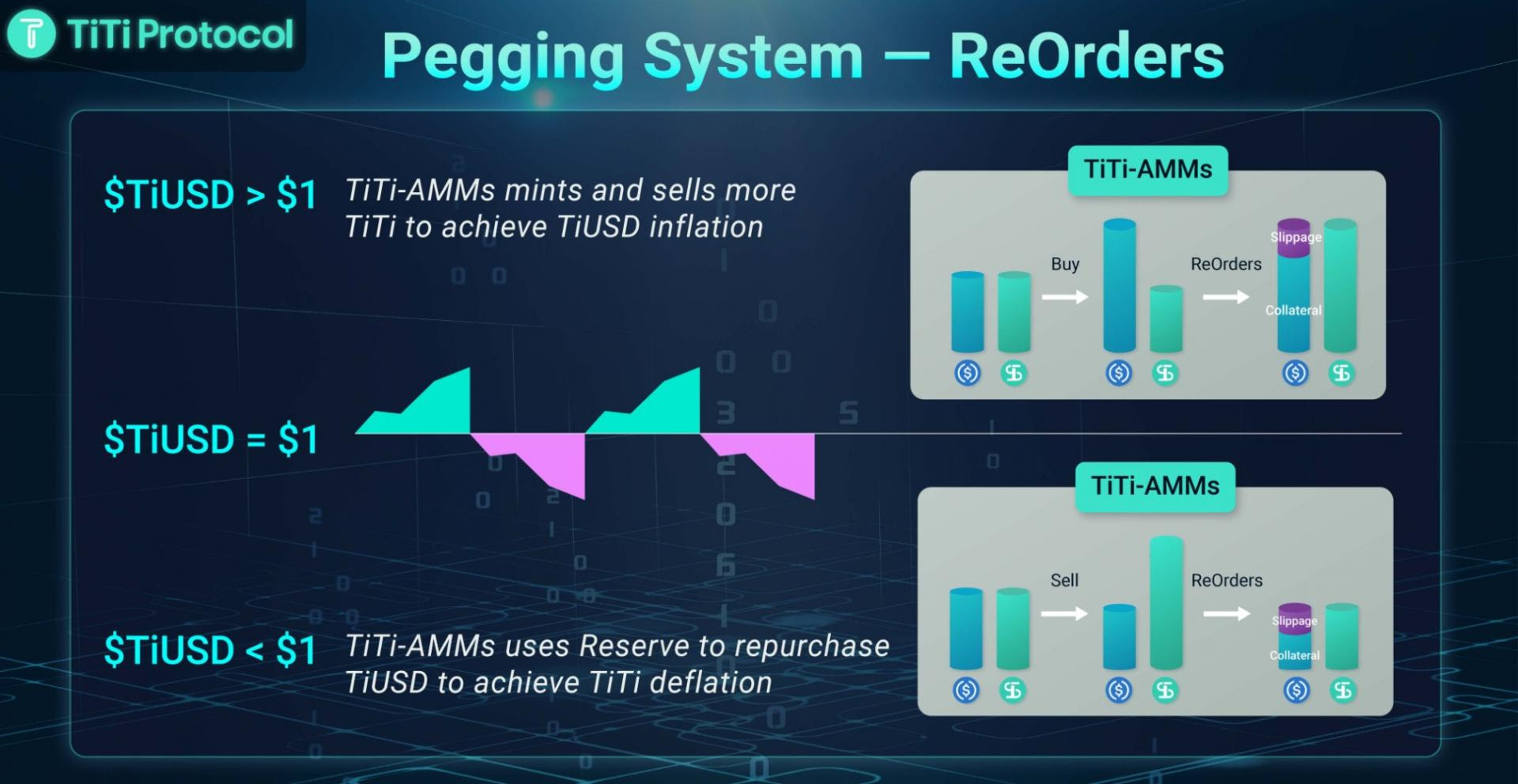

Unlike existing stablecoin projects in the market, the TiTi protocol combines the Multi-Assets-Reserve and the Reorders algorithms mechanisms to bring about a new paradigm of algorithmic stablecoin solutions to DeFi and Web3. In the end, the project hopes to boost algorithmic stablecoin adoption while at the same time maximizing the benefits for DeFi users.

TiTi Protocol has six major advantages: decentralized, resistance to volatility risks, high capital utilization, and more stable efficiency guaranteed by risk-proof reserves and multi-asset reserves. In addition, TiTi’s most unique feature is that it is created to improve algorithmic stable coins liquidity providing stability. Note that algorithmic stablecoins ensure price stability through automatic adaption of the supply and demand of the stablecoin in question.

TiTi has several innovative modules in place to support this feature, including a new stablecoin issuance paradigm and TiTi-AMMs that greatly boost stablecoin on-chain liquidity and increase capital efficiency. The protocol also has Multi-Asset Reserve that ensures an upper limit for the issuance size and maintains stability.

TiTi’s use to earn is the first-ever stablecoin tokenomics design. The platform’s stablecoin, TiUSD, will become a new trading medium in the crypto world. Users will be able to earn protocol fees by using TiUSD or holding the token.

Join our Telegram/Discord for the latest updates, follow us on Twitter, or read more about us on our Blog and Document!