Disclaimer: The information shared is for educational purposes only. While AMBCrypto might be compensated for any links shared herein, that does not affect our writers’ evaluations in any way.

Proof-of-stake (PoS) blockchains have recently gained popularity for various reasons. And, one of the less-discussed advantages of adopting PoS-based blockchains is crypto-staking.

Staking is the process of merely storing crypto-assets in a wallet for a specific period to collect rewards from them. Staking can be done on reputable exchanges or wallets defined by Proof-of-Stake (PoS) blockchains.

When users stake their digital assets, they lock up the tokens to contribute to the blockchain’s functioning and maintain its security. In exchange, users receive incentives estimated in percentage yields.

Crypto-staking has contributed to the widespread adoption of DeFi, with over $82 billion in total value locked (TVL) and numerous new investors entering the sub-sector. In light of the vast market demand, here are some of the best staking platforms for 2022 –

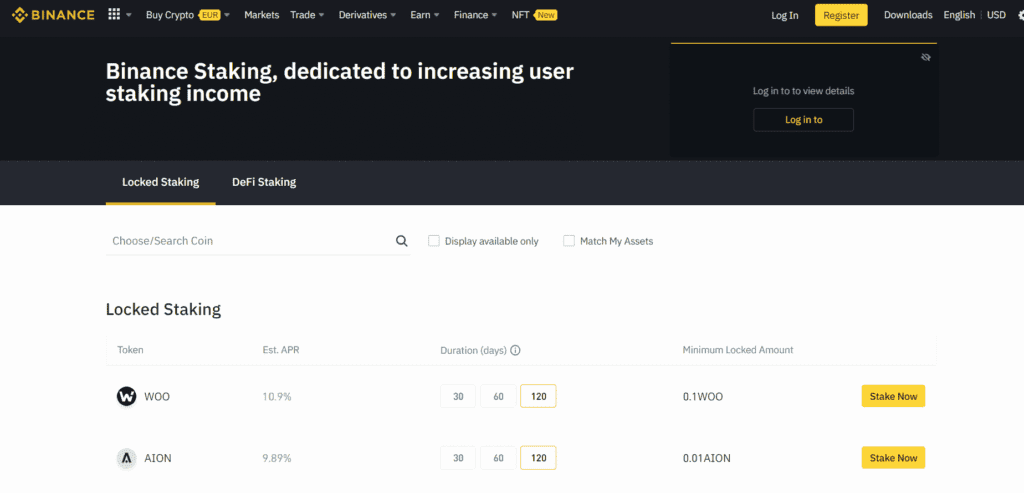

Binance

Binance is the biggest cryptocurrency exchange in terms of daily trading volume. The Secure Asset Fund for Users (SAFU) offered by the platform protects user assets and 10% of all trading fees on the crypto-exchange are allocated as insurance coverage in the case of a major hack or theft.

This trading platform can support up to 100 distinct staking currencies like Audius (AUDIO), Avalanche (AVAX), Binance Coin (BNB), Cosmos, Livepeer (LPT), Solana, The Graph (GRT), etc., covering a wide range of projects and APYs. In addition, Binance offers a variety of alternatives depending on how long users want to lock up their tokens. This often spans a time frame of 10, 30, 60, or 90 days.

Staking on Binance can be either fixed or variable. Locked staking is centered on a defined bond time, whereas flexible staking provides greater discretion at the expense of smaller staking rewards. Flexible withdrawals are also possible with locked staking, but users risk losing all of their earnings.

Binance currently allows users to stake over 30 different cryptocurrencies when using Locked Staking, and 5 other DeFi staking options are also featured.

eToro

eToro is a well-known SEC-approved cryptocurrency broker with modest account minimums and market-leading costs. eToro has recently developed a webpage that enables users to stake their idle Bitcoin assets. The platform is popular in the financial space with over 20 million users worldwide.

The platform provides top-notch staking crypto-services, eliminating major concerns like security issues, and allowing customers to produce high interests hassle-free. eToro rewards users every month for doing nothing more than locking up their crypto for a set time.

eToro is one of the most secure locations to store cryptocurrencies. Apart from being regulated by the UK’s FCA, CySEC, ASIC, and FinCEN, the platform is also monitored by the Guernsey Financial Services Commission (GFSC). This guarantees that the user’s crypto holdings and personal information remain secure.

Users can stake crypto of two separate digital assets, Cardano (ADA) and Tron (TRX) (TRX). eToro provides a dynamic reward scheme depending on an investor’s staking ability. Users are awarded depending on their eToro club membership, which includes bronze, silver, gold, platinum, and platinum+ memberships, and rewards are proportionate to their percentage yield.

Coinbase

Coinbase offers a regulated and easy-to-use exchange platform for users of all levels of experience, looking to buy and sell digital assets in a secure environment. The exchange assists customers in running nodes, syncing them to the blockchain, and meeting the volume margin for staking. It allows users to sit back and earn rewards proportionate to the number of coins staked.

This exchange supports six digital currencies – Ethereum, Algorand, Cosmos, Tezos, Dai, and USDC – that can be staked. Users do not need to buy crypto on Coinbase to be eligible for staking rewards as they can transfer the tokens from an external wallet.

Users can deposit funds into their “vault option” if the funds are of a coin the site accepts. Although certain currencies’ protocols demand users to keep their coins locked up for some time, most coins stakeable on Coinbase allow users to withdraw them as if they were regular coins placed on the user’s Coinbase wallet.

Coinbase also distinguishes itself as a staking provider by promising to compensate users for amounts lost by any slashing events.

KuCoin

KuCoin is the sixth-largest crypto-exchange by trading volume. The platform offers multiple staking offerings and large staking pools where users can earn several rewards using KuCoin Earn. KuCoin runs two separate staking programs – Soft Staking and Pool X.

Soft staking allows users to stake a wide variety of 32 different cryptocurrencies, with completely flexible withdrawals available at any moment. The grace period soft of staking programs is essentially the time between stopping to stake and getting access to the staked money or incentives back. This program also provides stake rewards of up to 15% and delivers awards regularly to maintain consistency.

Pool-X accepts eight different cryptocurrencies, including EOS, ATOM, TRX, and TOMO. Users can profit from both staking and proof of liquidity (POL). Staking expenses are charged at a minimum of 5% and a maximum of 8% by KuCoin. Pool-X also offers Locked Staking, with APY rewards going over 100% APY on some smaller coins.

Kraken

Kraken is a cryptocurrency exchange that simplifies the buying and selling of cryptocurrency for individuals and institutions. With just a $1 initial investment, users can invest in more than 65 cryptocurrencies and earn up to 12% APY.

Users may stake their Bitcoin for as long as they choose, but the longer they stake, the more they can earn. Kraken rewards users instantly as there is no waiting or lockup time. The platform provides the best-fixed returns in the sector and pays out twice a week, making it the fastest in the industry.

Kraken provides staking on ten different currencies. Kraken supports both on-chain and off-chain staking. Off-chain staking allows users to stake their money using Kraken’s internal procedures rather than a coin’s protocol.

Gemini

Gemini is a top staking platform that offers over 40 cryptocurrencies for earning rewards through its Gemini Earn program. Although it is not a traditional staking program, Gemini Earn is a lending platform that lets users lend out their crypto holdings in exchange for interest payments.

Users earn an annual percentage yield (APY) for staking their crypto0holdings. Even though its “earn” features pay interest on certain coins, it does not advertise its offering as a standard staking program. Users can claim the return of their bitcoins at any time, although they may have to wait up to five business days owing to liquidity constraints on Gemini.

MyCointainer

MyCointainer is a one-stop shop for earning cryptocurrencies that aims to become an easy-to-use, global crypto-community. With over 150 supported coins, the site now provides a range of services to earn rewards like regular and cold crypto-staking, exchange, cashback, airdrops, and so on.

The platform provides an efficient shared master node and automatic staking services. Users can earn by retaining money in their wallet, delegating them to MyCointainer nodes straight from their wallet, or storing the coins offline.

The platform supports both online and offline staking and has no lockup periods. Cold staking allows users to hold their coins in a hard wallet like Ledger or Trezor, then delegate them to MyCointainer and wait for their rewards.

Crypto.com

Crypto.com offers simple and low-cost exchange services across more than 250+ tokens and various crypto-centric products. In addition to digital asset loans, crypto credit cards, debit cards, and NFT markets, the platform also provides staking services through its Crypto Earn facility.

Crypto.com offers both flexible and fixed-term staking with just a few clicks. When the user deposits their preferred digital tokens, the platform will assign the funds to account holders who want to borrow capital. The end-borrower will then refund the amounts plus interest, which the user will receive daily.

Users staking CRO tokens, the native digital asset of the platform, will earn higher APYs irrespective of which tokens they decide to stake. Crypto.com facilitates immediate access to a large suite of digital tokens that can be purchased with a debit card for as little as 2.99%.

Here’s the bottom line

Staking is a great alternative for investors who don’t mind short-term market changes and want to generate yields on their long-term investments. Users may optimize their benefits by selecting a staking pool with minimal commission costs and a track record of validating a large number of blocks. This also reduces the possibility of the pool being penalized or suspended from the certification process.