In this article, BeInCrypto will take a look at five coins in the decentralized finance (DeFi) sector which have interesting developments lined up for the month of December.

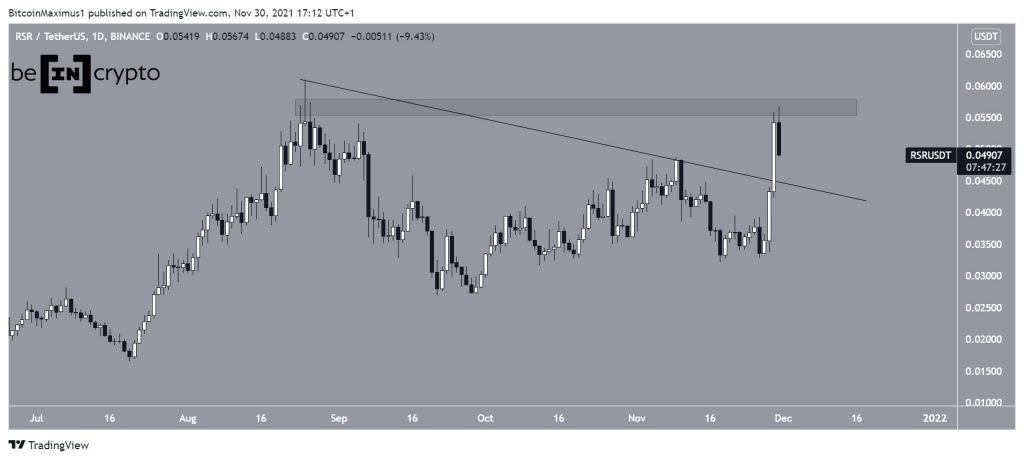

Reserve Rights (RSR)

- Current Price: $0.049

- Market Cap: $655 Million

- Market Cap Rank: #143

RSR is a stablecoin platform that uses two tokens, the Reserve stablecoin (RSV) and the Reserve rights token (RSR). The latter uses an arbitrage system in order to keep the price of the former at $1.

The full reserve protocol will launch in the Ethereum mainnet prior to Dec 31.

RSR has broken out from a descending resistance line and is approaching the Sept highs at $0.06. Once it manages to move above this horizontal resistance area, there would be no more resistance left until the $0.1 all-time high price.

THORChain (RUNE)

- Current Price: $11.06

- Market Cap: $2.85 Billion

- Market Cap Rank: #63

THORChain is a decentralized liquidity protocol. It provides users to exchange assets through various networks. RUNE is the native token of the protocol and serves as the base currency.

Similarly to RSR, RUNE will release its mainnet prior to Dec 31, most likely by Christmas.

RUNE has broken out from a descending resistance line. It returned to validate it as support on Nov 18 (green icon) before bouncing and moving upwards. The bounce also served to validate the $10 horizontal area as support.

As long as the token is trading above these levels, the trend can be considered bullish.

Swipe (SXP)

- Current Price: $2.3

- Market Cap: $443 Million

- Market Cap Rank: #166

Swipe is a cryptocurrency platform that has the goal of connecting the cryptocurrency and fiat financial worlds. The main token is SXP, which powers the network and is used to pay transaction fees.

The Swipe application allows cryptocurrency to fiat transactions (and vice versa) through the use of the Swipe debit card.

Swipe financial, one of the main applications offered by the platform, will fully launch in Dec.

Despite these positive news, the SXP price is lagging considerably, and is barely holding on above the $2.10 horizontal support area.

It seems to be trading inside an ascending parallel channel, which is usually a corrective structure.

Chainlink (LINK)

- Current Price: $26.13

- Market Cap: $12.17 Billion

- Market Cap Rank: #20

Chainlink is a platform that uses a decentralized in order to allow various blockchain to interact with each other. In the network, participants run their own nodes.

BitFlier, the number one exchange by volume in Japan will list Chainlink in December 2021.

While LINK has broken down from an ascending support line, it has bounced above the $22.10 horizontal support area, which is also the 0.618 Fib retracement support level. Therefore, it could potentially initiate an upward movement.

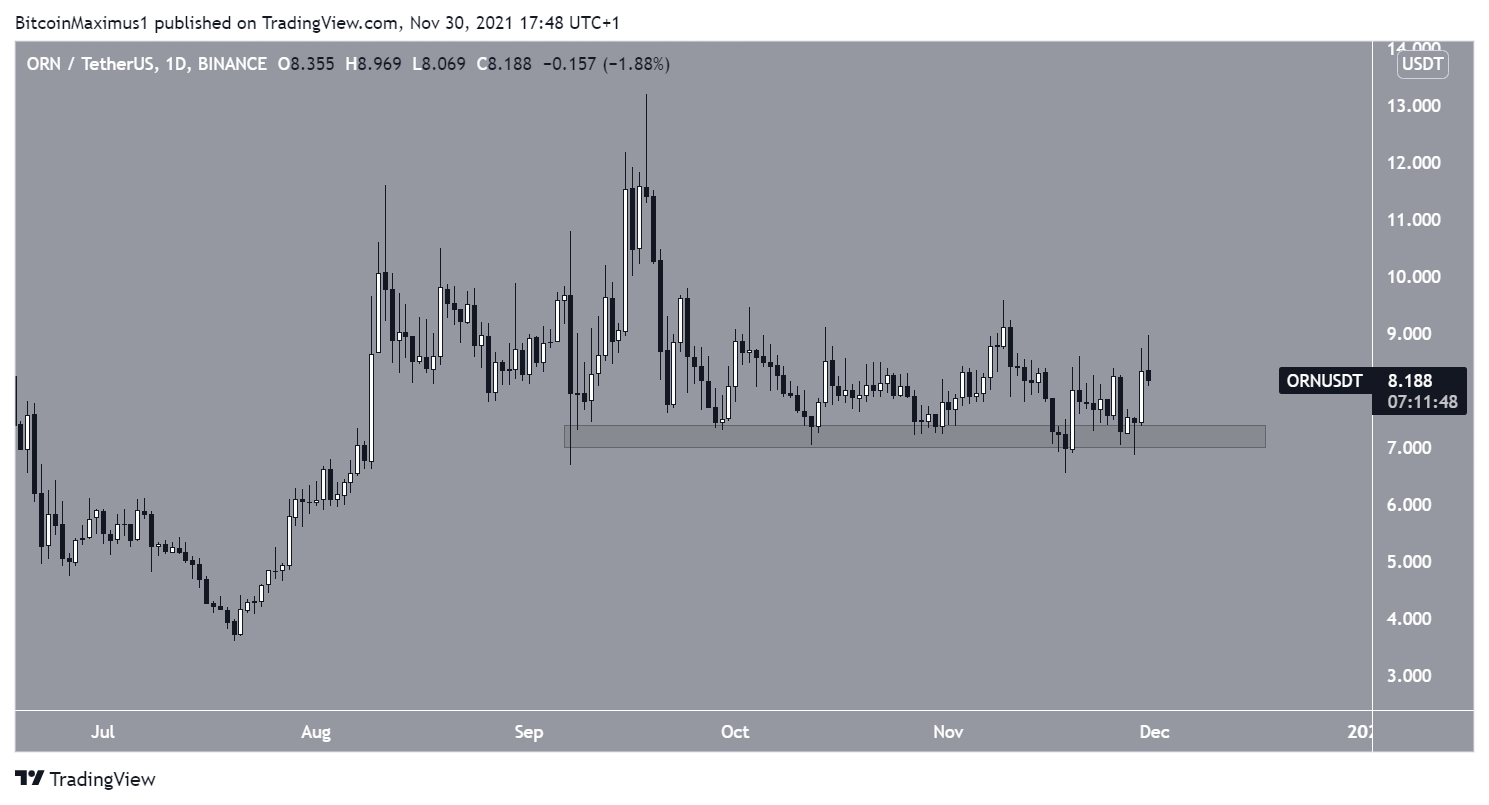

Orion Protocol (ORN)

- Current Price: $818

- Market Cap: $263 Million

- Market Cap Rank: #296

Orion Protocol is a decentralized platform that focuses on offering liquidity. Its main goal is to create a platform that aggregates every centralized and decentralized platforms alongside swap pools. The native token that powers the network is ORN.

The official launch of the liquidity boost plugin will occur in December.

The ORN price has barely moved since the beginning of Sept and is hovering above the $7 horizontal support area.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.