The Metaverse is a hybrid virtual reality. A virtual world, where people can live, work, shop, and do other things from the comfort of their home in the physical world. In simple terms, the Metaverse is the future of the internet.

advertisement

Ever since Facebook alternate its name to Meta, the value of these coins has gained popularity. There are many Metaverse coins available, but all are not for trading.

Here we give you a list of the top five Metacoin to trade in September:

1 ApeCoin

Trending Stories

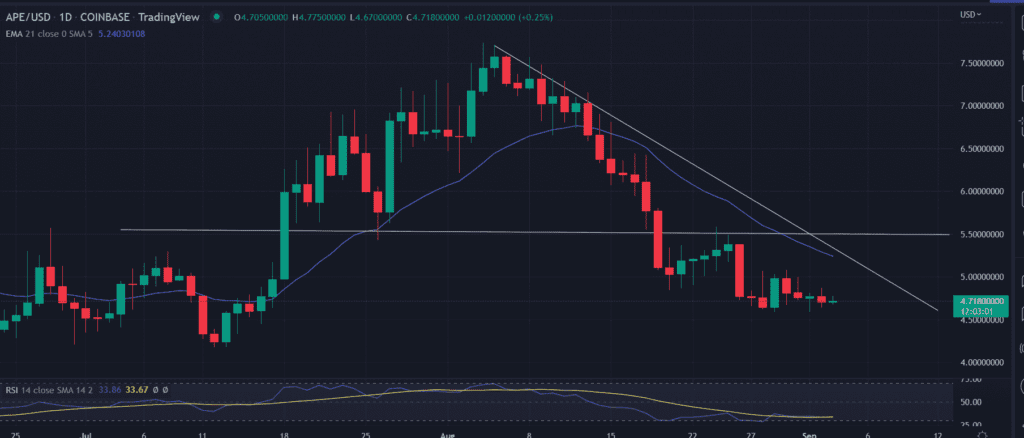

On the daily chart, the ApeCoin (APE) price looks for a 50% appreciation in September month. The coin met the critical support near $4.71. After testing the mentioned level on July 17, the price zoomed 45% to the swing highs of $7.33. The formation of the Spinning top near the higher level, which is a bearish reversal pattern set the downward trend.

APE retraced to the same level with the formation of multiple Doji candlesticks, suggesting a consolidation.

The RSI (14) indicator is in the oversold zone. A renewed buying pressure could push the price forward.

We expect a short-term target of $7.0.

2 Axie Infinity (AXS) Coin

Axie Infinity (AXS) has beaten almost 20% in the previous month. It started the new trading session on a higher note. For the past five days, the token registered a growth of 14%. If the price pierces above the 21-day exponential moving average, we can expect the continuation of the current upside momentum.

The double top structure near $19.70 resulted in the downtrend that begin on August 13.

Additional buying participation would apply the required thrust to the price. On moving higher, the price could recapture the recent swing high.

However, the bullish arguments would be challenged if the price slid below the monthly support crafted around $13.0.

In that case, another round of selling could start below $10.0.

3 SushiSwap (SUSHI)

On the daily chart, the SushiSwap (SUSHI) token has a short-term resistance zone near $1.60. As it formed a “Tripple Top” structure, a bearish reversal technical formation. The price fell nearly 36% to test the lows of $1.02.

The buyers found reliable support around the mentioned level as SUSHI verified with multiple bottoms at this level. The formation of the bullish hammer at the beginning of the September series made the bulls hopeful for a quick recovery rally.

The oversold RSI (14) indicator combined with the positive divergence calls for upside momentum. Currently, it reads at 37.

The market structure points that the bulls being on the front foot. The first upside target is found at $1.40. Additional buying shall meet $1.60.

A break down below $0.90 would make a fresh all-time low toward $8.0 or below.

4 Enjin (ENJ) Coin

Enjin (ENJ) coin on the daily chart earlier was trading in a “Rising channel” pattern, making higher highs and higher lows. From the channel’s high, the price formed a Double Top structure, and fall more than 35% from the highs. On August 26, the token gave a breakdown of a “Rising Channel” formation with above the average volumes, giving more confirmation of the coming downtrend.

However, the $0.50 price level acted as a short-term price barricade for the bears. If the buyers are able to flip this level, we expect the first upside target of the upper trend line of the Rising Channel at $0.85, this would be the turnaround level.

Since the last week, prices is consolidating in a tight range, making no moment whatsoever, with declining volumes. If the price breached below $0.49 on the daily chart, then we can expect a sharp fall to $0.37, the levels last seen in June.

5: Decentraland (MANA)

Decentraland (MANA) price depreciated more than 20% in the previous month. MANA faces strong rejection near the $1.10-1.00 resistance zone. As the bulls failed to sustain above the mentioned level since June 2022.

We expect the price to take a quick recovery to the immediate resistance playing around $0.85. Next, market participants could jump to reclaim the psychological $1.0 level.

Currently, the price hovers near the demand zone of $0.70-$0.77. It is a crucial trading zone if this range is broken would create havoc.

advertisement

In conclusion, we expect a rebound in the crypto space as the market is technically in the oversold zone.