Bitcoin climbed toward the $50k area in the past couple of days. But it has not yet regained a momentum that can propel it past the $53.6k level. Another rejection for Bitcoin could see altcoins like Tron form a lower high and continue to descend.

The alt formed a descending wedge pattern but still faced significant selling pressure as it fell to the $0.077 level. A dip to $0.075 was quickly bought up, but it remained to be seen if bulls can follow through.

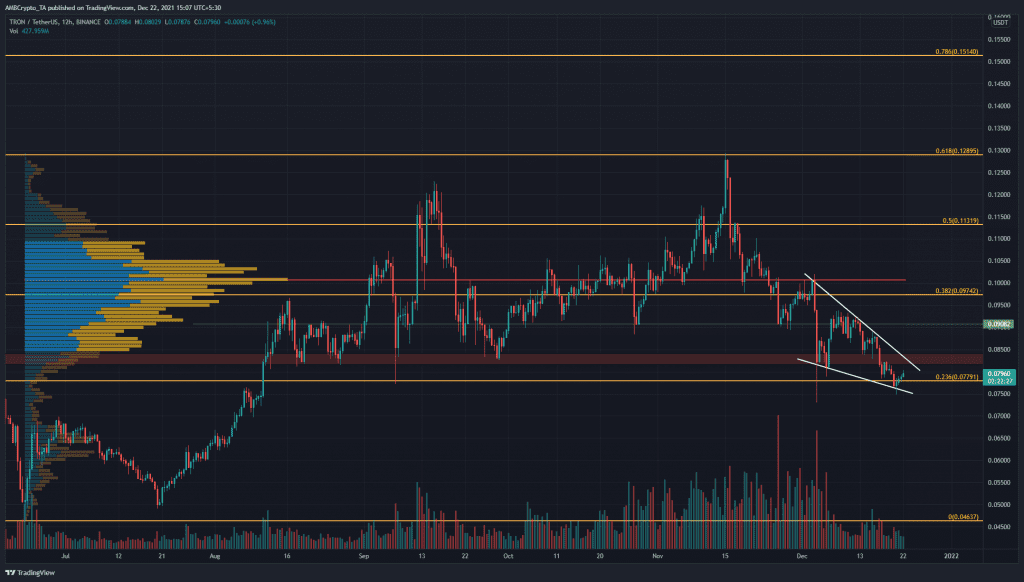

TRX: 12-hour chart

Source: TRX/USDT on TradingView

The Fibonacci retracement tool was used to plot levels of significant resistance on the 12-hour chart based on Tron’s move from $0.18 to $0.046 in April-June earlier this year. Since August, the price stayed above the 23.6% retracement level at $0.077.

Apart from this, the $0.082 area (red box) was also identified as an area of supply where sell orders are likely to be thick. The price fell beneath this region in recent days and could retest it as resistance and continue on its descent, as it did, over the past month.

However, the formation of a descending wedge pattern, coupled with the defense of the $0.077 level, could see TRX rise to test the $0.09 and $0.097 levels in the weeks to come.

Rationale

Source: TRX/USDT on TradingView

The CMF formed higher lows since July to this day, on the 12-hour chart, meaning significant buys have stepped in at the $0.082 and $0.077 levels.

Even though the RSI has been unable to break trendline resistance (pink), it has not fallen significantly below the 35 value. Hence, so long as this region holds, a bounce could be expected.

Breaking out of the wedge pattern, the price could see the RSI breakout too. However, the supply at $0.082 is in confluence with the wedge’s upper trendline, reinforcing the idea of strong resistance. The Fixed Range Volume Profile showed the Point of Control (POC, red) at $0.1, which is also a round-number resistance.

Conclusion

If Bitcoin’s dominance drops below 40.4, combined with Ethereum climbing past $4100 and $4500, a market-wide altcoin rally could occur. This could shift the longer-term sentiment behind coins such as TRX. However, until TRX can break out of the wedge pattern and flip the $0.082 highlighted area to demand, sellers will have the upper hand.