TRON TVL spiked in July due to renewed investor interest in decentralized finance (DeFi).

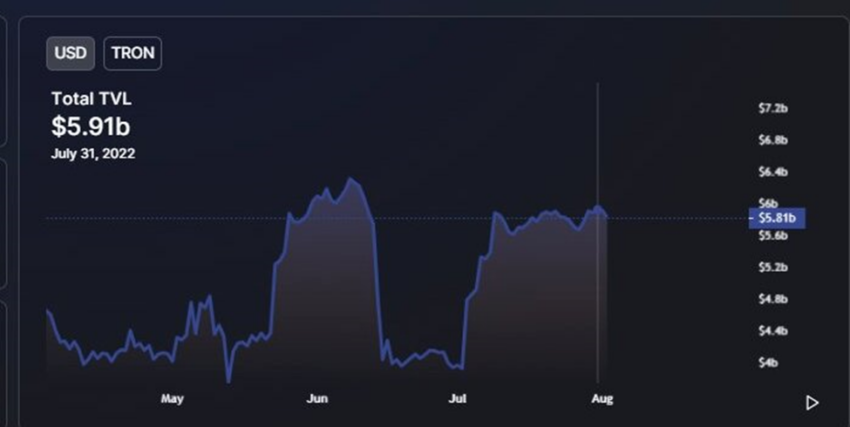

TRON has been among the most patronized decentralized finance smart contracts in the last two years. According to Be[In]Crypto research, the blockchain increased by 49% in TVL in July. On July 1, TVL was $3.95 billion and soared to $5.91 billion on the last day of the month.

New to TRON?

Founded in 2017 by Justin Sun, TRON labels itself as an ambitious project that has a high throughput, scalability, and availability. It is a protocol dedicated to building the infrastructure for a truly decentralized internet.

Initially, TRON was housed in the ecosystem of Ethereum as an ERC20 token. Due to the scalability problems associated with Ethereum’s old network coupled with high gas fees, TRON announced in 2018 that it is moving to an independent peer-to-peer network.

What contributed to the spike in TVL?

TRON TVL ascended in July due to decentralized applications (dApps) in its ecosystem soaring to new highs.

Decentralized lending platform JustLend (which has the most TVL in TRON) rose by more than 19% in the last month. Algorithmic stablecoin JustStables (USDJ) increased by more than 2% within the same period. Decentralized exchanges (DEXs) SocialSwap and UniFi were up by more than 6% and 550% respectively.

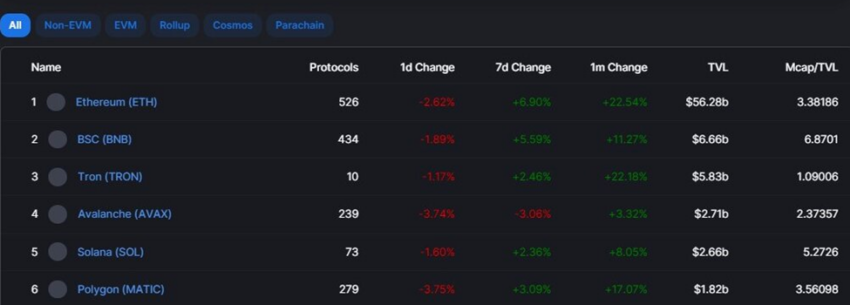

The latest metric has seen TRON move to third place behind Binance Smart Chain (BSC) and Ethereum. With that said, the chain holds more TVL than Avalanche, Solana, and Polygon.

TRX price reaction

TRX opened on July 1, with a trading price of $0.06479, reached a monthly high of $0.07166, tested a monthly low of $0.06256, and closed the month at $0.06894. Overall, this represents a 6% increase between the opening and closing price of TRX in July.

What do you think about this subject? Write to us and tell us!

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.