With the recent general market price rally, Tron [TRX] traded at a five-day high of $0.06382 on 5 November as per data from CoinMarketCap. The cryptocurrency stood at rank #15 by market capitalization. Furthermore, TRX exchanged hands at a 1.5% drop in the last 24 hours, at a press time price of $0.06351.

Here’s AMBCrypto’s price prediction for Tron [TRX] for 2023-2024

A consideration of the asset on a daily chart revealed that TRX buyers had control of the market on 5 November. This was gleaned from the position of the Directional Movement Index (DMI). The DMI showed that the buyers’ strength (green) at 27.78 was placed solidly above the sellers’ (red) at 13.94.

This was further confirmed by the position of the Exponential Moving Average (EMA). At the time of writing, the 20 EMA (blue) was right above the 50 EMA (yellow), indicating that buyers have forced sellers out of market control.

In addition, key indicators such as the Relative Strength Index (RSI) and Money Flow Index (MFI) were positioned above their respective neutral regions in uptrends. As of 5 November, TRX’s RSI was 57, while its MFI was 57. This indicated a steady growth in the coin’s buying pressure.

Tron in Q3

Cryptocurrecy research platform Messari revealed its assessment of Tron Network’s performance in Q3. It was found that the network’s usage remained stable while its quarterly revenue within the three-month period dropped.

Although the count of newly activated accounts on Tron dropped by 21.7% in the last quarter, Messari found that daily active accounts on the network remained stable. Furthermore, this metric witnessed a 0.3% growth within the same period. Comparing Tron’s Q3 network usage to that of Q2, Messari said,

“On average, total account activity seems to have settled down to ~2.6 million per day. The daily average of 2.6 million over Q3 was not based on an uptrend or bursts of usage as in Q2. Q3 daily activity was relatively more stable. The activity in Q2 was a period of high growth primarily supported by the burst in May, after the launch of USDD, TRON’s decentralized, overcollateralized stablecoin.”

As for revenue on the network, Messari found that this declined by 21% over the quarter. The total quarterly revenue made by Tron within the period under review was $38 million. In Q2, this was $48 million. On the cause of the revenue decline, Messari stated that this was due to a 33% decline in “average transaction fees on the network.

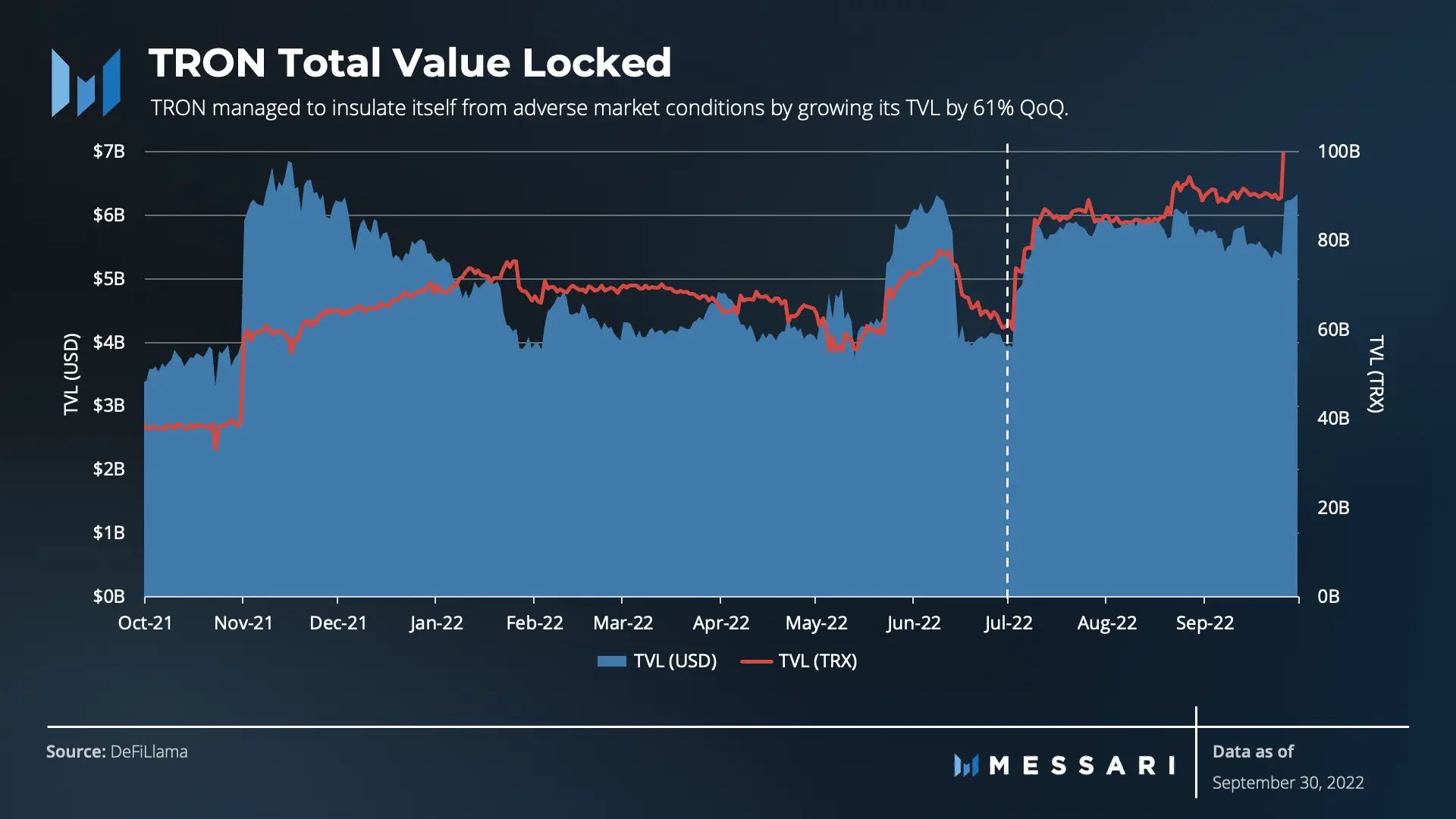

While the majority of L1 blockchains suffered a fall in DeFi TVL, Messari found “Tron managed to insulate itself from adverse market conditions by growing its TVL by 61% QoQ.”