TUSD-am3CRV pool has launched on Curve’s Polygon network with the gauge feature – which only seven pools on Curve’s Polygon network have – to distribute CRV rewards on April 1. The TUSD-am3CRV pool is supported on Curve’s Ethereum network as well.

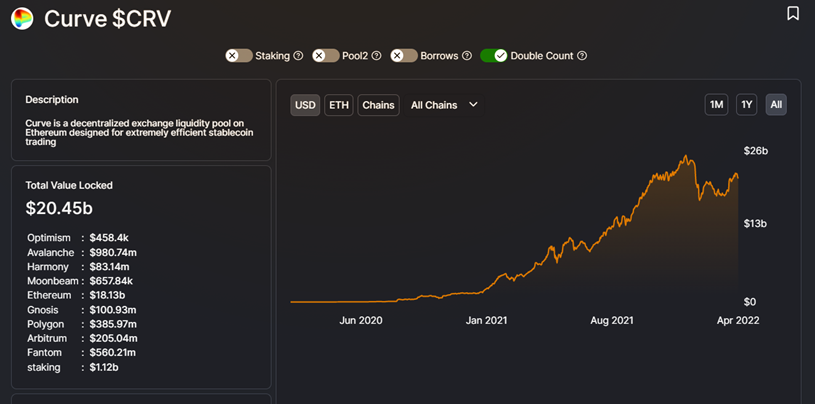

As an automated market maker in DeFi that offers stablecoin swap services, Curve’s total value locked (TVL) has hit $20.45 billion, ranking first among all decentralized exchanges (DEXs). Compared with other trading protocols, Curve offers more carefully chosen trading pairs featuring exceptionally low slippage and handling fees for better liquidity. Swap fees paid by traders also fund liquidity provider (LP) rewards.

In addition, Curve’s gauge system is a focal point of many liquidity pools. LPs of pools with gauges can get a share of the handling fees collected and receive additional CRV distribution.

This is not the first time TUSD has integrated with protocols on Polygon. Last November, TUSD launched on Balancer Polygon with a stablecoin pool to offer TUSD and BAL distributions to liquidity providers. The TVL of this pool was $116.9 million. TrueUSD on Polygon has over 31,600 transfers, and the entire supply exceeds 25.61 M TUSD.

The relationship between TUSD and Curve is long-standing. In the Ethereum ecosystem, the TVL in the TUSD-3CRV pool amounted to $80 million, higher than that of most other pools. Many leading applications have deployed their Polygon version due to Polygon’s high compatibility with Ethereum, its advantages in performance and cost, and the frequent small transactions.

The adoption of this proposal showcases the community’s recognition of TUSD’s value and marks a significant step forward on TUSD’s journey of multi-chain deployment. In response, some community members commented that stablecoins are pivotal to DeFi, and more quality stablecoins like TUSD are needed for lending protocols and DEXs to diversify their markets.

“As a crypto asset with low volatility, TUSD boosts the transparency and stability of various ecosystems and diversifies high-yield investment options for TUSD holders through partnerships with financial institutions, including exchanges and banks,” Annabel, Marketing and BD Director of TUSD, said.

TUSD is currently live on major public chains such as Ethereum, TRON, Avalanche, BNB Chain, Fantom, and Polygon. TUSD will build itself into a multi-dimensional, secure, and convenient digital asset bridge to narrow the gap between the digital and the physical worlds.

About TUSD

TrueUSD (TUSD) is the first independently-verified digital asset pegged 1-for-1 to US Dollars. This stablecoin uses multiple banks, escrow accounts, and third-party attestations to reduce counterparty risk, provide transparency, and prevent fraud.

TUSD offers liquidity on dozens of leading exchanges, DeFi protocols and is supported by major OTC desks. TUSD also supports nearly instant minting and redemption speeds through the Silvergate Exchange Network (SEN) and PrimeX by PrimeTrust.

Media Contact

Annabel G

Marketing & BD Director of TrueUSD

Email: [email protected]

Disclaimer: Any information written in this press release does not constitute investment advice. CoinQuora does not, and will not endorse any information on any company or individual on this page. Readers are encouraged to make their own research and make any actions based on their own findings and not from any content written in this press release. CoinQuora is and will not be responsible for any damage or loss caused directly or indirectly by the use of any content, product, or service mentioned in this press release.